The global economic volatility and inflationary pressures in Ghana have made the credit decisions of banks very difficult. A significant majority of financial institutions have decided to play safe by investing heavily in government securities. Government securities, particularly bonds have in recent times proven to be unsafe due to the Domestic Debt Exchange Programme (DDEP) undertaken by the government. Presently, Treasury bills seem to be the only safe option for banks having recorded massive investment in recent times. Concerns have, however, been raised by various civil society groups about the current interest rate on Treasury bills and government’s ability to meet its repayment obligations. These concerns require that financial institutions that wish to remain profitable and grow rethink their investments in government securities and focus on the provision of credit to the private sector. This article seeks to provide strategies to adopt in the provision of credit during periods of economic volatility and inflationary pressure. It concludes with some reasons why improving the provision of credit during this period can be good for financial institution.

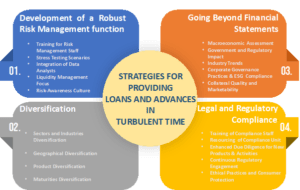

Strategies for providing loans and advances in volatile and high inflation periods begin with the development of a robust risk management function, all the way through going beyond financial statements, diversification, and compliance with legal and regulatory requirements.

Development of a Robust Risk Management function

With the current developments in technology spearheaded by Artificial Intelligence (AI) software, training of risk management staff can go a long way to improve their effectiveness and efficiency of the risk management function. Risk management staff must be equipped with modern dynamic models and methodologies of evaluating credit risk, market risk, operational risk, and liquidity risk. Stress testing scenarios that specifically tackle the challenges posed by high inflation and economic volatility must be undertaken to determine the resilience of financial institutions’ assets and liabilities under diverse economic conditions.

Financial institutions must employ more data analysts to complement their traditional Credit Administration staff. Data analysts help generate reports from customer data that informs management decision on the credit worthiness of customers. Data analysts can also help develop a robust monitoring and reporting framework for the loans and advances portfolio that will track key risk indicators in real-time to ensure timely and accurate information for decision making. Special focus must be given to liquidity management to ensure that the financial institution does not only meet its obligations but also have a liquidity buffer to withstand unforeseen events and market disruptions during the period of economic stress. Finally, risk-awareness culture must be encouraged throughout the organisation to ensure that all communications with customers in matters relating to loans and advances are done properly and professionally.

Diversification

Diversification as a strategy for improving the provision of loans and advances to customers in times of economic volatility relates to diversifying across sectors and industries, geography, products, and maturities. In relation to diversification across sectors and industries, financial institutions must assess their loans and advances portfolio to ensure they are not too concentrated in some particular industries. A comprehensive evaluation of the impact of high inflation on all industries must be undertaken to determine how resilient or susceptible each sector or industry is to an increase in inflationary rate. The impact of high inflation can also vary across different geographic locations. Diversification of credit exposure across geographical regions can help reduce the credit risk in giving out loans and advances. Product diversification in times of economic volatility can be employed to help reduce the credit risk faced by financial institutions. This can be achieved by profiling customers into market segments based on their risk appetites and the impact of an increasing inflationary rate on their businesses. Loans and advances products can then be tailored towards the various market segments to reduce the overall credit risk associated with the portfolio. Finally, the Assets and Liability management of financial institutions is very critical in times of high inflation and economic volatility owing to the crucial role liquidity plays in this period. Loans and advances must therefore be diversified based on the maturity brackets of the matching liabilities of financial institutions to mitigate interest rate risk.

Going Beyond Financial Statements

In periods of economic volatility, evaluation of borrowers by financial institutions must go beyond the regular financial statements review. Credit risk assessment must incorporate the effects of the macroeconomic environment on the business of the borrower and the sustainability of the business in the long term. The impact of government and regulatory directives on the performance and growth of the borrower must also be given paramount focus. Critical attention must be given to the industry trends and market positioning of the borrower by assessing its metrics as compared to industry peers. Attention must also be given to the corporate governance practices of the borrower in terms of their track record when it comes to competence and effectiveness. An addition to the evaluation of the corporate governance quality of the borrower is their compliance with Environmental, Social, and Governance (ESG) principles in terms of sustainability practices and risk mitigation practices that ensure financial stability. The collateral provided by borrowers must be assessed in terms of their quality and marketability bearing in mind the impact high inflationary rate will have on its market value. Finally, financial institutions must go beyond the review of annual financial statements to closely monitor the monthly, quarterly, and semi-annual financial performance and operations of their top 50 loans and advances clients. This will help in the early detection of issues that could lead to loan delinquency and where necessary take the appropriate steps needed to address them.

Legal and Regulatory Compliance

In periods of economic volatility, financial institutions in the quest to remain profitable tend to undertake various activities which they would not normally undertake in stable economic conditions. It is therefore very important that legal and regulatory compliance be at the forefront of the operations of financial institutions in their bid to give out loans and advances during periods of economic volatility. Existing and newly issued relevant directives and regulations governing the practice of lending during periods of high inflation must be strictly adhered to. Financial institutions must continuously engage regulatory institutions on new products or activities they wish to undertake to ensure they are not in breach of existing regulations. Efforts must be put in place by financial institutions to ensure their compliance and legal divisions are properly equipped and resourced to safeguard their interests in all loans and advances transactions. It is important that financial institutions acknowledge the fact that relevant laws and regulations governing lending practices are put in place to safeguard the financial industry as a whole and it is in everybody’s interest if they are adhered to.

Region-Beta Paradox: reason to provide credit

The region-beta paradox as illustrated in the study by Daniel Gilbert et al (2004) is the phenomenon that people can sometimes recover more quickly from distressing experiences than from less distressing ones. In other words, intense states trigger psychological defence processes that reduce the distress, whiles less intense states do not trigger the same psychological defence processes.

Applying this to financial institutions giving out credit, financial institutions are less likely to trigger their “psychological defence” of developing a robust risk management function, diversify, go beyond financial statements, or improve upon their legal and regulatory compliance in periods of economic stability of mild inflationary pressures. However, with the significant increase in inflation rate and economic volatility, there is the need for financial institutions to trigger their “psychological defence processes”. This will not only help the financial institutions to survive the high inflationary pressures but also help the entire economy recover faster.

In developing a robust risk management function, financial institutions improve on the efficiency and effectiveness of their role as financial intermediaries. The problems of adverse selection, information asymmetry and moral hazards are effectively addressed, and funds are moved efficiently from surplus units to deficit units to promote economic growth.

In diversifying, financial institutions may focus their lending on essential industries like healthcare, food and agriculture, utilities which are somewhat inelastic to price or technology and innovation that adapt and thrives in changing economic conditions. This will in the long-run increase supply to meet the demand to stabilise prices.

By going beyond the financial statements, financial institutions take active interest in the profitability, growth, and success of businesses, thereby ensuring overall economic growth.

Adherence to relevant laws and regulations governing lending ensures that financial institutions do not overexpose themselves for credit risk which safeguards the financial industry and the entire economy.

Outlook

Investing in government securities, particularly treasury bills by financial institutions seems to be the most conservative and prudent thing to do in our current economic circumstances. However, it is important to note that government securities are safe as long as government is able to meet its obligations as and when they fall due. Government will be able to meet its obligation by raising funds through non-tax revenue, tax revenue and borrowing. Where government is not able to raise funds from these sources, it either restructures its debt or it outrightly defaults. Taxation is a means by which government raise funds to meet its debt obligations without creating more debts. How much funds government can raise through taxation is dependent on the success of businesses in the economy. Therefore, when financial institutions invest their funds in mainly government securities to the detriment of the private sector, it could lead to collapse of businesses and reduction in tax revenue. Government will then have to borrow more to pay existing debts to meet its current non-debt obligations. When this continues over time, government debts will become unsustainable in the long run which will result in a debt restructuring or default with dire consequence for all financial institutions.

Following from the above, it is in the interest of financial institutions to adapt the above listed strategies and continue to carefully provide credit for the private sector. The maintenance of a very decent loan to deposit ratio by financial institutions will not only promote private sector growth but also safeguard the financial industry against possible government debt restructuring or default in future.

The author is a member of the Institute of Chartered Accountants Ghana.

Email: [email protected]