Concerns have arisen within the market regarding potential limitations on the scope of yield correction across the spectrum of Treasury bills ranging from 91 days to 364 days, amid the significant domestic financing requirements of government in 2024.

The projected deficit of GH¢61.9billion is set to be covered through a blend of foreign and domestic sources, with a substantial reliance on net domestic financing estimated at GH¢61.4billion and constituting 99.3 percent of the total financing for 2024.

Cumulatively, as of November 20, 2023, the Treasury has issued GH¢128.93billion on the money market, surpassing the GH¢119.77billion target. Investors tendered GH¢133.07billion during this period. Notably, GH¢22.95billion of the total issuances represented net issuance (new debts), aimed at supporting the 2023 budget due to government’s inability to access international capital markets.

In assessing the fiscal trajectory’s impact for 2024, GCB Capital highlighted that the substantial Treasury appetite could potentially dampen the prospects for yield correction.

“The fiscal path in 2024 will result in a larger overall budget deficit compared to the anticipated outturn for 2023, with a substantial funding obligation of GH¢61.88billion primarily sourced from the domestic market. Hence, it appears that the Treasury will sustain its robust funding appetite at the front end of the LCY curve in 2024, possibly limiting the potential for yield correction,” it said.

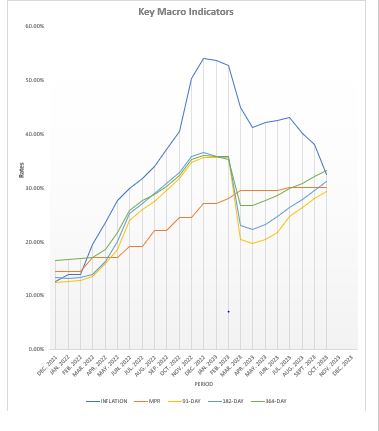

The ongoing cycle of yield correction occurs against the backdrop of declining inflation rates, a stable monetary policy rate, and implementation of new pricing directives by the Treasury. The gradual reduction in uncertainties sets the stage for a correction of nominal yields in the forthcoming weeks, barring unforeseen shocks to the macro-fiscal outlook.

Market sentiments indicate that nominal yields may have peaked within the range of 29.97 percent to 33.70 percent along the T-bill curve. Furthermore, there is anticipation for a yield correction – especially with adjustments in the T-bill auction process whereby the Treasury, through Primary Dealers (PDs), now offers price guidance before the auctions open. GCL expressed: “We anticipate a more pronounced correction in yields once inflation falls below 30 percent, thereby restoring positive real returns on money market instruments”.

The front-loaded fiscal adjustments within the IMF programme, coupled with a stringent monetary policy stance and favourable base effects, have contributed significantly to an 18.9 percent drop in year-to-date headline inflation – reaching a 15-month low of 35.2 percent in October 2023. Despite persistent FX pressures, expectations lean toward an even sharper decline in headline inflation during the remaining months of 2023; primarily due to favourable base effects potentially closing around 25 percent by year-end, provided other factors remain constant.

During last week’s auction of 91-day to 364-day bills, total demand amounted to GH¢3.75billion (-6.45 percent w/w); surpassing the auction target by 14.8 percent. The Treasury accepted nearly all submitted bids, covering both the auction target and the maturity obligation due on November 20, 2023 by 1.15x and 1.60x respectively. The benchmark 91-day yield decreased by 10bps to 29.74 percent, continuing a declining trend from the previous week. However, the 182 and 364-day yields remained relatively stable at 31.88 percent and 33.45 percent respectively.

In addressing concerns about fiscal measures and financing operations, Mr. Ashiagbor highlighted the potential implications of high domestic financing needs on market rates and inflation during an interview with B&FT at the 2024 Budget review.

He expressed concern about the challenges in lowering rates if government borrows a substantial amount like GH¢61.4billion, considering prevailing inflation levels. However, he remained optimistic – emphasising prudent management and meeting set targets as key factors that could eventually lead to rate reductions.

Mr. Ashiagbor acknowledged the validity of concerns, but pointed out the positive impact of projected inflation trends in recent months as a potential mitigating factor; stressing the importance of a focused revenue mobilisation agenda aimed at reducing the necessity for extensive borrowing.

The Country Senior Partner emphasised the necessity for a long-term approach to economic recovery, cautioning that 2024 will continue to present challenges. He underscored the importance of implementing corrective measures while recognising that immediate solutions might not be forthcoming.