- bags GH¢9.4million profit before tax

- gets BoG’s approval to pay dividend

- climaxes 40th anniversary celebrations

Atwima Kwanwoma Rural Bank PLC, at Pakyi No2 in the Amansie Central District of the Ashanti Region, has recorded yet another remarkable operational performance in the 2022 year under review.

Profit & dividend

The bank recorded a profit before tax of approximately GH¢9.4million in the 2022 reviewed year as against a little over GH¢7million in the previous year, representing a remarkable growth of 33.39 percent. Consequently, profit after tax increased from GH¢4.9million in 2021 to approximately GH¢7million in 2022, representing an increase of 41.75 percent.

Due to the domestic debt exchange programme’s [DDEP] effect on banks in general, the bank of Ghana directed all banks and deposit taking institution not to declare dividend.

The central bank further directed that any bank or institution that wants to pay dividend must show evidence of readiness and technical justification for approval, which Atwima Kwanwoma Rural Bank easily “passed the test”.

In this regard, the Bank of Ghana has approved the payment of dividend for the year 2022 and therefore, the board has presented a proposal for a dividend payment of GH¢ 0.090 per share, representing 18 percent of return on shareholders’ investment for the year 2022.

In all, 15,583,233 ordinary shares qualify for the dividend as at the closure of register on September 30, 2022, and this amounts to GH¢ 1,402,490.97. Meanwhile the board has assured shareholders that they would continue to work harder to ensure dividend payment in subsequent years.

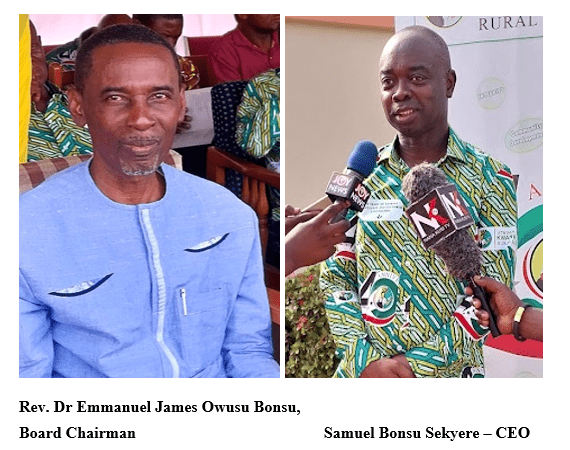

The Chairman of the Board of Directors, Rev. Dr Emmanuel James Owusu Bonsu, announced these and more at the bank’s 40th Annual General Meeting of shareholders and the climax of 40th anniversary celebration held last Saturday at the forecourt of the bank’s head office at Pakyi No 2 near Kumasi.

Operational environment

According to him, Ghana’s economy was confronted with considerable challenges in the year 2022, with the economy growing by 3.1 percent in 2022 against 5.1 percent recorded in the preceding year. The country recorded a high inflation of 54.1 percent as at December 2022. The cedi also depreciated by 30 percent against the US dollar, compared to 4.1 percent depreciation in 2021. This, coupled with the inflationary pressures, drove cost of essential items such fuel, utility and rent to an all-time high during the year 2022.

The monetary policy rate moved from 14 percent at the start of 2022 to 27 percent in December 2022. Treasury bill rate soared to a record high of 35.36 percent in December 2022 from 12.14 percent in December 2021.

The government’s decision to access an extended credit facility of US$3billion in July 2022 from the International Monetary Fund [IMF] was not concluded as at December 2022.

The government’s debt sustainability plan led to the announcement of domestic debt exchange programme (DDEP), which required investors to surrender their existing bonds in exchange for new Government of Ghana Bonds, the maturity of which was up to 15 years. The DDEP undeniably had far-reaching repercussions on the banking sector.

In view of this, Bank of Ghana issued some regulatory interventions for the banks that agreed to sign on to the DDEP. The intervention includes non-payment of dividend, revised liquidity annual reports & financial statements.

In spite of all these, the banking industry in Ghana remained robust and well-placed despite economic challenges encountered during the year under review.

Total assets of the banking sector grew by 22.9 percent to GH¢221billion at end-December 2022, compared to 20.4 percent growth recorded in December 2021.

Investments contracted by 4.8 percent to GH¢79.2billion in December 2022 from a growth of 29 percent in 2021 as banks rebalanced their asset portfolios in favour of loans and other assets due to the debt exchange programme.

Net loans and advances recorded 29.2 percent growth in December 2022 to GH¢60.9billion, compared to 12.8 percent growth in the previous year.

Deposits increased by 30.4 percent to GH¢157.9billion in December 2022, compared with the growth of 16.6 percent recorded in December 2021. Borrowings, however, declined by 14.1 percent to GH¢18.9billion in December 2022, compared with 51.9 percent growth recorded in December 2021.

Operational performance

In spite of the afore-mentioned macroeconomic and other external challenges, the bank still remained strong and resolute in the market to achieve good results as shown in the table.

| Indicators | 2022 | 2021 | % Change |

| Deposit | 293,938,997 | 245,714,209 | 19.63 |

| Investment | 227,427,147 | 204,109,040 | 11.44 |

| Loans /Advances | 57,818,466 | 44,645,307 | 29.51 |

| Total Assets | 356,743,095 | 300,145,830 | 18.86 |

| Stated Capital | 3,550,565 | 3,414,415 | 3.99 |

| Shareholders Fund | 48,150,683 | 42,265,373 | 13.92 |

| Gross Income | 66,728,49 | 49,855,101 | 33.84 |

| Profit Before Tax | 9,441,868 | 7,078,566 | 33.39 |

Corporate social responsibility

In the year under review the bank spent a total amount of GH¢120,306 on corporate social responsibility activities toward the stakeholders within its catchment areas, with special focus on health, education, security, agriculture and other social needs.

Awards for the year 2022

The bank received many awards during the year under review. Notable and most prestigious among them was the Rural Bank of the Year – 2022 award at the CIMG Annual National Marketing Performance Awards, which took place at the Labadi Beach Hotel in Accra.

The bank was also selected and honoured with the topmost Platinum Award at the 16th Ghana Premier Business and Finance Excellence Awards, which took place at the Coconut Grove Regency Hotel, North Ridge, Accra, among others.

Operational expansion and service delivery

The bank opened the eleventh branch at Adum Business Centre in Kumasi. This is in conformity with the expansion of the bank’s branch networks to reach every community. The bank is exploring another area within Greater Kumasi to open another branch to bring services to the doorstep of the people in the chosen communities.

Future outlook

For the bank to keep growing and ensure soundness and sustainability by improving its performance to achieve more in the coming years, management and staff are assiduously working under the direction of the board to achieve the strategic plans.

The CEO of the bank, Samuel Bonsu Sekyere, in an interview with Business & Financial Times, said the bank was able to achieve sustainable growth in the year under review, including developing digital platforms, product innovation, improved staff and board career advancement through training and innovative programmes.

According to him, plans are advanced in the coming years to improve the digital and technological platforms of the bank.

“We will continue to work with our micro, small, medium-sized enterprises as well as government and other stakeholders through new product innovation and service delivery channels,” he said.

He disclosed that the bank is introducing cutting-edge technology and innovation to grow income and profits this year and beyond in order to achieve the bank’s vision to consolidate and sustain its leadership in the rural banking industry.