Africa Currencies Topline

- Nigeria: The federal government seeks to set a new precedent in the FX market.

- Ghana: Fuel prices to stabilize.

- South Africa: Business activity index falls in South Africa.

- Egypt: China provides a boost to the Egyptian economy.

- Kenya: Inflation rate increases to 6.9% in October, a three-month high.

- Uganda: Uganda’s annual inflation rate continues to moderate, reaching a two-year low.

- Tanzania: Foreign reserves on the rise.

- XOF Region: Senegal and the EBID ink two deals totaling 65 billion FCFA.

- XAF Region: Cameroon intends to bring in 60,000 tons of LPG during the first half of 2024.

Nigerian Naira (₦)

Compiled by Ikenga Kalu

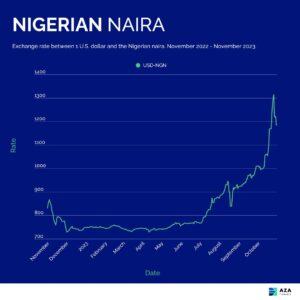

The naira appreciated against the U.S. dollar from USD/NGN 1300 to USD/NGN 1185 amid expectations of an influx of $10 billion destined for clearing the huge backlog of FX demand on the official window.

The federal government aims to implement new FX rules in the bid to crack down on illicit currency trading and close the gap between the official and unofficial FX rates. The new rules will be enforced before December, 2023 when the government also expects to achieve a “fair price” between USD/NGN 650 and USD/NGN 750.

Naira stability in the coming weeks may depend on the pace of implementation of the federal government’s proposed strategy to close the FX gap.

Further reading:

Bloomberg — Nigeria Plans New FX Rules in Hopes of Naira Reaching ‘Fair Price’ by End of 2023

Ghanaian Cedi (GH¢)

Compiled by Sakina Seidu

The currency started November at USD/GHS 12.2 as users of the U.S. dollar still await news of the $800 million cocoa syndicated loan and the second tranche of the International Monetary Fund loan.

Fuel prices are expected to stabilize and ultimately lower with the slight drop in prices of finished petroleum goods on the international market. This gain might however be thwarted if the cedi keeps depreciating.

We expect the Ghana cedi to hold its level as forex consumers continue to look forward to an influx of funds in the market before November end.

Further reading:

Ghana web — Cedi starts November selling at GH¢12.20 to $1, GH¢11.50 on BoG interbank

Joy Online — Fuel prices likely to remain same from November 1, 2023 – IES

Asaase radio — World Bank sees lower 2024 oil price, but Middle East war could cause spike

South African Rand (R)

Compiled by Alex Barmuta

The USD/ZAR exchange rate was at 18.7253 on Wednesday, November 1, up 0.44% from the previous Friday. Looking ahead, we expect USD/ZAR to rise as the seasonally adjusted Absa Purchasing Managers’ Index fell to 45.4 in October 2023 from an upwardly revised 46.2 in September, indicating South Africa’s factory activity contracted for the ninth consecutive month, despite a reduction in the frequency and intensity of load-shedding.

The biggest drag was the business activity index, which fell by 2.8 points to 40.3. Although it is unclear why activity fell further in October, it does correspond with persistently low demand readings. Despite a minor increase, the PMI new sales orders index remained below 40 index points for the second month in a row. The index measuring expected business conditions in six months fell by more than 12 points to 43.4.

Further reading:

Marketscreener — South African factory activity accelerates decline in October – Absa PMI

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound traded at USD/EGP 30.90 on Wednesday, November 1, 2023 and depreciated marginally from 30.85 as at the close of last week.

Thanks to an agreement that was reached between Israel, Hamas and Egypt, the Rafah crossing has been opened by Egypt this week to allow some wounded patients out of the Gaza strip.

A likely boost for the Egyptian economy was received this week from the China Development Bank in the form of a loan of approximately $1 billion. The loan will be used for infrastructure development, to improve economic and trade activities, as well as improve trade and cooperation between Egypt and China.

This week the Egyptian pound is expected to trade around USD/EGP 30.90.

Further reading:

Egypt today – CBE received close to $1B in Chinese Yuan from China Development Bank

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenyan shilling has depreciated to a new record low and is trading at the levels of USD/KES 149.94/151. This is mainly due to increased foreign exchange demand from major sectors outweighing the thin supply of hard currency. The weaker shilling is pushing up the high cost of living as inflation reached 6.9% year-on-year in October, up from 6.8% in September the month earlier. Data from Kenya National Bureau of Statistics show that the major contributors to the inflation levels were price increases for fuel, transport and food which cover about 57% of household budgets. We expect the shilling to continue weakening amid high demand for dollars.

Further reading:

reuters — Kenyan inflation edges up in October, fuel a big driver

Ugandan Shilling (USh)

Compiled by Yadhav Panday

USD/UGX was trading at 3,780 on Wednesday, November 1, down 3.21% from the previous Friday. Looking ahead, we expect USD/UGX to fall as Uganda’s annual inflation rate continues to moderate, reaching a two-year low of 2.4% in October 2023, down from 2.7% the previous month. Prices for food and non-alcoholic beverages fell (2.6% vs 5.1% in September), clothing and footwear fell (2.4% vs 2.8%), furnishings and household equipment fell (2% vs 2.5%), and information and communication fell (1.9% vs 2.4%).

Furthermore, transport prices continued to fall). Consumer prices rose 0.6% month on month in October, following a 0.7% increase the previous month.

Further reading:

Ugbusiness — Consumer inflation slows to lowest level in two years

Tanzanian Shilling (TSh)

Compiled by Kristin Van Helsdingen

The Tanzanian shilling strengthened to USD/TZS 2,496 toward the end of last week and has managed to maintain this level since. The shilling is currently trading at USD/TZS 2,498.

Foreign reserves in Tanzania have been slowly increasing as the country’s earnings have been on the rise. This has allowed the Bank of Tanzania to gain more control over the value of the shilling.

We expect the shilling to strengthen slightly in the week ahead as the currency gains investor confidence which is owed to Tanzania looking towards increasing its economic development and foreign investment through its relations with Germany and South Korea. The shilling is expected to be trading around USD/TZS 2,495.

Further reading:

AFRICA Press – MPC: Foreign currency scarcity improves gradually

AFRICA Press – Tanzania, Germany eye to boost trade, investments

AFRICA Press – Korea commits continued support to Tanzania

West African CFA Franc Region (XOF)

Compiled by Yashveer Singh

The ECOWAS Investment and Development Bank (EBID) and Senegal’s Ministry of Economy signed two significant agreements. The first involves a sum of 65 billion FCFA (approximately 100 million euros), with 50 billion FCFA designated for an infrastructure project in Diamniadio, aimed at creating a “smart” city with advanced facilities for industries and trade.

The second agreement allocates 15 billion FCFA for the construction of a 200 km highway linking key coastal cities, aiming to boost economic development in agriculture, mining, fishing, and tourism sectors. The Minister of Economy, Doudou Ka, praised the EBID’s commitment, highlighting the importance of these agreements in Senegal’s economic development and infrastructure modernization strategy. The partnerships signify Senegal’s drive to amplify its economic policies and integrate modern infrastructure into its development goals.

Further reading:

Sikafinance — Senegal and the EBID sign two agreements worth 65 billion FCFA

Central African CFA Franc Region (XAF)

Compiled by Yashveer Singh

Cameroon plans to import 60,000 tons of liquefied petroleum gas (LPG) for household use in the first half of 2024 due to increased demand. The country’s local production of LPG is insufficient to meet the rising demand, which increases by 5% annually. The government subsidized domestic gas consumption in 2022 with an expenditure of CFA 75 billion, aiming to mitigate the high costs for consumers.

Despite significant subsidies, adjustments were made in February 2023 to alleviate the substantial burden on the public treasury, amounting to nearly CFA 700 billion in 2022. The government aims to manage the rising costs of hydrocarbons and ensure a consistent supply of LPG for households.

Further reading:

BusinessinCameroon — Cameroon plans to import 60,000 tons of domestic gas in H1 2024