The value of all final goods and services produced in the country is set to surpass the GH¢1trillion (US$85billion) mark in nominal terms for the first time ever in 2024, Minister of Finance Ken Ofori-Attah has announced.

If realised, the GH¢1.047trillion – which is summed up as the gross domestic product (GDP) – will be a 24.86 percent increase over the GH¢801billion projected for 2023, and almost four times higher than the GH¢219.5billion nominal value in 2016.

“The 2024 budget is even more significant because we will cross the GH¢1trillion GDP mark for the first time in our economic history… (it) is projected to be valued over GH¢1trillion in 2024 from the GH¢219.5billion in 2016,” Mr. Ofori-Atta said during the presentation.

This comes as the minister outlined macroeconomic targets for the upcoming fiscal year, including an overall real GDP growth of at least 2.8 percent and a Non-Oil Real GDP growth of at least 2.1 percent.

Additionally, government aims to achieve an end-period inflation rate of 15 percent, compared to 54.1 percent at the end of 2022 and 35.2 percent in October 2023 – even as it is expected to trend further down to the medium-term target band of 8±2 percent by end of December 2025.

The head of government’s fiscal arm reiterated that the 2024 framework is in alignment with objectives and policy priorities of the three-year IMF-supported Post COVID-19 for Economic Growth (PC-PEG) programme, as it targets a primary balance on commitment basis at a surplus of 0.5 percent of GDP, in addition to gross international reserves to cover not less than three months of imports for the period.

Revenue matters

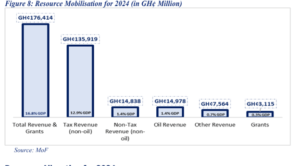

Total revenue, including grants, is projected at GH¢176.4billion – 16.8 percent of GDP – underpinned by permanent revenue measures, primarily tax revenue measures amounting to 0.9 percent of GDP.

These measures include a particular emphasis on property taxes under the Property Rate Reform Project, which according to the finance minister has resulted in a notable surge for the number of billable properties.

The pre-2023 count of 1.3 million property has skyrocketed to 12.42 million, marking an astonishing 856 percent increase in the identification of property eligible for proper billing. Additionally, the identification of registered individuals and entities associated with these billable property has risen by 831 percent, from 186,542 to 15.68 million.

In continuation of the aforementioned measure, a set of relief measures has been outlined for immediate implementation. These include an extension of the zero-rate Value Added Tax (VAT) on locally manufactured African prints for an additional two years; a waiver of import duties on electric vehicles for public transportation over an extensive 8-year period; and a corresponding waiver on semi-knocked down and completely knocked down electric vehicles imported by registered Electric Vehicle (EV) assembly companies in Ghana.

Furthermore, government plans to extend the zero-rate VAT on locally assembled vehicles for an additional two years, and introduce a zero-rate VAT on locally produced sanitary pads.

Importantly, import duty-waivers for raw materials necessary for local manufacture of sanitary pads will be granted. The relief measures also encompass exemptions on imports of agricultural machinery, equipment and inputs, as well as medical consumables and raw materials for the pharmaceutical industry. To streamline administration, a VAT flat rate of 5 percent is set to replace the existing 15 percent standard VAT rate on all commercial properties.

In addressing environmental concerns, government aims to combat plastic waste and pollution by reviewing and expanding Environmental Excise Duty. This expansion will now cover plastic packaging, industrial emissions and vehicle emissions, reflecting a commitment to environmental responsibility.

Government intends to realign stamp duty rates with current economic realities, by expanding bands subject to ad valorem taxes and upwardly revising specific rates.

A key proposal includes the introduction of a simplified tax return to encourage voluntary compliance, particularly among individuals in the informal sector.

The finance minister also reported a successful conclusion of negotiations by the Tripartite Committee on the National Daily Minimum Wage, with a new figure of GH¢18.15 (US$1.58) versus a global poverty threshold equivalent to US$2.15 per person per day. Organised Labour has also successfully negotiated a minimum 23 percent increment in the base pay for 2024.

Expenditure

On the expenditure side, government projects a commitment basis of GH¢226.7billion (21.6 percent of GDP); reflecting a significant reduction of 6.1 percentage points relative to the 2022 outturn.

To tackle existing arrears, Ghana Audit Service will continue the verification and validation process for arrears identified as of December 2022 – consistent with the Spending Arrears Clearance and Prevention Strategy, Mr. Ofori-Atta noted.

To prevent the accumulation of new arrears, government will ensure quarterly budget allotments with cash flow forecasts, revising cash plans for Ministries, Departments and Agencies (MDAs) as well as reconfiguring the cash plan module on Oracle Hyperion by December 2023 – which is expected to facilitate efficient cash planning and enhance the transparency of financial transactions.

“It is envisaged that in the coming weeks, extensive negotiations with creditor groups will commence and ensure we achieve the targets set under the IMF/World Bank Debt Sustainability Framework,” Mr. Ofori-Atta said regarding external debt negotiations, while expressing optimism for a year-end resolution.