With the pilot deemed successful but full roll-out delayed, Ghana’s central bank has engaged the fintech community to explore use-cases for the digital currency through a 12-week hackathon.

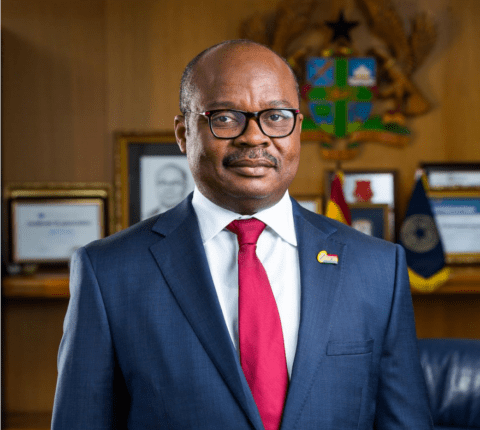

At a press briefing following the 115th Monetary Policy Committee meeting, Bank of Ghana (BoG) Governor Dr. Ernest Addison said: “The pilot was concluded successfully and there is currently an e-Cedi hackathon that is ongoing – innovators in the fintech community have been competing on use-cases for the e-Cedi, developing all kinds of products which can be facilitated by e-Cedi person-to-person payments, merchandise payments and government payments”.

He disclosed that after receiving over 88 initial registrations, the pool was reduced to 10 participants who pitched projects across various categories of payments, agriculture/trade, data privacy, remittances, interoperability with existing systems, know-your-customer (KYC) models, cross-border transfers and combatting illicit uses.

Winners will be selected over multiple rounds and announced at a ceremony in December 2023. Participants retain full intellectual property rights over their submission.

The e-Cedi hackathon kicked off on October 6, 2023 under supervision of the BoG and its technology partner EMTECH Solutions. The competition brought together creators, developers and entrepreneurs to ideate groundbreaking solutions leveraging the e-Cedi.

“Unfortunately, we don’t think that it will be available in 2024 – because we really need to focus on stabilising the economy and bringing in the e-Cedi at a time when the economy is very stable; otherwise, we will really defeat the whole purpose of the exercise,” Dr. Addison said.

The hackathon’s focus areas provide insight into functionalities and versatility that the Bank of Ghana envisions for the e-Cedi. Use cases for merchant and consumer payments could improve accessibility and financial inclusion, allowing those without bank accounts to seamlessly pay with e-Cedi stored on devices.

Exploring government disbursements could reduce reliance on cash for distributions like salaries and pensions. Additionally, dwellers in remote regions may benefit from digital social interventions.

e-Cedi launch timeline remains uncertain

The hackathon innovations will likely inform eventual e-Cedi capabilities, but the full-launch timeline remains uncertain. The Governor confirmed that the e-Cedi pilot met expectations; however, the launch date has been deferred due to Ghana’s current macroeconomic instability.

Dr. Addison indicated that introducing a new form of currency during continued inflation and depreciation could undermine financial stability. The BoG has shifted focus to stabilising conditions to make them conducive for adoption.

Nonetheless, Governor Addison positioned the e-Cedi as crucial for driving future financial inclusion and recognised the hard work done by internal tech teams and partners toward launch-readiness.

The e-Cedi hackathon allows developers to prepare innovative use cases so that when the economy stabilises, the Bank can swiftly capitalise on built momentum to deploy the digital currency.

Through the competition, the Bank of Ghana continues advancing its goals for the e-Cedi in service of Ghanaians despite the delay. The hackathon also spotlights Ghana’s expanding influence at the frontier of digital currency innovation globally.