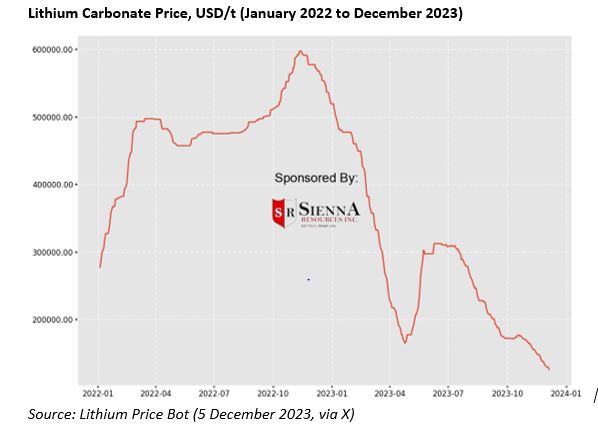

…Having dropped sharply since its highs in late 2022, how much more value from Ghana’s first lithium mine will be wiped as a result of the falling lithium price?

Due to the pessimistic demand outlook for electric vehicles (EVs), recent research from global investment banks, including the likes of UBS and JP Morgan, predicts that the lithium price, which has already fallen drastically since its highs in late 2022, may have further to fall in 2024.

Lithium is a key component in electric vehicle (EV) batteries and is expected to play a key part in the global drive to combat climate change. Affectionately known as ‘white gold’ and found in abundance around the world, most commonly in the form of hard rock ore or as brines, lithium is currently the subject of aggressive exploration efforts.

In January 2023, however, the Chinese Government announced it would be stopping the provision of subsidies for the purchase of EVs. As a leading producer of EV batteries, the announcement rocked the lithium industry, causing prices to drop steeply over the course of the year.

As of Monday, 5th December, 2023, the price of spodumene concentrate (the lithium mineral derived from pegmatite rock) had fallen to US$1,670 per tonne, representing a 71.33 percent decline since the beginning of 2023. Similarly, the price of lithium carbonate (a higher-purity lithium chemical used in EV batteries), which closely correlates the spodumene price, had fallen to US$17,640 per tonne (a 76 percent decline year-to-date).

Lithium Carbonate Price, USD/t (January 2022 to December 2023)

Ghana looks set to play its part in the supply of lithium, having recently awarded a mining lease in respect of the Ewoyaa Lithium Project, expected to become Ghana’s first lithium mine in the country’s Central Region.

The project, which is owned by Atlantic Lithium via its Ghanaian subsidiary Barari DV Ghana Ltd, will produce on average 350,000 tonnes of spodumene concentrate per annum, delivering revenues of US$6.6billion over the 12-year life of the mine.

Over 70 percent of the US$6.6billion revenues forecast to be generated from Atlantic Lithium’s Ewoyaa Lithium Project is expected to be retained in Ghana through royalties, a 13 percent free-carried state interest, the Minerals Income Investment Fund of Ghana’s 6 percent contributing interest in the project, the procurement of goods and services (in line with Ghana’s Local Content Regulations), salaries, a community development fund (whereby 1 percent of the project’s revenues will be allocated to the initiatives benefitting the local communities surrounding the project), and a number of other streams.

With other new mines nearing production and a number of projects intending to ramp up lithium production in the near to medium term, however, analysts foresee a further decline in lithium prices in 2024.

Four China-based analysts told Reuters this week, for example, that lithium carbonate prices in China could fall by a further 30 percent next year from its current level.

Atlantic Lithium’s Mining Lease application was submitted in October 2022, when, according to Fastmarkets, the spodumene price sat above US$7,000 per tonne (versus US$1,670 per tonne earlier this week).

For near-term projects, such as Ewoyaa which intends to achieve initial production in the first half of 2025, further weakness in the lithium price would slash margins and the expected value to Ghana, including royalties, taxes and dividends, just as they are close to achieving production.

Before being able to commence construction at Ewoyaa, Atlantic Lithium requires the mining lease for the project to be ratified by Ghana’s Parliament, as well as the successful completion of its permitting milestones. Having already seen c. 70 percent of the value of its spodumene concentrate wiped out since the beginning of 2022, additional delays could bring about a further significant reduction in the value generated by the project to Ghana.

This could have far-reaching consequences in terms of discouraging lithium exploration by both Atlantic Lithium and other prospective explorers, as well as further tarnishing of Ghana’s image as a leading mining investment jurisdiction. With ambitions to become a leading supply hub for EVs in Africa, has Ghana already missed the boat on achieving spodumene concentrate production before the lithium price falls too far?