Focusing on net worth and the balance sheet is a better way to manage public assets and liabilities

In the 1880s, Otto von Bismarck, anxious to preempt emergent socialism in the German Empire, introduced a series of measures that would transform the role of the state. Under Bismarck’s chancellorship, the Reichstag passed legislation covering sickness and accident insurance for workers in 1883 and 1884 and old age and disability insurance in 1889. Over subsequent decades, Bismarck’s initiatives have evolved into the modern welfare state—an integral part, in one form or another, of all the world’s developed economies.

This revolution in the role of government has brought enormous benefits to the lives of ordinary citizens. When Bismarck’s old age and disability measures were introduced, life expectancy at birth was about 40 years. With a qualifying age of 70, it was expected that only a small fraction of citizens would live long enough to benefit. German average life expectancy at birth reached Bismarck’s pension age in the mid-1960s; today, it surpasses 80 years.

These improvements in individual welfare come at a collective cost. Longer lives mean longer periods of postretirement life, with increasingly intensive health care needs and greater pension costs. Falling birth rates, if not offset by immigration, mean a continued increase in the postretirement population as a percentage of the economically active population. These factors are most acute in the world’s most developed economies.

Chart 1 provides interesting insight into how government spending has evolved over the past 300 years or so. The data are for the UK, which publishes good long-term economic statistics. But the trends are consistent across developed economies.

The path from warfare to welfare is clear; until the beginning of the 20th century, warfare and servicing the debt incurred to pay for it, dominated government spending—but rarely exceeded 10 percent of GDP. Today, after more than 70 years of peace, the UK government accounts for about 40 percent of GDP.

For developed economies, government expenditure typically represents between 40 and 55 percent of GDP, most of it for the services that comprise the welfare state. As populations age, the trend is upward. But we are not dependent on the state just for the services it provides. Our entire financial system and our savings, pensions, and currency all depend on the government’s ability to meet its obligations.

This is equally true in less-developed and emerging market economies, where governments comprise a smaller proportion of the economy. But for those countries, the cost of bad financial decisions is perhaps even higher.

Accounting for government and fiscal rules

A government’s financial health is central to the lives of its citizens, but many governments do not produce full financial statements. Those that do often publish them far too late to be of practical use or without important information about the value of the assets governments use. And very few countries—perhaps only New Zealand—put the balance sheet at the heart of government financial decision-making. Governments thus deprive themselves of crucial information that could greatly improve the management of public services and the safety of public finances.

Governments would benefit from complementing their current fiscal rules with a primary rule based on net worth that more comprehensively reflects their financial position. Currently, almost all governments measure their financial health, and set fiscal policy, using very simple measures: the relationship between income and expenditure and the amount of outstanding debt, often measured as a percentage of GDP. The current measures are, if anything, less sophisticated than those in common use in the 18th century, and they have several major flaws:

- Nondebt liabilities such as pension obligations to state employees are excluded. Often—especially in highly developed economies—these exceed debt liabilities.

- Assets and, by extension, the uses of borrowing are ignored. There is a big difference between borrowing to invest and borrowing to consume.

- Debt-based fiscal rules may encourage consumption at the expense of investment.

The focus on cash measures obscures what accountants call “accruals”: changes in value resulting from consumption of assets, changes in market valuations, and incurrence of liabilities for pension payments, for example.

Instead, governments—like all other economic entities—should focus on their total balance sheet, not just debt liabilities. They should measure and manage their net worth, the difference between total assets and total liabilities, with assets ideally valued at their current market value rather than based on historical cost.

Moreover, fiscal policy should consider not just short-term measurement but also long-term forecasts of government revenue and expenditure, driven largely by demographics, but also by geopolitics, climate change, and sustainable development.

Public sector balance sheet

“Few governments know how much they own, or how they use their assets for the public’s well-being,” began a 2018 blog by three IMF officials following publication of the IMF Fiscal Monitor: Managing Public Wealth, October 2018. The IMF’s focus is on the broadest definition of government finances—the public sector balance sheet—because this represents the most complete picture of fiscal health. IMF research sought to address the lack of data on public sector balance sheets around the world and in March 2023 published updated data. The data expanded the universe to 55 countries, although only 24 have consolidated public sector balance sheet data up to 2020 or 2021.

The limited availability of this important information suggests that the IMF is right to worry. And what is available paints a rather bleak picture of the current state of public finances, especially in the largest and most developed economies, which underpin the global economy and financial system.

Chart 2 compares general government net worth data for the Group of Seven (G7) countries. It is positive for only one of these, according to the IMF’s latest data, and the picture has deteriorated markedly since the global financial crisis. Despite more than 70 years of peace, the citizens of the other wealthy countries are effectively financing their current lifestyles by borrowing from their children.

In practice, the current picture might not be quite so bad. Governments are notoriously bad at accounting for their assets, especially property holdings, which are frequently valued (if they are valued at all) based on their historical cost or current use rather than their market value. Basing assets on market value could mean an uplift of up to 100 percent of GDP in the public sector balance sheet, according to our estimates. This suggests a worrisome lack of transparency and accountability—but also scope for much better management of public assets.

Whether or not governments have a fully developed accrual accounting system—many do not or are still in the process of implementing one—they can gain significant benefits from a balance sheet perspective in their fiscal policymaking. While in the process of establishing an accrual-based financial management system, governments can assess key financial decisions, such as asset sales, by considering the impact on the government’s net worth and balance sheet structure. And the more decisions reflect this understanding, the greater the incentive to implement accrual-based public financial management reforms rapidly and comprehensively. This point holds regardless of an economy’s state of development.

Comprehensive balance sheet

We started by discussing how the welfare state dominates government spending, and how these welfare costs—especially on health care and pensions—are driven by demographics. A graying population means (proportionately) more consumers of public services and fewer generators of tax revenue.

To assess the impact on public finances, it is necessary to estimate the cost of delivering future services and anticipated government revenue. These figures can be expressed as implicit liabilities and implicit assets and added to the conventional balance sheet to construct a “comprehensive balance sheet”; public sector net worth then becomes intertemporal net worth.

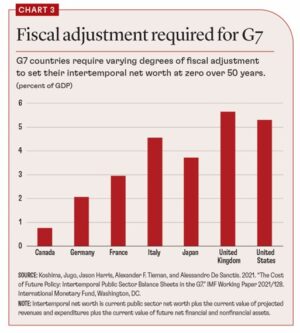

IMF officials have used public sector balance sheet data as a baseline to assess the comprehensive balance sheets of the G7 countries. This assessment be used to derive an estimate of the “fiscal adjustment” (reduction in policy costs or increase in revenues) necessary to meet a given future target. Chart 3 illustrates the adjustment required in each G7 country to set international net worth at zero over the 50-year forecast period. The starting point is 2018 (before the COVID fiscal shocks); however, as an offset to the COVID shocks, the public sector balance sheet data probably understate public sector net worth for the reasons described above.

Regarding the fiscal adjustment measure, the UK, US, and Italy all need adjustments of about 5 percent, starting immediately, in order to balance the books over the period. Although the amounts are substantial, these targets are not impossibly high; for example, France and Germany already have higher tax burdens than would be required for the UK and US to meet the target without reducing policy costs. The question, however, is the political will. Can these democracies generate support for near-term tax increases or spending cuts to solve a problem that is decades away? If they cannot, the challenge may be insuperable.

Accountants to the rescue

The good news is that by breaking free of debt-based fiscal rules and unlocking the benefits of proper accounting, governments can capture substantial economic gains—perhaps sufficient to meet the challenges caused by graying G7 populations. And for less advanced economies there is an opportunity to develop a more comprehensive concept of the fiscal position and unlock the fiscal benefits that this can provide, before the challenges become acute for them. And hence, to avoid the same pitfalls.

On the asset side, IMF research suggests that there is potential to extract efficiency gains equivalent to 1.5 percent of asset value for undermanaged government assets. Using our assessment of how much government property holdings are typically unrecognized—and hence almost certainly undermanaged—suggests that there is scope for improvement in government revenues of perhaps 1–1.5 percent of GDP. This requires thoughtful, commercially oriented management and appropriate institutional arrangements at a national or local level, as demonstrated by public wealth funds established in Singapore, Hong Kong SAR, Sweden, Hamburg, and Copenhagen. But we need accounting to reveal these assets and ensure that governments are held accountable for their efficient use.

On the liability side, the opportunities are often even greater. We have seen how nondebt liabilities sit outside debt-based fiscal rules but are just as onerous. By implementing a program of continuous borrowing and investment in a global portfolio, a G7 government can expect to capture a spread larger than its cost of borrowing—perhaps 3 percent on average. This can also make a material difference to government revenues. In the case of the UK, for example, funding existing public sector pension obligations through investment returns could raise government revenues by the equivalent of 3 percent of GDP within a couple of decades and also greatly improve the resilience of the government’s balance sheet. Existing fiscal rules would not permit substituting debt for nondebt liabilities. But an accounting-driven focus on net worth unlocks the opportunity.

Conclusions

G7 public finances are weak and getting weaker, driven by self-indulgent fiscal policies and demographic trends. Failure to deal with this problem soon will magnify the burden on future generations and further stress political systems. And if any G7 country tumbles into financial distress, it could have severe implications for the global economic and financial system.

Debt-based fiscal rules as employed by most G7 countries do little to describe the problem, and even less to manage it. Understanding the true state of public finances requires a full balance sheet, driven by accrual-based accounting. This in turn will open up opportunities for better management of assets and liabilities, which will greatly assist in meeting the challenges faced by graying G7 countries and their overstretched public finances.

For less-developed and emerging market economies, the key message is that the sooner the adoption of a net worth– and balance sheet–focused approach to public financial management, the less likely they are to repeat some of the mistakes of more developed economies.

This article is based on a recently published book, Public Net Worth—Accounting, Government and Democracy, by Ian Ball, Willem Buiter, John Crompton, Dag Detter, and Jacob Soll.

IAN is a principal architect of the New Zealand government’s financial management reforms.

JOHN is a former investment banker and three-time UK Treasury official and advisor.

DAG is an investment advisor to governments and author of The Public Wealth of Nations.

Credit ;Finance&Develpoment