Yields on money market Treasuries have experienced consistent growth for the past 26 weeks, a trend expected to persist.

During the previous week’s auctions, held on October 9, 2023, the yield on 91-day bills increased by 40 basis points to reach 29.19 percent – while the yield on 182-day bills saw a 30-basis point increase, reaching 31.22 percent. Similarly, the 364-day bill settled at 33.02 percent. Based on the prevailing trend, it is anticipated that the yield on 91-day bills will surpass the 30 percent mark in the coming fortnight.

The sustained increase in money market yields can be attributed to government’s heavy reliance on Treasury bills (T-bills) as investors search for suitable investment options amid elevated inflation levels and the consequent monetary policy rate adjustments. Investors have been demanding higher yields at T-bill auctions, given the negative real returns offered in the market.

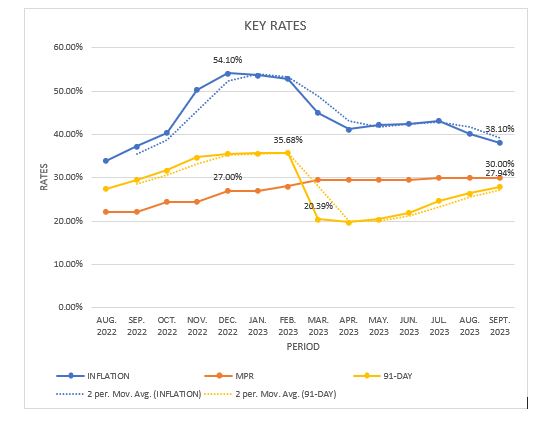

This trend has offset the interest savings achieved following the reduction of T-bill yields in the early months post-Domestic Debt Exchange Programme (DDEP). Government’s strategy to reduce yields after the DDEP initially led to a 17 percent drop in the 91-day T-bill rate, from 35.75 percent pre-DDEP to 18.53 percent by March 20, 2023. Nonetheless, yields have been on the rise since April owing to continued money market borrowing and limited external funding.

Despite the ongoing upward trend in money market yields, the sustained deceleration in headline inflation signals a disinflation process that is currently underway, with expectations that this trend will continue through Q4 2023. Notably, with a relatively higher base effect for October compared to the previous two months, the market anticipates further declines in consumer prices. This disinflation expectation by the market may help tame the rate at which yields on money market instruments increase going forward, even though they are still in negative real return territory.

Inflationary pressures eased further in September 2023, driven by the ongoing food harvest season and recent stability of the cedi. The annual inflation rate in September stood at 38.1 percent year-on-year, marking a decrease of 200 basis points from August 2023. Although the headline figure still exceeds the Bank of Ghana’s upper band target, it represents the lowest inflation rate recorded in a year. On a monthly basis the Consumer Price Index (CPI) reversed course, shifting from a deflation of 0.20 percent in August 2023 to an increase of 1.90 percent month-on-month in September 2023.

The cedi’s stable outlook amid government’s engagement with the IMF and external creditors to unlock US$600million also supports the view that disinflation will persist.

The decline in headline inflation, in conjunction with rising T-bill yields, has significantly improved the negative real return. The ’91-day bill-inflation’ spread has narrowed to a 10-month low at -891 basis points, while the ‘policy rate-inflation’ spread hovers at -810 basis points.

“Although we expect T-bill yields to rise this week due to refinancing pressures, we believe the decline in inflation will slow down the increase,” highlighted Apakan Securities in its review of the September 2023 inflation figures.

The Treasury is set to offer GH¢2.24billion in new short-term papers to refinance an upcoming maturity of GH¢2.09billion across the 91- to 364-day tenors.

Market observer Constant Capital notes an expectation of continued strong demand and a likely upward bias in yields in the short-term, until pricing fundamentals stabilise.

“GCB Capital, in its review of inflation data, also suggests that a disinflation process is in motion; with expectations supporting a continued decline in inflation through Q4-23 despite emerging upside risks.

“Accordingly, we reiterate that the Monetary Policy Committee (MPC) will hold the policy rate constant at 30 percent in the Nov-23 MPC meeting. We expect the ongoing macroeconomic and structural reforms – particularly the frontloaded fiscal tightening, debt reforms and memorandum on zero-deficit financing – to anchor the disinflation process,” stated the market watcher.

Thus, GCL anticipates that the MPC could maintain a rate-neutral decision through January 2024 to anchor the disinflation process, with a potential monetary policy stance change by March 2024 if the inflation outlook improves sufficiently.

“Once again, we expect that nominal interest rates will continue their upward trajectory throughout the quarter – but at a slower pace as the negative real return gap narrows,” GCL noted.