- posts 179% growth in profit

- pays 40% of profit after tax as dividend

The Adansi Rural Bank PLC at Fomena in the Adansi North district of Ashanti Region has held its 33rd Annual General Meeting of shareholders and posted remarkable growth in some financial indicators for the 2022 year under review.

The bank recorded a profit before tax of a little over GH₵2.4million against GH₵867,838 in 2021, representing an impressive growth of 179% that translates to GH¢1,555,459 in absolute terms. This was due to some high level of provision for Bad and Doubtful Debts due to the downgrading of some loans.

The bank is currently on a trajectory of growth and making realistic profit after impairing over GH¢4million cedis in investment income.

By this, existing shareholders and prospective ones have been urged to buy more shares to set the bank’s growth pattern on the long-term objective of making positive impact in the communities where it operates.

The bank’s Management Performance Review as at September 2023 revealed a profit before tax of about GH¢1.6million. This is a significant performance, and therefore the board and management are doing everything possible to ensure sustained operational efficiency to end the year well and give value to shareholders.

The bank’s Total Assets amounted to approximately GH¢164 million in December 2022, representing an increase of 30.98% from about GH¢125million in 2021.

The bank’s growth in Total Assets was driven by a healthy increase in Deposits, and the performance for year-to-date strongly suggests the bank is very likely to witness a similar trend in 2023.

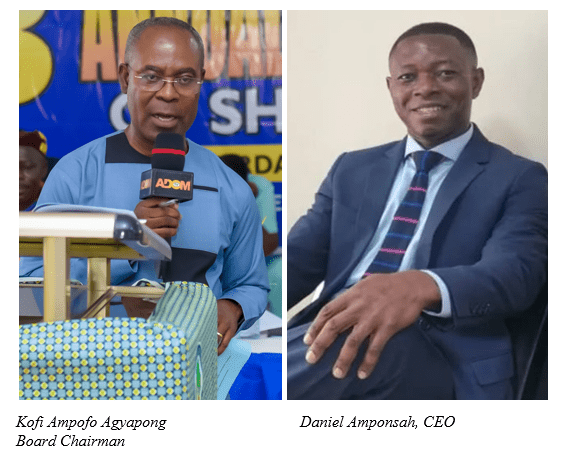

Chairman-Board of Directors, Kofi Ampofo Agyapong, made these known at the bank’s 33rd AGM of shareholders held last Saturday at Fomena in Ashanti Region.

Operational Environment

According to him, from the COVID-19-induced contraction observed in 2020, the global economy appeared to rebound in strength in 2021. However, global financial stability risks were heightened in 2022 as a result of lingering effects from COVID-19 and ramifications of the Russia-Ukraine conflict.

He mentioned that Ghana’s domestic economic vulnerabilities deepened in 2022. Government had to reach out to the International Monetary Fund (IMF) for an Extended Credit Facility bail-out of US$3billion in July 2022, which was subsequently approved by the IMF Board in May 2023.

The local economy recorded a gross domestic product (GDP) growth rate of about 3.1% in 2022, compared with a growth rate of 5.4% in 2021. Inflationary pressures were very high in 2022, closing at 54.1% in December compared to 12.6% in December 2021 – this emanating from exchange rate vulnerabilities, high food costs, high fuel prices and significant increases in transportation cost.

The year 2022 witnessed one of the fastest surges in Monetary Policy Rates (MPR), ending at 27% in December 2022 from 14.5% at the beginning of 2022; a change of 1,250 basis points.

However, since July 2023 and following IMF approval of the Extended Credit facility on US$3billion and subsequent disbursement of the US$600,000 first tranche, there has been some level of financial stability.

Operational Performance

Despite a challenging macroeconomic environment coupled with the unprecedented occurrence of DDEP amid a high inflationary rate that pertained during the reviewed year, the bank managed to pull yet another remarkable operational performance in some key financial indicators as indicated in the table below.

Payment of Dividend

The Board of Directors proposed a total dividend payment of GH¢463,117 – which represents 40% of the profit available for distribution, after the statutory reserve requirements. It also translates to a dividend-per-share of GH¢0.01. This dividend proposal was made after seeking exceptional approval from the BoG. It is the Board of Directors’ hope that the bank’s performance will continue to improve and enable payment of dividends in the years ahead.

Stated Capital & Shareholders’ Fund

The bank’s Stated Capital grew by only 1.68%, from about GH¢4.9million in 2021 to GH¢4.98million. Shareholders’ Funds also increased by 19.36% in 2022 compared to 24.30% in 2021.

While the bank expects an expansion of its Balance Sheet through organic growth, the Board chairman stressed that it is important to sign new shareholders – and also have existing shareholders invest more into the Bank’s Stated Capital.

This, according to him, will enable the bank’s growth to be accelerated and ensure it is able to expand operations and enhance its profitability to the benefit of its cherished shareholders.

Corporate Social Responsibility

Adansi Rural Bank over the years, has been providing support to various state institutions and stakeholders within its operational territories. Some projects supported within the Bank’ catchment areas during the year under review included that of the Traditional Councils, Ghana Education Service (GES) and the Ghana Police Service.

The Board Chairman stressed that the Bank is socially responsible and will not renege on supporting projects and engaging in environmentally friendly activities in the years ahead.

Future Outlook

The Chief Executive Officer of the Bank, Daniel Amponsah in an interview with Business & Financial Times said the Bank would continue to put in pragmatic measures to ensure positive growth and achievement of the Strategic Plan of the Bank.

He stressed that the Bank would intensify loan recovery, embark on intensive deposit mobilization, strengthen internal controls and maintain quality assets to increase profitability.

He has also emphasised that the Bank’s business focus in 2023 is on driving growth, innovations, efficiency and service as the main pillars in achieving profitability.

Mr Amponsah stressed the Bank would develop the human capital to meet demands of functioning profitability as well as achieving the objective of overcoming the shocks of the unfriendly macro economy and rising cost of living as well as its devastating effects.