When I was growing up in my Tontro village in the Eastern Region, several vehicles plied the route from Tafo and Koforidua to the village. Most of those vehicles had fascinating inscriptions on them.

There was one particular inscription that has been indelible on my mind till now, perhaps chiefly due to the way it frequented the village and how we – children in the village – related to the driver.

The inscription was simply, ‘FUTURE IS UNKNOWN’. It was fun when the driver started to toot his horn and we would all run to the roadside in excitement to see him and his Bedford ‘wooden bus’; but as I continued to grow, I learnt some lessons from the famous inscription.

That is, in this life two things are inevitable. No one can live to bypass or avoid them, or at least one of them. Others will experience the two. Death and retirement. These two great events touch almost every life and point to the future.

I got back to Tontro after my long absence from the village I , and anytime I saw some people who I knew worked hard on the farms to generate great worth for themselves and now see how they live miserable lives, then my memory jogs to the inscription on the old Bedford ‘wooden bus’.

There is a profound saying, that: “The past cannot be changed. The future is yet within your power. Happiness is not something you postpone for the future; it is something you design for the present, as tomorrow belongs to those who prepare for it today”.

Indeed, the future belongs to people who prepare for it today – because tomorrow is unknown since it also forms part of the future. The need for a pragmatic preparation towards one’s future has therefore become more paramount and critical than ever, especially in this part of the world.

We live in a society where social and economic challenges abound, even when there is a job to do for regular income. Obviously, there is going to be a future when one cannot work anymore. The future time – when parents rely solely on their children for survival during old and inactive age – is giving way to a period that is characterised by what I call the ‘sole survival system’. This is a situation wherein parents have to fend for themselves.

It is not that children are becoming wicked or uncaring. No, that is not the case; it is rather the case that children do not simply have enough for the “crumbs to fall for the parents”. This situation honestly does not apply to everyone – but frankly speaking, it does to most people in Ghana today.

Many old people try to keep their souls young, but they still become quivering for obvious reasons. Rightly so, nature cannot be cheated as the saying goes. If there are no preparations toward old age, and retirement for that matter, old age becomes more of a nuisance than the blessing God wants old age to be. That’s why it is said: “If you fail to prepare; you rather prepare to fail”.

Old age brings along its burdens. What has been the best strategy to avoid this stress, poverty, loneliness, protracted illness, boredom and sadness in old age around the globe, and Ghana in particular, is adequate preparation.

When you get old, you will not be able to work as before; and circumstances are such that you will be compelled to retire from active work even if you are self-employed.

All over the world preparation toward comfort and enjoyable old age, and retirement for that matter, has been the process of pensions. Effective and secured pensions are the key solution to retirement challenges.

Pension is defined as a “regular payment made by the state to people of or above the official retirement age”; and in some cases, widows and disabled people are considered in pension plans.

In Ghana, for instance, pension is considered a “type of retirement plan that provides monthly income in retirement”. It is a sure way of getting relief from economic hardship after retirement, when one is not working for a regular income.

With a pension plan, something else is added to your contribution and invested in a very secure, viable and effective manner. Then the money will usually be paid to you as a monthly pay cheque in retirement; that, is after you have reached a specific retirement age.

Unfortunately, in Ghana pension was known and practised only within the formal sector – which comprises only 15 percent of the entire working population. This means about 85 percent of the working class in Ghana has not been enjoying any form of pension after retirement over the years.

In recognition of the need to address such a challenge, which would also ensure a universal pension scheme for all employees in the country, and to further address the concerns of Ghanaian workers, government in July 2004 initiated a major reform of the Pension System in Ghana. The process started with establishing a Presidential Commission on Pensions under the chairmanship of Mr. T. A. Bediako.

The Bediako Commission was charged with the responsibility to examine existing pension arrangements and make appropriate recommendations for a sustainable pension scheme(s) that would ensure retirement income security for the entire Ghanaian working population, with special reference to the public sector.

The Commission’s main recommendation was the creation of a new contributory Three-Tier Pension Scheme or System for Ghana, funded by direct contributions of employers and employees to replace existing parallel pension schemes.

Statistics available have it that only one percent out of the 85 percent within the informal sector was on any form of pension scheme in Ghana some four years ago. Now, the figure stands at seven percent. So, this new scheme is a good step that needs to be encouraged and continued.

The three-tier (3rd Tier) pension scheme is a voluntary pension scheme for workers and self-employed workers in the informal sector, and it is privately managed by a Corporate Trustee. Contribution is up to 16.5% (35% of declared income) of one’s basic salary.

Pension schemes until then had been operated in the country with a sharp focus on workers in the formal sector in mind. This obviously was a huge limitation, because the scheme failed to consider the plight of most workers in the informal sector, who constitute the bulk (about 85%) of Ghana’s working population.

One can start contributing minimal sums per month today and reap maximum figures at the end of working life. There are about thirty pension service providers called ‘Corporate Trustees’ across the country, which one can contact and start something today. Before you realise, you will have all all-time regular income after retirement or when incapacitated. Then you can say ‘the future is known’.

So therefore, today no one has any excuse to be poor after retirement irrespective of where one works, whether in the formal or informal sector. Appropriately, we could say one’s retirement happiness is in his/her own hands; or better still, in his/her own pocket.

Pension gained in the future will help you to at least maintain a middle-class standard of living and retirement saving. It will also provide important supplemental income for unforeseen expenses.

This can be done as an individual or as a group, depending largely on the type of work you do or where you work. Pension plans are the most economical and efficient way to fund retirement.

You can start yours today if you are not on one yet. The National Pensions Regulatory Authority is in this vein organising a three-day Pensions Fair – for everyone to understand and appreciate the urgent need for a pension scheme.

Starting from Monday 23rd October to Thursday 25th October on the forecourt of Accra Metropolitan Assembly premises, all pension scheme providers are showcasing their products and services, and providing insight into how one can benefit from a pension after retirement – irrespective of what he or she does for a living. This is a great opportunity. Tell friends to attend and benefit.

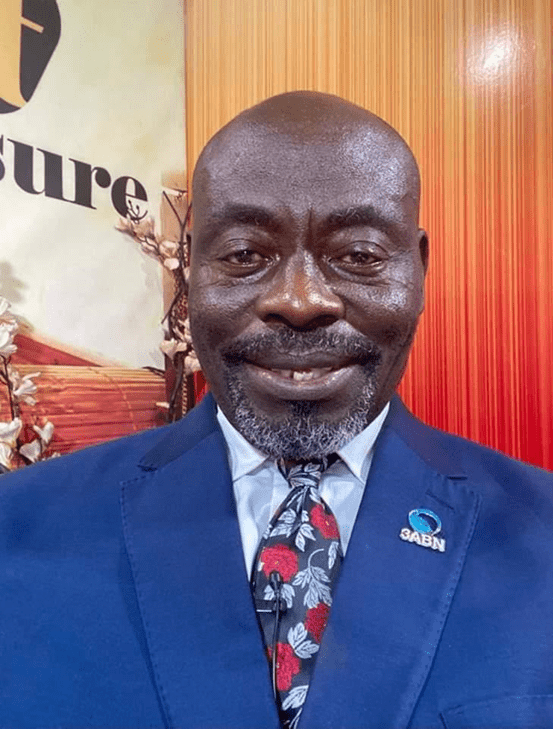

The writer is Head-Corporate Affairs, National Pension Regulatory Authority (NPRA)