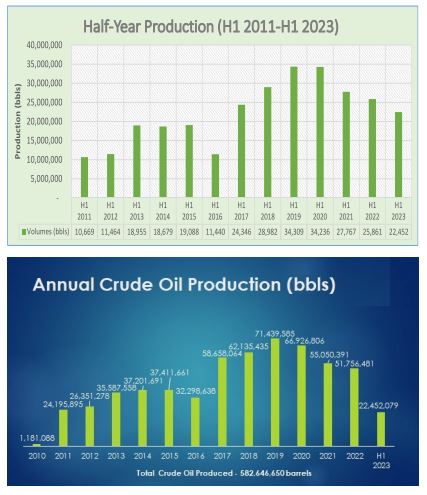

Crude oil production in the country for first-half (H1) 2023 saw a significant decline, amid various developments and concerns related to petroleum revenues and regulatory compliance.

The country produced a total of 22.4 million barrels (bbls) of crude oil from its three offshore producing fields – Jubilee, Tweneboa, Enyenra, Ntomme (TEN) and Sankofa Gye Nyame (SGN), representing a 13.2 percent reduction from H1 2022’s production volume of 25.8 million barrels (bbls). This is the fourth consecutive reduction in year-on-year (y-o-y) crude oil production volume since inception.

According to the Public Interest and Accountability Committee (PIAC), this decrease was the result of a fall in production by the three producing fields during the period. Crude oil production declined by 12 percent, 17.5 percent and 12.9 percent in the Jubilee, TEN and SGN Fields respectively.

Jubilee’s production decreased from 14.9 million bbls in H1 2022 to 13.1 million bbls in H1 2023, being a 12.03 percent fall. Average daily oil production in the Jubilee Field in H1 2023 was 72,449 bbls compared to 82,560 bbls in H1 2022, representing a decrease of 12.2 percent.

According to the Petroleum Commission (PC), as noted in PIAC’s 2023 Semi Annual Report, the drop in production was mainly due to poor reservoir performance and process upsets; while the increase in production was a result of adding the J64-P infill well on 22nd May 2023.

Production from Tweneboa-Enyenra-Ntomme also declined from 4.4 million bbls in H1 2022 to 3.6 million bbls in H1 2023, representing a 17.5 percent drop. Average daily oil production declined from 24,263.00 bbls in H1 2022 to 20,032.24 bbls in H1 2023.

The highest monthly oil production during the period was recorded in March, while February recorded the lowest. The low production was mainly attributed to flow assurance issues and non-performance of the En08-P and En10-P producing wells.

Similarly, in the case of Sankofa Gye-Nyame (SGN) field, production also declined from 6.5 million bbls in H1 2022 to 5,712,891 bbls in H1 2023, being 12.9 percent lower. Average daily production reduced from 36,206.76 bbls to 31,562.9 bbls during the period. The highest monthly oil produced within the period was in May, with the lowest in February.

These developments come on the back of the country’s reduction of existing Petroleum Agreements (PAs) from 14 to 13 as of June 2023 – due to the relinquishment of AGM Petroleum’s entire interest in the South Deep Water Tano Contract Area.

According to findings of the 12th Semi Annual Report of the Committee, Jubilee Oil Holding Limited (JOHL) failed to pay proceeds from lifts in H1 2023 amounting to US$70,456,719 into the PHF.

“This is the fourth consecutive time the Company has failed to pay the proceeds of lifts from the Jubilee and TEN Fields, amounting to US$343,108,928,” it was stated.

Also, it observed that Kosmos Energy Ghana Limited wrongfully paid withholding tax into the Petroleum Holding Fund (PHF) in 2020 and 2021, totalling US$3.9million.

Furthermore, it said, during the period under review Ghana National Petroleum Corporation (GNPC) spent an amount of US$6.40million on production and development costs at the TEN field – and lifted one parcel of crude oil from the field in May 2023.

However, it was noted that the Corporation received no revenue from the field – neither in respect of its equity interest nor its share of net CAPI – even though revenues were received in the PHF during H1 2023.

This development, according to PIAC, is in violation of Section 16 (4) of the Petroleum Revenue Management Act (PRMA) as amended, which states that the Minister for Finance shall ensure the Bank of Ghana transfers to a national oil company a relevant portion of the revenue due to that national oil company under sub-section (2), not later than 3 working days after the receipt of petroleum revenue into the Petroleum Holding Fund.

PIAC, in its recommendations on the findings, reiterated its position that proceeds from lifts of JOHL and any other subsidiary of GNPC constitute petroleum revenues and therefore must be paid into the PHF.

Also, it said, to ensure effective monitoring and evaluation of petroleum revenues, International Oil Companies (IOCs) should be mindful not to pay monies other than petroleum revenues into the PHF.

The Ministry of Finance should comply with the provision in Section 16(4) of the PRMA as amended – release funds to the National Oil Company not later than three working days after the receipt of petroleum revenue into the PHF.