- climaxes 40th anniversary celebration activities

- bags GH₵7million profit in 2022

- records growth in all indicators

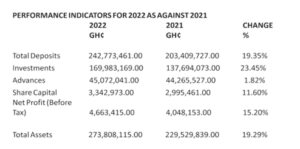

Odotobri Rural Bank PLC at Jacobu in the Amansie Central district of Ashanti Region has recorded impressive growth in all financial indicators for the 2022 year under review

Operational Performance

The bank posted a pre-tax profit of a little over GH¢4.7million in the 2022 year under reviewcompared to about GH¢4.1million recorded in 2021, representing a satisfactory growth of 15 percent.

The bank recorded total deposits of GH¢243million, representing a percentage increase of 19.35 percent from approximately GH¢203.4million in 2021, with total assets hitting GH¢273.8million compared to the previous year at about GH¢229.5million – which represents a percentage growth of 19.9 percent.

Total Loans and Advances for the period under review also moved up marginally, by 1.82 percent from approximately GH¢44.2million in 2021 to about GH¢45million in 2022, with stated capital also going up marginally from a little over GH¢2.99million for 2021 to GH¢3.3million in 2022 year under review.

Investments of the bank grew to approximately GH₵170million as against a little over GH₵137million in 2021, representing a 23 percent increase.

The bank’s board as well as management were confident about the year under review because other opportunities for sustainable growth were explored, and the team’s commitment to be innovative and distinguished in-service delivery and pandemic recovery was also expected to propel public confidence.

Chairman-Board of Directors, Dr. Kwaku Mensa-Bonsu, announced these and more at the bank’s 36th Annual General Meeting of shareholders held recently at the Nana Adu Darko Community Centre at Jacobu in Ashanti.

Operational Environment

According to him, even though the bank achieved so much in the year 2022, it did so through hard work and commitment as the economic environment was unfriendly.

The country continued to suffer from impacts of COVID-19, macroeconomic instability, global financing tightening and spillover effects from Russia and Ukraine’s conflict.

GDP growth is estimated to have slowed to 3.2 percent in 2022, down from 5.4 percent in 2021. High inflation and interest rates depressed private consumption and investment. Government’s lack of access to capital markets and high debt service obligations weakened its spending power.

Banking sector vulnerabilities have increased because of the cedi’s depreciation and impact of the Domestic Debt Exchange Programme (DDEP). Implementing the DDEP will impact Ghana’s financial sector due to the banks’ heavy exposure to government debt.

In respect of these difficulties which had to be surmounted, the bank redefined its operational strategies considering its strength, weaknesses, external threats and opportunities to mitigate the far-reaching effects; and Odotobri Rural Bank managed to pull yet another remarkable operational performance in all financial indicators for 2022 as indicated in the table below.

Dividend

Following the Bank of Ghana’s (BoG) directive as part of measures to safeguard banks as a result of the DDEP, no dividend was paid to shareholders for the 2022 financial year even though the bank made profit and recorded positive variance in all indicators.

Corporate Social Responsibility

The bank continues to support communities, individuals and institutions within its catchment areas. A total amount of GH¢183,000 was spent on donations and Corporate Social Responsibility in the areas of Agriculture, Education, Health, Security and Recreations to deepen the bank’s commitment to societal responsibility.

Awards

The bank received the Best Regional Rural Bank award for the year 2021 from the Association of Rural Banks in Ghana. Odotobri Rural Bank PLC received a Gold Award for Rural Banking (Deposit mobilisation) during the 19th Ashanti Financial Services awards organised under the auspices of Manhyia Palace.

Future outlook

The bank will not be opening a new branch in 2024 but rather consolidate the gains made so far. It will also pay attention to its electronic channels as part of expansion and customer service satisfaction activites.

Dr. Mensa-Bonsu commended the commitment of management and staff to the bank’s objectives, as their efforts have led to significant improvements in its operational results for the 2022 financial year under review.

He then encouraged staff to work harder, since the bank expects maximum contributions from staff members over the ensuing years.

The bank’s Chief Executive Officer, Abraham Coffie, in an interview with Business & Financial Times said the bank’s business focus in 2023 is on driving growth, innovations, efficiency and service as the main pillars in achieving profitability.

He has stressed that the bank will follow stringent cost reduction policies, strengthen internal control measures and develop its human capital to meet demands of functioning profitability, as well as achieving the objective of overcoming shocks from an unfriendly macroeconomy and rising cost of living, as well as their devastating effects.

40th Anniversary Climax

The bank chalked up 40 years of success and celebrated its 40th anniversary this year. As part of activities to mark this historic occasion, the bank organised a number of activities to commemorate the occasion. Notable among the activities were a float through the principal streets of Kumasi, health screenings, a thanksgiving service and the 36th Annual General Meeting to climax the occasion.