The continent of Africa stands at a pivotal juncture, with its vibrant economies exhibiting immense potential for growth and innovation. Central to unlocking this potential is the transformation of financial systems and structures, particularly in the realm of Supply Chain Financing. Supply Chain Financing has emerged as a critical tool for enhancing liquidity and ensuring the smooth operation of supply chains, which are the lifeblood of businesses across the continent. This article zeroes in on the transformative journey of Supply Chain Financing in Africa, highlighting why it is indispensable and how the advent of fintech is rewriting the rules of the game.

In a landscape marked by diverse economies and varying levels of financial inclusion, Africa presents a unique set of challenges and opportunities for Supply Chain Financing. Traditional banking systems have often fallen short in meeting the dynamic needs of businesses, especially small and medium-sized enterprises (SMEs) that constitute a significant portion of the African economy. The rise of fintechs is proving to be a game changer in this context, introducing innovative solutions, enhancing accessibility, and driving efficiency in supply chain financing.

This introduction sets the stage for an in-depth exploration of the symbiotic relationship between Supply Chain Financing and fintech in Africa, underscoring why this collaboration is not just beneficial but vital for the economic prosperity of the continent. It sheds light on the ways in which fintech is bridging gaps, simplifying processes, and creating a more inclusive financial ecosystem, thereby propelling Supply Chain Financing to new heights. Through this article, readers will gain insights into the intricacies of supply chain financing in Africa, understand the catalytic role of fintech, and appreciate the broad implications of this financial revolution for businesses, economies, and communities across the continent.

Understanding Supply Chain Financing and Its Digital Twist

Supply Chain Financing leverages technological advancements and financial instruments to strengthen the connections among suppliers, buyers, and financial entities. Its primary goal is to release trapped funds, reducing the overarching financing costs in the process. By utilizing tailored solutions from either banks or tech-focused providers, Supply Chain Financing aims to optimize cash flows across organizations. It provides short-term lending options for businesses, allowing them to boost their working capital and seize chances to enhance operational efficacy. In essence, Supply Chain Financing ensures a seamless sales transaction cycle, hastening payments for suppliers without curtailing the payment time frame for buyers. Given its capabilities to unlock funds drive by technology, especially through FinTech platforms, Supply Chain Financing presents a significant opportunity for African businesses that consistently grapple with working capital access issues. The innovative technology behind FinTech can indeed be pivotal in introducing and elevating supply chain financing solutions for businesses in Africa.

Supply Chain Financing, The Misconceptions

There are a couple of common misconceptions surrounding Supply Chain Financing. Firstly, there’s an erroneous perception that Supply Chain Financing is similar to a loan. This is not the case. In the context of Supply Chain Financing, suppliers engage in a ‘True Sale’ by selling their outstanding invoices in exchange for immediate cash. For buyers, Supply Chain Financing represents an extension of their accounts payable, not a borrowing arrangement.

Secondly, there’s confusion between Supply Chain Financing and factoring. Factoring is a form of debtor finance where businesses offload their accounts receivable (often invoices) at a potentially significant discount to address immediate liquidity concerns. Supply Chain Financing differs from this model. With Supply Chain Financing, invoices are settled in full, sometimes even before their due date, with only a minor service charge applied. Moreover, unlike recourse factoring where the supplier might bear the risk of non-payment, Supply Chain Financing ensures that the supplier isn’t held accountable for uncollectable invoices.

This arrangement enables suppliers to have their accounts settled faster than initially planned, allowing buyers to enjoy the advantages of deferred payments. Consequently, both parties can efficiently allocate funds where they’re most needed within their supply chain, promoting timely financial fluidity.

How Does Supply Chain Financing Work?

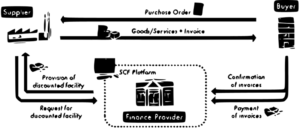

In a standard sales transaction, once a supplier sends an invoice to the buyer, the buyer verifies its alignment with the initial purchase order, along with any mutually agreed-upon terms and conditions. If all details match, the buyer approves the invoice for payment, waiting until its due date to make the actual payment. However, in the realm of Supply Chain Financing, the dynamics change slightly. After the buyer approves the invoice, it is uploaded to the Supply Chain Financing platform—a specialized fintech platform. This platform holds details such as payables and potential payment offsets like credit or debit memos.

Having access to this platform, the supplier can view all approved invoices and then faces a pivotal decision. One option is to remain passive, letting the invoice be settled by the designated finance provider on the initially set maturity date. Alternatively, the supplier can opt to sell or ‘trade’ the receivables to a financial entity on the platform, exchanging it for an immediate payment. If the latter is chosen, the supplier receives an electronic transfer equating to the complete invoice value, minus a minimal financing fee or discount.

Figure 1: The Workings of Supply Chain Finance

A crucial aspect of Supply Chain Financing is that the finance provider’s primary concern is the creditworthiness of the buyer. This assessment hinges on the buyer’s anticipated capability to clear supplier invoices by the initial due date. In contrast, the supplier’s financial status isn’t factored into the equation. When the invoice’s maturity date arrives, the buyer settles the entire amount to the finance provider via the Supply Chain Financing platform.

Historically, the introduction of Supply Chain Financing dates back to the 1980s, a period marked by soaring interest rates and enhanced bank regulations. Presently, Supply Chain Financing offers highly competitive rates, often significantly lower than other financial solutions, even dwarfing factoring rates by nearly tenfold. The beauty of Supply Chain Financing lies in its dual benefits: suppliers incur only a modest discount if they opt for early payment, and buyers face no fees to prolong their payment schedules. Essentially, Supply Chain Financing serves as a mutually beneficial arrangement for both parties involved.

The Nature of Financing Supply Chains in Africa

While the idealized model of supply chain financing sounds promising, the reality in developing economies, especially in Africa, deviates significantly from this framework. In nations like Ghana and numerous other African counterparts, businesses predominantly turn to banks to secure loans for bolstering their supply chains. These bank loans, contingent upon the discerned risk, often come with daunting interest rates, sometimes starting at 15 percent and potentially soaring to a staggering 35 percent.

The financing amount hinges intricately on the risk profile associated with various businesses, be it vast enterprises or modest ventures. In their risk assessment, lenders meticulously evaluate the individual businesses in conjunction with their broader operating environment. This evaluation encompasses aspects like adherence to robust record-keeping, deployment of best practices, fluctuations in cash flows across seasons, the reliability of collateral, organizational governance structures, and even broader elements like institutional robustness, the extent of political meddling, and compliance with prevailing regulations. These multifaceted considerations make financing supply chains in Africa a complex endeavor.

Taking Ghana as an illustrative example—where agriculture contributes to over half of the nation’s GDP— unique challenges arise for financial institutions and the predominantly small to medium-sized agricultural businesses. Ghana, mirroring many African nations, is characterized by small family-managed agricultural plots, typically spanning two hectares or less. These diminutive farms are operated by individuals who lack access to contemporary farming machinery and aren’t well-versed with modern agricultural practices. Moreover, there’s a prevalent trend among these farmers to overstate their prospective crop yields. Given that lenders are inherently risk-averse and rigorously scrutinize various determinants before sanctioning loans, the predicament arises: How should a bank appraise, set terms for, or even decide on financing a Ghanaian farmer with such a modest landholding?

Banking institutions, too, aren’t free from flaws. A recurring issue is the observed complacency post loan disbursal. Once funds are allocated for supply chain activities, many banks adopt a passive stance, meaning they don’t actively oversee how borrowers utilize these funds. This lack of ongoing vigilance often culminates in unforeseen challenges surfacing only when loan repayment is imminent, leading to unsatisfactory performance and potential default by borrowers.

Compounding these challenges, African governments’ dependency on treasury bills and bonds to bridge their financial deficits inadvertently sidelines private sector financing. With banks gravitating towards investing in these governmental instruments over extending credit to private entities, the private sector finds itself in a quandary. A deeper exploration is required to discern the role governments play in this intricate financial tapestry.

Supply Chain Financing Evolution in Africa. The Rise of Fintech

Traditional banks have long served as the predominant financing avenue in Africa, with many of these institutions continuing to rely on manual transaction processing. Contrastingly, Supply Chain Financing hinges on digital platforms, facilitating the provision of short-term financing at reduced interest rates. However, the entrenched position of these conventional banks, coupled with the limited accessibility to technological platforms, has hindered the comprehensive adoption of Supply Chain Financing across most of Africa. Consequently, a multitude of African businesses remains deprived of the advantageous short-term financing options their counterparts in other regions benefit from.

In financial cultural terms, the majority of African nations operate as debit societies, markedly different from the credit societies found in more economically developed regions. In these debit societies, almost all acquisitions, be it goods or services, necessitate immediate upfront payments. Conversely, in credit societies, merely demonstrating creditworthiness often suffices to access resources. This distinction implies that while businesses in credit societies can avail loans at interest rates of about 2 to 5 percent, those operating within the context of Africa’s prevalent debit societies face steeper rates, sometimes between 15 to 35 percent.

Despite these challenges, the financial panorama in Africa is evolving. The meteoric rise in mobile money usage is paving the way for more flexible financial practices. Countries like Ghana are at the forefront of this transformation, progressing steadily towards a more digitized, cashless economy. Simultaneously, an emerging cohort of fintech firms is partnering with diverse financial providers to usher in Supply Chain Financing platforms, heralding a new phase in African finance.

The Emergence of Fintech in Africa

Africa boasts one of the world’s most rapidly expanding mobile phone markets, only surpassed by Asia in terms of sheer volume. On a continent inhabited by 1.3 billion people, over 650 million individuals are mobile phone users, with more than 930 million registered SIM cards. Even with persisting infrastructure challenges, the rise of mobile phone usage in Africa is addressing and alleviating numerous issues. Mobile phones have become essential tools for a range of activities, from daily communication to accessing healthcare, banking, and even marketing agricultural products. This burgeoning mobile infrastructure is significantly contributing to the continent’s GDP growth. Much like their counterparts in the West, the first thing many Africans do each day is reach for their mobile phones.

Capitalizing on this widespread mobile phone adoption, several tech firms have introduced digitized payment methods, like digital wallets, that function without internet dependency. The MoMo app stands out as a leading example. These financial technologies utilize straightforward USSD short codes, making them user-friendly even for those less familiar with technology. Consequently, banks and other financial entities are collaborating with fintech organizations to craft innovative Supply Chain Financing solutions.

Fintech’s Potential in Revolutionizing Africa’s Supply Chain Financing

Fintech’s rise in Africa has ushered in the development of Supply Chain Financing platforms, enabling enhanced collaboration among suppliers, buyers, and finance providers. This advancement potentially offers credit to suppliers at impressively low, even zero, interest rates. However, the focus of fintech firms in Africa has predominantly been on digitalizing payment collections – from consumer purchases and utilities to governmental services. A scant few that ventured into credit provision faced significant default rates. Even fewer dared to extend credit to businesses. The ones that did encountered challenges in partnering with banks or financial institutions willing to join Supply Chain Financing platforms, aiming to extend more affordable credit to stakeholders. For those financial entities that did engage, a primary setback was the exorbitant interest rates. Such hurdles deter fintechs from crafting Supply Chain Financing platforms tailored for the African landscape.

Supply Chain Financing is pivotal for Africa’s business expansion, providing the much-needed working capital for SMEs to manage cash flow and mitigate risk. Fintech innovations are already reshaping Supply Chain Financing across the globe. How soon will Africa benefit from these breakthroughs? Here are avenues where fintech can significantly impact African businesses through Supply Chain Financing:

- Innovative Financing Access: By offering alternative credit scoring, digital lending platforms, and invoice financing tailored for Africa’s SMEs, fintech can help bridge the financing gap. Many suppliers in the supply chain, particularly SMEs, struggle with gaining access to financing. These fintech solutions can streamline the lending process, enabling suppliers to receive timely payments and continue their operations without cash flow interruptions.

- Broadening Financial Reach: By reaching communities previously left out, fintech solutions can expand the base of potential customers, suppliers, and intermediaries. In the context of Supply Chain Financing, a broader financial reach means even the smallest suppliers or buyers in the supply chain can engage in digital financial transactions, creating a more inclusive and efficient supply chain ecosystem.

- Embracing Blockchain: Blockchain’s transparency and security can revolutionize Supply Chain Financing. Payments, contract terms, and other transaction details can be securely recorded. This transparency can build trust among participants, reducing the need for intermediaries and potentially lowering costs. Additionally, tokenizing real-world assets can offer suppliers new ways to leverage their assets for financing.

- Enhanced Supply Chain Management: Real-time tracking tools allow for a more transparent supply chain where all participants have access to the same information. This can lead to faster payment processes. When suppliers know when their goods have been received, they can invoice more quickly and accurately, speeding up the financing cycle.

- Facilitating International Trade: Efficient remittance services enable African suppliers to engage in cross-border trade with reduced transaction costs and delays. This can open new markets for African products, and by integrating with international Supply Chain Financing platforms, African suppliers can access financing on competitive terms.

- Fostering Collaborative Ties: Collaboration can lead to standardized processes and shared platforms, making Supply Chain Financing more accessible and efficient. For instance, a fintech solution accepted by multiple banks can enable suppliers to easily find the best financing rates, while shared platforms can reduce the administrative burden on suppliers, buyers, and financiers.

- Shaping Regulatory Landscapes: A supportive regulatory environment can encourage more financiers to participate in Supply Chain Financing, increasing competition and potentially reducing costs for suppliers. Furthermore, a clear regulatory framework can give suppliers, buyers, and financiers the confidence to engage in Supply Chain Financing, knowing that their rights and obligations are clearly defined and protected.

Conclusion

In a nutshell, Supply Chain Financing in Africa holds great promise, offering businesses the opportunity to optimize cash flow, mitigate risks, and enhance operational efficiency. Technology, particularly fintech, plays a crucial role in unlocking the potential of Supply Chain Financing by providing an alternative to traditional financing methods and addressing many of the challenges faced by African businesses. Despite misconceptions about Supply Chain Financing, its distinct features separate it from other financial instruments and make it an advantageous option for both suppliers and buyers. However, the true realization of Supply Chain Financing in Africa is somewhat hampered by the dominant traditional banking systems, the unique financial culture of the continent, and certain infrastructural challenges.

Nevertheless, the rise of mobile technology in Africa and the growing fintech ecosystem are offering a fresh avenue for the evolution of Supply Chain Financing in the region. Fintech innovations are not only digitalizing payment collections but also creating opportunities for innovative financing, broadening financial reach, embracing blockchain, enhancing supply chain management, and fostering international trade. For Supply Chain Financing to flourish in Africa, collaboration among fintech firms, traditional financial institutions, and businesses will be paramount. Coupled with a supportive regulatory environment, Supply Chain Financing could revolutionize the way African businesses operate, providing them with the tools they need to grow and thrive in a global marketplace.

The author is a Senior Technical Advisor

Centre for Applied Research and Innovation in Supply Chain, Africa.