… records growth in all indicators but DDEP effects ‘swallow’ profit

The Kumawuman Rural Bank PLC at Kumawu in the Sekyere Kumawu District of Ashanti Region has posted growth in all financial indicators in the 2022 year under review.

The Bank recorded profit before tax of a little over GH¢ 1.9million in the year under the review as against about GH¢ 1.2 million in the previous year representing 58 .33% growth.

However, the bank made a statutory impairment loss on investment in government securities of over GH¢10 million following the bank’s participation in the Domestic Dept Exchange Programme, DDEP making the bank record a technical loss of GH₵8,429,382.

The Bank’s total deposit grew from approximately GH₵148million in the year 2021 to a little over GH₵192 in the year 2022 representing 30.7% growth. The high growth of the deposits

shows the confidence the general public and the cherished customers have in the Bank.

The Board and Management remain resolute to continue to formulate strategic policies and

plans to improve on the deposit mobilization while minimizing the corresponding market risk associated.

The Bank’s Total Assets also grew from GH₵160 million in 2021 to GH₵195million in 2022 representing 21.83% increase.

The share capital of the Bank grew marginally from GH₵2,943,052.00 as at the year 2021 to GH₵2,961,946.00 showing 0.64% growth

Operational Environment

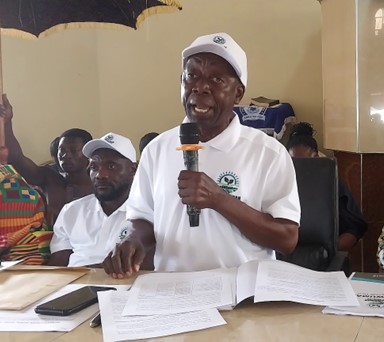

The Chairman of the Board of Directors Dr. Alexander Adomako Mensah whose report was read to the shareholders by Dr Kodua Addai – Mensah Vice Chairman of Board announced these and more at the Bank’s 30th Annual General Meeting of shareholders held last Thursday at Kumawu in Ashanti.

According to him the Bank started the year 2022 very well with a continued focus on their strategy to drive deposit and profitability growth, enhance the resilience of balance sheet and reinforce the core strength of the Bank.

In the latter part of the year, the Government of Ghana launched the Domestic Debt Exchange Programme (DDEP) as part of effort to address the economic crisis and bring the country debt to a sustainable level.

Under the DDEP the Government invited certain bondholders of domestic notes and bonds issued by the Government to exchange them for a package of new bonds with lower coupons and longer tenor.

This programme had a significant impact on the financial performance of Banks that

participated in the program including Kumawuman Rural Bank PLC.

In spite of these macroeconomic challenges, Kumawuman Rural Bank remained

a viable business and significant potential for further growth and value creation for its shareholders.

Operational Performance

In spite of the many challenges faced by the Board of Directors and Management, they worked hard during the year under review, to raise all the performance indicators as shown in the table

Key highlights of the Bank’s financial performance in 2022 are summarised in the table below:

| SN | INDICATOR | 2021 | 2022 | CHANGE

(%) |

|

1 |

TOTAL INCOME |

21,750,863.00 |

27,410,604.00 |

26.02 |

|

2 |

OPERATING EXPENSES |

(19,939,351.00) |

(25,440,205.00) |

27.59 |

| 3 | DDEP IMPAIRMENT LOSS | (10,399,781.00) | ||

|

4 |

PROFIT AFTER TAX |

1,194,177.00 |

(9,696,264.00) |

(911.96) |

|

5 |

TOTAL DEPOSIT |

147,918,763.00 |

192,401,603.00 |

30.07 |

|

6 |

INVESTMENT |

73,167,153.00 |

96,593,136.00 |

38.07 |

|

7 |

LOANS / ADVANCES |

51,109,020.00 |

51,308,008.00 |

0.39 |

|

9 |

TOTAL ASSETS |

159,264,808.00 |

194,679,231.00 |

21.83 |

|

10 |

STATED CAPITAL |

2,943,052.00 |

2,961,946.00 |

0.64 |

Corporate Social Responsibilities

The Bank during the year under review supported institutions, communities and individuals as part of its corporate social responsibility. As a socially responsible institution, an amount of Gh¢240,637 was spent in supporting individuals and institutions in the operational territories of the Bank.

Future Outlook

The CEO of the Bank, Evans Sarfo-Kantanka told Business & Financial Times in an interview that Management would continue to seek ways of strengthening and developing the Banks’ operations to maintain the confidence that customers and shareholders have in the Bank.

The Bank’s business model according to the CEO would still be tailored for the Micro Small and Medium Enterprises and would push for more market penetration as they develop new and innovative products and trusted relationships with clients of the bank as well as improving the liquidity base of the Bank by investing in cash assets.

The CEO also emphasised the improvement and strengthening of internal controls to ensure that the growing assets of the Bank is protected from major risks that comes along with the growth.