President Nana Addo Dankwa Akufo-Addo has hailed the Bank of Ghana (BoG) for its pivotal role in safeguarding the nation’s financial stability and spearheading economic resurgence.

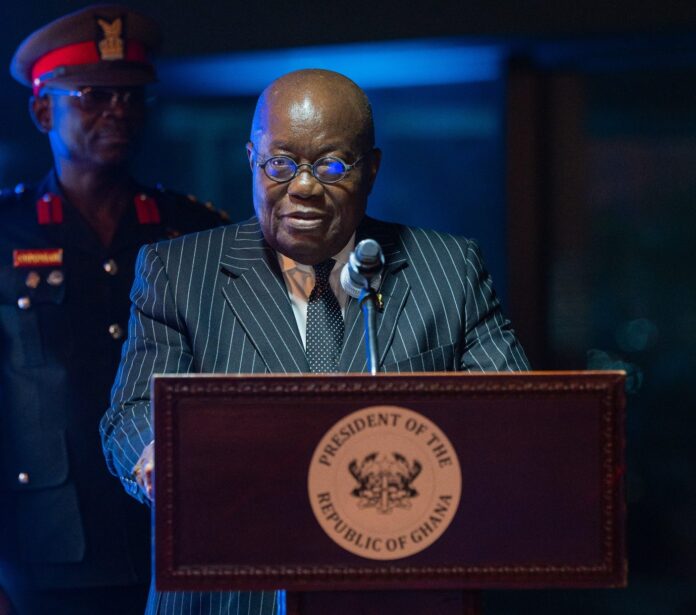

Speaking at the BoG’s end-of-year cocktail event, the President extolled the institution’s remarkable performance over the past years, particularly amid adversities like the COVID-19 pandemic and global economic upheavals.

“In the last seven years, the Bank of Ghana has distinguished itself in discharging its duties to the admiration of all well-meaning Ghanaians,” President Akufo-Addo declared, emphasising the BoG’s multi-faceted contributions.

He lauded its role as a stalwart financial custodian, an efficient currency manager, and a reliable lender of last resort, crucial during times of crisis.

The President highlighted the BoG’s instrumental intervention during the dire straits of the COVID-19 pandemic. With a GH¢3billion credit and stimulus package jointly executed with commercial banks, the BoG revitalised critical sectors like pharmaceuticals, hospitality and manufacturing. A palpable outcome of this intervention has been the noticeable economic growth.

However, Akufo-Addo reminded listeners of the formidable challenges confronting the banking industry upon his government’s inception in 2017. A system marred by distress and teetering financial institutions necessitated radical measures to prevent a sector-wide collapse. The BoG’s interventions, supported by a government allocation of GH¢21billion, rescued 4.6 million depositors and resuscitated the sector, enabling a more robust financial landscape.

Acknowledging the recent global crises, notably the Russia-Ukraine conflict and the COVID-19, President Akufo-Addo emphasised the BoG’s pivotal role in restoring macroeconomic stability. Notably, inflation rates have been reined in significantly, dropping from 54 percent in December 2022 to 26.4 percent in November 2023. This, coupled with sustained exchange rate stability, underscores the BoG’s effective strategies.

Dr. Ernest Addison, Governor of the BoG, echoed the sentiment of recalibrating central bank roles in a rapidly evolving financial landscape. He emphasised the institution’s expanded mandate beyond traditional monetary policies, leveraging unconventional strategies to stabilise economies in today’s multi-faceted crises.

Dr. Addison underscored the BoG’s collaboration with the Ministry of Finance, a partnership pivotal in crafting policies that bolster Ghana’s economic resilience. Citing prudential data, he reaffirmed the domestic financial sector’s stability, showcasing resilient bank profitability and robust capital adequacy ratios, indicative of its soundness amid turbulent global conditions.

“The evidence is clear that the economy is responding well to the policy initiatives that have been put in place,” Dr. Addison concluded, instilling confidence in the BoG’s strategies to navigate and mitigate ongoing challenges.

President Akufo-Addo’s address culminated in a call for intensified collaboration between the BoG and the Ministry of Finance, emphasising the need for synchronised policy efforts to drive Ghana’s economic transformation.

He urged the BoG to maintain focus on executing its mandate while dismissing distractions that could derail its mission.