Delegates and participants at the Intra African Trade Fair, IATF in Cairo, Egypt, witnessed the signing of financing and other agreements valued in excess of US$1bn between the African Export-Import Bank (Afreximbank) and several leading business entities from across the continent.

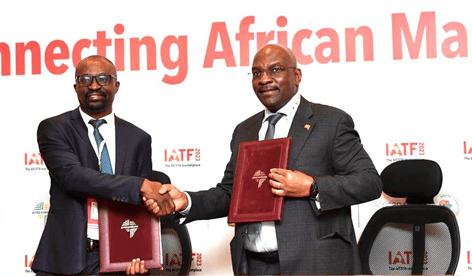

United Bank for Africa PLC – US$150m

The Bank signed a US$150million trade finance facility agreement with United Bank for Africa (UBA) PLC – under the Ukraine Crisis Adjustment Trade Financing Programme for Africa – to be utilised in financing trade and trade-related transactions to support UBA clients facilitate increased financing for trade businesses in various sectors of Nigeria’s economy to mitigate adverse effects from the Russia-Ukraine crisis.

Signed by Denys Denya, Executive Vice Presiden-Finance, Administration and Banking Services, Afreximbank; and Oliver Alawuba, Managing Director-UBA PLC, the facility is expected to enhance confidence in the settlement of international trade transactions for strategic imports.

FDH Bank Malawi -ATEX – US$10m

Another facility agreement, for US$10million, was signed with FDH Bank Malawi to support trade finance in Malawi. Gwen Mwaba, Director-Trade Finance, signed for Afreximbank while George Chitera, Deputy Managing Director, signed for FDH Bank Malawi.

Banque Commerciale du Burundi (BANCOBU) – US$55m

Under a facility agreement with Banque Commerciale du Burundi (BANCOBU), Afreximbank will provide US$55million trade facilitation limits for BANCOBU to support importation of essential commodities, such as petroleum products, which are important for the Burundi’s trade and manufacturing sector.

Rene Awambeng, Global Head-Client Relations, signed for Afreximbank while Sylvere Bankimbaga, Deputy Managing Director, signed on behalf of BANCOBU during a ceremony witnessed by Audace Niyonzima, Minister of Finance, Budget and Economic Planning, of Burundi.

Banque de Credit de Bujumbura – US$40million

Afreximbank also signed an agreement under which it will provide a US$40million AFTRAF facility for Banque de Credit de Bujumbura (BCB) to support trade finance in Burundi. Signers were Rene Awambeng, Global Head-Client Relations, for Afreximbank, and Roger Guy Ghislain Ntwungeye, Managing Director, for BCB.

Exodus and Company – US$141million

A term sheet for a US$141million intra-African investment finance facility was signed with Exodus and Company. Denys Denya, Executive Vice President-Finance, Administration and Banking Services, signed for Afreximbank; while Progress Mambo, Chief Executive Officer, signed for Exodus and Company.

Ora SPV/Vista Group – €140million

Another term sheet, for a €140million intra-African trade investment facility, was signed with Ora SPV/Vista Group for funds to be deployed in Burkina Faso. Kanayo Awani, Executive Vice President-Intra-African Trade Bank, signed for Afreximbank, while Simon Tiemtore, Chairman-Lilium Capital, signed for Ora SPV/Vista Group.

ADI SPV/Vista Bank – €113million

The Bank also signed a term sheet with ADI SPV/Vista Bank for a €113million facility to be deployed in Burkina Faso. The term sheet was signed by Kanayo Awani, Executive Vice President-Intra-African Trade Bank, for Afreximbank; and Simon Tiemtore, Chairman-Lilium Capital, for ADI SPV/Vista Bank.

Lilium Gold – US$75million

Another term sheet signed during the day was with Lilium Gold for a US$75million senior debt facility – for a strategic investment that will significantly enhance Burkina Faso’s mining infrastructure through acquisition of the Boungou and Wahgnion gold mines. Helen Brume, Director-Project and Asset Based Finance, signed for Afreximbank; while Simon Tiemtore, Chairman-Lilium Capital, signed for Lilium Gold.

Sapro Mayoko – US$96million

The Bank also signed a term sheet with Sapro Mayoko for a US$96million iron ore mine development facility in Congo. The document was signed by Kanayo Awani, Executive Vice President-Intra-African Trade Bank, for Afreximbank; and Paul Obambi, Chief Executive Officer, for Sapro Mayoko.

International Centre for Regional Integration and Trade Research (ICRITR) – MoU

An additional document inked during the day was a memorandum of understanding with the International Centre for Regional Integration and Trade Research (ICRITR) signed by Kanayo Awani, Executive Vice President-Intra-African Trade Bank, for Afreximbank, and Prof. Charles Okechukwu Esimone, Vice Chancellor-Nnamdi Azikiwe University, Awka, Nigeria, for ICRITR.

Anambra State – US$200million

Early on the trade fair’s second day, Afreximbank signed a mandate letter to provide capital raise financial advisory services to the Anambra State government of Nigeria for an estimated US$200million facility to support development of three major projects in the state – covering the Ikenga Mixed-Use Industrial City Project; Anambra Export Emporium; and Akwaihedi Unubi Uga Automotive Industrial Park.

The Bank also signed an agreement to provide the state government with financial advisory services for developing an operational and governance framework for the Anambra Diaspora Fund – including capital raise financial advisory services for the Anambra Intra-City Rail Master Plan project and Anambra Diaspora Fund. Kanayo Awani, Executive Vice President-Intra-African Trade Bank, signed for Afreximbank; while Mark Okoye, Chief Executive Officer-Anambra State Investment Promotion and Protection Agency, signed for the state government.

Central Africa Building Society – US$40million

Afreximbank also signed an agreement with Central Africa Building Society (CABS), Zimbabwe’s largest building society, to provide a US$40million line of credit to help build capacity among hundreds of small and medium enterprises (SMEs). Signed by Denys Denya, Executive Vice President-Finance, Administration and Banking Services, Afreximbank; and Mehluli Mpofu, Managing Director-CABS, the agreement is for three years and aimed at fostering growth of the SME sector by supporting productive sectors such as agriculture, manufacturing and mining.

Arise Integrated Industrial Platforms (ARISE IIP) – Heads of Terms

The Bank signed a heads of terms agreement with Arise IIP for implementing African Quality Assurance Centres’ (AQAC) projects in Benin and Gabon. Under the heads of terms, Afreximbank will develop AQACs to offer conformity assessment services such as testing, inspection and certification services in Benin, Gabon and possibly other African countries in collaboration with Arise IIP – within industrial parks developed by Arise to support park tenants and other industries outside to enable them meet local and export market requirements. The AQAC initiative was created by Afreximbank to support African countries in improving their capacity to comply with international standards and technical regulations, so as to promote exports and facilitate intra- and extra-African trade while ensuring the safety of products for consumption in Africa.

Gagan Gupta, Founder and CEO-rise IIP, signed for the company while Oluranti Doherty, Director-Export Development, signed for Afreximbank.

Cooperation Agreements

The Bank also announced a conclusion of cooperation agreements with the Comoros National Investment Promotion Agency (ANPI – Invest in Comoros), the Kenya Private Sector Alliance (KEPSA) and Kenya Association of Manufacturers (KAM) aimed at accelerating intra-African trade and investment.

The agreements, signed seek to deepen collaboration with the institutions through sharing ideas, exchange of business-oriented information to facilitate trade and investment, business matchmaking, grants, training, technical assistance and capacity building, inter-institutional cooperation and other agreed activities.

They are intended to increase the impact of Afreximbank’s TRADAR Club – a member-driven network set up to empower international businesses and executives to transform trade and investments in Africa through trusted trade intelligence and advisory services.

IATF2023, Africa’s largest trade and investment fair, opened on 9 November and will run till 15 November 2023.

About the Intra-African Trade Fair

Organised by the African Export-Import Bank (Afreximbank), in collaboration with the African Union Commission (AUC) and African Continental Free Trade Area (AfCFTA) secretariat, the Intra-African Trade Fair (IATF) is intended to provide a unique platform for facilitating trade and investment information exchange in support of increased intra-African trade and investment; especially in the context of implementing the African Continental Free Trade Agreement (AfCFTA).

IATF brings together continental and global players to showcase and exhibit their goods and services, and to explore business and investment opportunities on the continent. It also provides a platform to share trade, investment and market information with stakeholders, and allows participants to discuss and identify solutions to the challenges confronting intra-African trade and investment.

In addition to African participants, the Trade Fair is also open to businesses and investors from non-African countries interested in doing business in Africa – and supporting the continent’s transformation through industrialisation and export development.