- records impressive growth in all financial indicators

The Juaben Rural Bank PLC in the Ejisu-Juaben municipality of Ashanti Region has recorded remarkable growth in all operational indicators for the 2022 year under review.

The bank recorded a profit before tax of approximately GH¢5.1million in the 2022 reviewed year as against a little over GH¢ 3.7million in the previous year, representing growth of 36.36%

Meanwhile, directors of the bank have recommended paying a dividend of GH¢0.06 per share amounting to GH¢932,929.02 (2021: GH¢852,419.16) for the year ended 31st December 2022, subject to exceptional approval by the Bank of Ghana.

The bank recorded a significant growth in deposits during the year under review, despite the challenging macro-economic environment that affected many businesses. Total deposits grew from about GH¢147.4million in 2021 to GH¢194million, representing 11.72% growth for 2022.

With this remarkable performance, the Board has pledged to continue working with all major internal stakeholders to sustain these gains which have been very consistent over the years. As the bank improves efficiency and service delivery, the board and management are confident of even greater performance in the years ahead

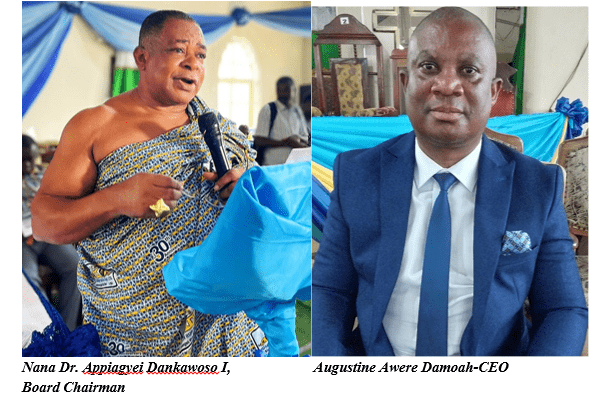

Chairman-Board of Directors, Nana Dr. Appiagyei Dankawoso I, announced these and more at the bank’s 37th Annual General Meeting of shareholders held last Saturday at the Wesley Methodist Church in Juaben.

Operational environment

According to him, during the year under review, the country witnessed economic challenges which saw a surge in inflation, a large exchange rate depreciation and stress on financing the government budget.

Headline inflation remained high in 2022. Inflation as of December 2022 stood at 54.1 percent, an increase of over 300 percent from the 12.6 percent rate recorded in December 2021. Interest rates on the money market increased in line with inflation across the yield-curve. The monetary policy rate also shot up to 27 percent from 14.5 percent in December 2021. The country recorded a significant depreciation of the Ghana cedi against all major currencies.

As part of efforts by government to bring the economy to a recovery path, the Domestic Debt Exchange Programme (DDEP) was launched by government to protect the economy and enhance the country’s capacity to service public debt at sustainable levels. This largely affected the banking sector – of which your bank was not left out, as it had investments in government bonds and bills. Even though the DDEP adversely affected its performance, Juaben Rural Bank remained resilient and continued to record positive results.

Operational Performance

Despite the challenging macroeconomic environment coupled with some unprecedented circumstances that pertained during the reviewed year, the bank worked hard to pull yet another remarkable operational performance in all financial indicators during 2022, as indicated in the table below.

| Item | Year 2022

(GH¢) |

Year 2021

(GH¢) |

Approx.

Percentage Change |

| Deposits | 194,094,199.00 | 147,473,907.00 | 31.61% |

| Loans and Advances (Gross) | 61,415,768.00 | 55,090,854.00 | 11.48% |

| Investments | 106,556,526.00 | 89,377,251.00 | 19.22% |

| Total Assets | 220,958,329.00 | 170,964,956.00 | 29.24% |

| Stated Capital | 4,231,848.00 | 3,671,040.00 | 15.28% |

| Profit before taxation | 5,093,616.00 | 3,735,490.00 | 36.36% |

| Profit after taxation | 3,774,192.00 | 2,459,365.00 | 53.46% |

Corporate Social Responsibility

In the 2022 year under review, Juaben Rural Bank contributed to the development of communities in which it operates as part of corporate social responsibility in the area of health, education, security and community development among others, to which the bank committed a total of GH¢81,459

Technology

The role of technology in today’s dynamic banking business cannot be overstated. Technology has taken over the banking space, as every activity within the banking hall has been automated; optimising speed, accuracy and efficiency within the sector.

During the period under review, the bank invested heavily in building a robust ICT infrastructure as part of efforts to modernise and improve its digital capabilities to ensure efficiency in banking business operations.

While opening up the bank through technology, the directors are also mindful of associated risks. The bank intends to deploy risk management strategies in response to risk events as quickly as possible, and will regularly assess various forms of cybercrime threats and adopt responsive cybersecurity mitigation measures.

Awards

Juaben Rural Bank PLC maintained its position in the Prestigious Club 100 Awards listing during the period under review. The bank also received a Gold Award at the 2nd Non-Bank Financial Institutions Awards ceremony under the auspices of Ghana Microfinance Institutions Network.

Furthermore, the bank’s Chief Executive Officer, Elder Augustine Awere Damoah, was admitted to the Eminent West Africa Nobles Forum at its 20th Anniversary and Awards Ceremony. Mr. Awere Damoah was honoured for his exemplary leadership style, positive contribution to society and upholding integrity.

Outlook

Emphasising what the future holds for the bank, its Board Chairman stressed that it remains focused on pursuing its market dominance agenda – and assured shareholders that the Board will continue developing proven strategies to ensure the sustainability of business while creating sustainable returns for shareholders through an intensive deposit and shares mobilisation drive, as well as cost-management programmes.

He further stressed that the bank will continue to invest in its digital transformation agenda by exploring other business opportunities while minimising and addressing all potential risks.

He said the Board is confident that the Ghanaian economy will bounce back, and the bank -which is well-positioned – will take full advantage of growth opportunities for sustainable and profitable growth in the years ahead.

The bank’s Chief Executive Officer, Augustine Awere Damoah, in an interview with Business & Financial Times said it will continue to put in pragmatic measures that ensure positive growth and achievement of its Strategic Plan.

He stressed that the bank will intensify loan recovery, embark on intensive deposit mobilisation, strengthen internal controls and maintain quality assets to increase profitability.

He has also emphasised that the bank’s business focus in 2023 is on driving growth, innovations, efficiency and service as the main pillars in achieving profitability.

Mr. Awere Damoah stressed the bank will develop the human capital to meet demands of functioning profitability while achieving the objective of overcoming shocks from an unfriendly macroeconomy and rising cost of living, as well as their devastating effects.

40th Anniversary Celebrations

Next year marks the bank’s 40th anniversary, a significant milestone that will be celebrated. Juaben Rural Bank PLC has contributed immensely to the country’s socio-economic development, and its directors are of the view that it is time to have an introspection of how far the bank has come and then strategise for the journey ahead.

A planning committee has been set up to oversee the organisation of this year-long anniversary programme, which will be climaxed at the next Annual General Meeting.