Africa Currencies Topline

Nigeria: Central bank reverses ban on ineligible items for FX amid rising inflation and falling currency

Ghana: Ghana expects to qualify for the 2nd tranche of IMF loan.

South Africa: Inflation rises – but remains within target range.

Egypt:

Kenya: Kenyan shilling continues to weaken to a fresh low.

Uganda: Kingfisher oil project resumes.

Tanzania: Real GDP growth is forecasted to remain stable at 5.4%.

XOF Region: Senegal: Subsidy allocation to energy sector drops

XAF Region: Cameroon: Bond prices reach all-time high in BEAC market.

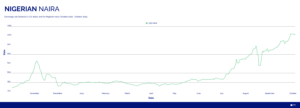

Nigerian Naira (₦)

Compiled by Ikenga Kalu

The naira resumed its freefall this week after breaking past the USD/NGN 1000 level and has already breached USD/NGN 1100 in an unprecedented dip against the U.S. dollar. Week to date, the naira fell from USD/NGN 1004 to USD/NGN 1100.

The Central Bank of Nigeria lifted an 8-year long ban on 41 items which had previously been labeled as ineligible for FX at the official window, in the bid to ease the demand on the parallel market and shore up rates. Despite a USD/NGN 300 rate difference between the official FX window and the parallel market, the central bank insists on its resolve to achieve a single forex market.

Annual inflation surged to 26.72% in September from 25.8% recorded in August due to the worsening cost of living in the county. The spike in inflation is caused by the combined effect of the subsidy removal and a rapidly depreciating currency which has lost roughly 47% of its value year to date.

We foresee a continued loss in value of the naira against the U.S. dollar given the severe FX shortages in the country.

Further reading:

Reuters — Nigeria central bank to intervene in forex market, lifts forex ban on 43 items

Punch — Subsidy removal, naira fall push food inflation to 30.64%

Ghanaian Cedi (GH¢)

Compiled by Sakina Seidu

The Ghanaian cedi has reached USD/GHS 12.00 and is climbing steadily.

Minister of Information Oppong Nkrumah said Ghana is on the way to qualifying for the second tranche of its International Monetary Fund (IMF) loan. Although the requirements have not been met yet, an agreement with creditors is likely, he stated while reiterating that receiving the second tranche of the $3 billion later in the month of November is highly likely.

Banks and corporations still have to fill rising orders as we inch toward December feeding into the expectation of still rising dollar-cedi rates.

Further reading:

Ghana web — Cedi sells at GH¢12.05 to $1, GH¢11.32 on BoG interbank as of October 18

B&FT — Debt sustainability: We are on track to achieve targets – Ofori-Atta

Ghana web — Second tranche of IMF loan not dependent on external debt restructuring

Asaase radio — Ghana dollar bonds tumble as investors balk at debt overhaul plans

Myjoyonline — Yuletide, corporate FX demand to sustain strain on cedi

South African Rand (R)

Compiled by Alex Barmuta

The South African rand closed trading at USD/ZAR 18.97 last week. On Monday, October 16, 2023, the rand briefly touched 18.75, before giving back gains during the course of Tuesday and Wednesday where it was trading at around 19.01.

The sharp move on USD/ZAR above the 19.00 level could be largely attributed towards an increasing expectation that interest rates will remain unchanged at next month’s Monetary Policy Committee (MPC) meeting, as inflation data released showed that despite an increase, it remains within the MPC’s target range. This news largely offset possible rand gains from positive Chinese GDP data released late on Tuesday evening.

Looking ahead, we can expect the rand to continue trading in the 18.90 – 19.20 range against the U.S. dollar over the coming week.

Further reading:

Reuters – South Africa’s inflation rises sharply on food and fuel prices

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound remained at levels of USD/EGP 30.90 this week despite volatility in the region following the ongoing Israel-Hamas conflict.

On October 18, 2023 Egypt’s Minister for Planning and Economic development shared updates on the sale of 3 state-owned enterprises (Safi, Jabal El Zeit, and Wataniya) and stated that they have made significant progress. The sale of Wataniya Petroleum is expected to be completed within the next few weeks and forms part of Egypt’s privatization strategy to shift away from certain sectors and allow for private investment. Privatization and stabilization of the economy will be vital in unlocking external borrowing in the future.

We expect the Egyptian pound to remain stable in the week ahead and trade at similar levels to what we have seen in the past few months.

Further reading:

Egypt today — Planning Minister shares updates on sales of Safi, Jabal El Zeit, and Wataniya

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenya shilling hit a new record low against the U.S. dollar this week and is trading at USD/KES 149.40/149.90 as a result of foreign currency shortages, high inflation, and increased import costs. The shilling has lost 17.4% of its value against the dollar since the beginning of the year. According to the Central bank of Kenya weekly report, the foreign exchange reserves remained adequate at USD 6,872 million which is 3.69 months of import cover, a drop from USD 6,913 million which is 3.71 months of import cover. The overall inflation increased to 6.8% in September compared to 6.7% in August which was mainly driven by food fuel inflation. We expect the shilling to remain under pressure as demand for dollars by energy and manufacturing sectors remains higher than forex inflows from tea exporters and the diaspora remittances.

Further reading:

Reuters – Kenyan shilling dips to record low

Ugandan Shilling (USh)

Compiled by Yadhav Panday

USD/UGX was trading at 3,755 on Wednesday, October 18 2023, up 0.23% from the previous Friday. In the preceding four weeks, USDUGX increased by 0.81%.

In the coming days, we expect USD/UGX to fall due to the petroleum regulator announcing on Friday that work at Uganda’s Kingfisher oil project area can resume, a week after operations were halted due to a fatality.. Drilling for commercial production of oil wells at the field began in January, as Uganda works towards producing its first oil output in 2025, after a long delay.

Furthermore, according to Standard Bank Group Ltd., a controversial $4 billion crude oil pipeline connecting Uganda and Tanzania has cleared a key hurdle that had delayed a final decision. Tanzania has resolved a separate dispute with some Chinese funders, allowing the negotiations to proceed.

Further reading:

Reuters – Uganda’s CNOOC can resume work at Kingfisher oil project, regulator says

Tanzanian Shilling (TSh)

Compiled by Kristin Van Helsdingen

The Tanzanian shilling has strengthened against the U.S. dollar since the close of last week moving from USD/TZS 2505 to USD/TZS 2501 as of Wednesday, October 18, 2023.

Fitch Solutions has forecasted Tanzania’s GDP growth to improve from 4.7% in 2022 to 5.4% in 2023 and 2024. It is worth noting that this has been revised down from an earlier forecast of 5.5% for 2023.

According to Standard Bank Group Limited, a key hurdle in the planned Uganda-Tanzania crude oil pipeline has been overcome and the process of structuring a deal may now continue. Some key challenges remain in focus for it to go ahead including deciding on a financing structure as well as the completion of an environmental and social impact assessment.

In the week ahead we forecast the Tanzanian shilling to trade above USD/TZS 2500.

Further reading:

Rigzone – Uganda-Tanzania Pipeline Nears Investment Decision: Standard Bank

Fitch Solutions – Economic Growth In Tanzania To Remain Steady In 2024

West African CFA Franc Region (XOF)

Compiled by Yashveer Singh

In Senegal, the battle against the high cost of living has had significant budgetary implications. In 2022, the government allocated 750 billion FCFA (1.14 billion euros), equivalent to 4.4% of GDP, in subsidies to the energy sector to control electricity, butane gas, and fuel prices. For 2023, these subsidies are expected to decrease to around 556 billion FCFA (847.5 million euros), a reduction of 194 billion FCFA (295.7 million euros). Additionally, efforts to stabilize consumer goods prices for households, such as wheat, oil, sugar, rice, and corn, cost 157 billion FCFA in 2022 and approximately 103 billion FCFA in 2023.

On the other hand, the wage bill for public administration has significantly increased, going from 428 billion FCFA in 2012 to 1,273 billion FCFA in 2023. During the same period, the public sector workforce grew from 95,779 employees in 2012 to 171,634 employees in 2023, representing a net increase of 75,855. The salary increases primarily focused on creating or revising bonuses and allowances, which rose from 149 billion FCFA in 2012 to 461 billion FCFA by the end of 2022. This increase aimed to combat the erosion of employees’ purchasing power.

Further reading:

Sikafinance — Senegal: The subsidy allocated to the energy sector drops by 194 billion FCFA in 2023

Central African CFA Franc Region (XAF)

Compiled by Yashveer Singh

In September 2023, the Central Securities Settlement and Registry (CRCT) reported that the average cost of Cameroon’s Treasury bond (OTA) issuances in the BEAC (Central Bank of Central African States) market was 7.2%, marking the highest average cost for the country’s medium- and long-term securities since the market’s launch in 2011. This change is significant, as for several years, Cameroon had been borrowing at relatively low interest rates of less than 3% for short-term securities (BTA) and less than 7% for long-term securities (OTA). However, several factors have contributed to this shift.

One major factor is increased competition from other countries offering more attractive interest rates. Additionally, the tightening of monetary policy by the BEAC (Central Bank of Central African States) has led to higher interest rates in the region. In an effort to combat rising inflation in the Cemac (Monetary Community of Central Africa) zone, the BEAC has implemented measures such as raising key interest rates, suspending liquidity injection operations, and intensifying withdrawals of liquidity from banks. As a result, borrowing costs have increased for both businesses and governments, prompting Cameroon to adjust its policy of conservative interest rates to adapt to the changing market dynamics.

Further reading:

Business in Cameroon — Cameroon’s bond prices reached the highest-ever record on Beac market in Sep. 2023