A few weeks ago, I asked my good friend Sam Avaala, who heads a major plantation business, what had helped a Ghanaian operation become a jewel in the crown of a global plantation giant when the World Bank in 1975 advised that Ghana would never be able to rival the productivity of Malaysia in the cultivation of oil palm. He responded that the Benso Oil Palm Plantation story so far could be summed up as follows:

- First, Unilever laid a solid foundation of standard operating procedures including ethical conduct, good corporate governance, sustainable and responsible business and production practices and human resource development.

- Second, the business adopted internationally recognized best practices in agronomy including scientific and precision agriculture and husbandry practices such as rigorous analyses of leaf and soil samples to establish the nutrient levels present in the soil. These allow BOPP to prescribe the type, dosage of fertilizers required per palm tree and the time required for absorption to address the nutritional needs of the palms.

- Third, the business has prioritised technology and digitised activities across the plantation starting with a digitised map of the 6,799 hectares broken down into 30 to 40-hectare blocks and a database identifying every block of the plantation according to the year of planting, production and yield history, and harvesting cycles.

The technological infrastructure includes a drone which to a limited extent is used for surveillance and an Electronic Plantation Management System (ePMS) which to a large extent removes errors and fraud associated with human factors. The ePMS provides real-time data on harvested fruit records, reconciliation of daily production from farm to mill, a biometric system for daily attendance of harvesters including facial recognition, mapping the number of bunches harvested to the year of planting, source block and the harvester, translating to payroll input and block data. This system is new and more comprehensive.

BOPP also operated AKATUA, an automated payroll software, and AFUOM, a farm production management software developed by SOFT during the Unilever era. These have now been replaced by the ePMS and SAP.

Ladies and gentlemen, the story of financing agriculture and agro-processing in Ghana is haunted by many ghosts and yet here is one enterprise that has thrived; pays good taxes to the State, is listed on the Ghana Stock Exchange and is making a difference in its community through the provision of healthcare, academic and agronomic education, utilities and other social amenities whilst blazing the trail in terms of clean energy from two biomass steam turbines that produce 0.5MW and 1MW per hour respectively.

There is no reason why such an example of globally competitive agriculture and agro-processing, cannot be the hallmark of farming and value-addition enterprises across Ghana. Even more impressive is the fact that BOPP is managed by an all-Ghanaian team. Perhaps, the person you should be listening to is my friend and brother Mr Sam Avaala.

The focus of this presentation could easily have been on the role that good governance, world-class agronomic practices and the application of technology, play, can play and should play in agriculture and agro-processing.

However, no farmer or agro-processor in Ghana today believes they have the space to focus on these critical matters because the basic need for finance to start and run their farms and businesses remains largely unmet. The lack of finance is the reason why much of our agriculture is characterised by uncompetitive, smallholder farms worked by aged, poor farmers and why our agro-processors remain small, largely inefficient operations.

Without discounting the equal primacy of the qualitative drivers that Sam listed, I wish to address this imperative of finance and how it serves or hinders agriculture and agro-processing. I will concentrate on how we can shape finance to work better for farmers and agro-processors. If by God’s grace there is another opportunity, I will return to discuss those other critical issues.

The problem – the nature of agriculture and agro-processing in Ghana

Agriculture accounts for approximately 18percent of GDP in Ghana. Apart from the heydays of cooperative farming from 1960 to 1966, farming in Ghana has largely been a private-sector venture generally tagged as Dirty, Difficult, and Dangerous. Ghana still has a largely agrarian, developing economy founded on smallholder farmers. As is the case in the rest of sub-Saharan Africa, about a third of these smallholder farmers in Ghana live in poverty. Farmers and agro-processors consistently cite the restricted access to finance as the main barrier inhibiting the growth of their enterprises.

The farmer is always the loser. The first to bear the brunt when policy shifts go wrong, and the one with the least benefit when everyone else is smiling. Similarly, agro-processors often watch helplessly as huge portions of agricultural produce rot or are discounted and sold to market queens in times of glut whilst their investments lie idle and their workers remain underemployed or are laid off. So, I add Debt-ridden and Risky to those perceptions of agriculture and agro processing, yet, BOPP has proven that agriculture can be rewarding as a business or occupation and agro-processing in Ghana can be hugely profitable and globally competitive. Indeed, in a 2005 paper titled Africa: Farming Challenges and the Farmer, Dr Ishmael Yamson wrote:

When I was in primary school my grandfather paid my fees, purchased my books and my uniforms and my siblings and I ate three meals a day. After 50 years, the state has to pay the fees, provide the books, and in some cases feed the children because the farmer can no longer afford these things following the long period of state exploitation and impoverishment of our rural people.

My following remarks will attempt to decipher the reasons for the limitations that farmers and agro-processors face in accessing finance, the solutions attempted by stakeholders, what we may learn from other developing economies and the opportunities to change our fortunes with innovative solutions.

The industry inhibitors

First, let me deal briefly with the global context. The global financial structure around agriculture and agro-processing does not favour countries like Ghana. The G20 account for nearly all of the US$640billion annual spend on subsidies to agricultural producers, most of which is used in a manner that distorts markets through production-linked support to farmers and big agribusiness. These then depress prices of agro products worldwide. Ghanaian farmers then find that they cannot produce crops at prices that compete with such heavily subsidised produce.

The problem then rolls onto agro-processors who are unable to source local maize, rice, tomato, sugarcane and other produce at prices that allow them to make the value-added industrial and consumer products that would generate jobs and save this country a stack of millions in import dollars. The complaints of countries like Ghana to the World Trade Organisation about this have been upheld but reform of the EU’s Common Agricultural Policy and US farm policy is painfully slow.

Second, I will look at Ghana’s financial sector. Though we have one of the most developed financial sectors in West Africa, agriculture and agro-processing are viewed as too risky and therefore credit and insurance facilities are limited, restrictive and costly. The Bank of Ghana requires that 50percent of loans disbursed by rural banks fund agriculture, however, this mandate is not enforced.

Additionally, of the 87percent of lending in Ghana that comes from commercial banks, less than 4percent of these loans are made to agri-businesses, some with a requirement for borrowers to pledge collateral equal to 100percent of the loan amount. The bulk of that lending, in any case, goes to large commercial farmers.

Financial institutions go on to cite a long list of rational business calculations for being reluctant to lend to agriculture and agro-processing including, the:

- Farm industry characteristics

- Lack of documentation and registered collateral required for loans;

- Low levels of farmer education and financial literacy;

- Perennial underperformance of agriculture and agro-processing

- Existential risks such as diseases, pests and changes in climatic factors;

then there are the

- Financial sector prejudices

- High-risk perception of the sector and lack of adequate risk management tools;

- Agriculture and agro-processing not seen as strategically important for their success;

- The perceived low-profit potential of agriculture;

- The inappropriate financing models applied by commercial banks for agricultural lending due to poor understanding of agribusiness; and

- The lack of reach by banks and the high service delivery and monitoring costs in rural areas;

Addressing these are key to making the financial incentives effective in attracting capital to agriculture and agro-processing once again. However, those who are passionate about agriculture and agro-processing will add that there are;

- Structural and institutional deficiencies in agriculture financing

- The inability of financial institutions to appropriately assess the creditworthiness of farmers and agro-processors using specialised diagnostic tools and credit information to mitigate risks.

- The absence of basic, affordable financial and insurance products to serve agriculture and agro-processing;

- The absence of fiscal incentives and legal mechanisms to attract, direct and reward finance from the financial sector and food importers;

- The absence of fiscal incentives for private investments by corporates and individuals to de-risk and finance agribusinesses; and

- The weak collaboration between sector ministries to harness synergies, reduce overlaps and better coordinate initiatives targeted at farmers and agro-processors.

In rural Ghana where many agricultural and agro-processing enterprises are located, only about 38percent of people have some form of bank or mobile wallet account. We cannot say the market does not exist for financial products to rejuvenate our agriculture and agro-processing industry. In the absence of policy determination to facilitate the private sector contribution to making finance work for agriculture and agro-processing, farmers and agro-processors will continue to be confronted by an unforgiving, complex and multi-layered reality characterised by;

- a dysfunctional relationship with capital and finance sources,

- the role and power of the aggregators and other supply chain actors in the middle markets,

- the lack of access to markets, and finally

- the power of markets over farmers.

The third reason for the restricted access to finance for agriculture and agro-processing is the inconsistent, uncoordinated, unfocused, unstructured and half-hearted execution of policies over successive Administrations.

Today, Africa has the highest levels of underutilized and underdeveloped agricultural land worldwide. Agricultural land in Ghana stands at about 57percent (12.9 Ha million) of the land area. The government made a commitment at the Second Ordinary Assembly of the African Union in July 2003 along with other AU Members to implement “the allocation of at least 10percent of national budgetary resources to agriculture and rural development policy implementation within five years.”

Government has not put its money where its mouth is. On November 2nd 2021, the Peasant Farmers Association of Ghana (PFAG) asked the Government to allocate a minimum of 10percent of its budgetary allocation to the agriculture sector in the 2022 budget noting that budgetary allocation in 2021 for agriculture was less than 5percent of the total and woefully inadequate to implement the many policies of the government.

Land devoted to agriculture has expanded by about 176percent from 1.7Ha million in 1961 to 4.7Ha million in 2018. That still means only a little over one-third of the potential agricultural land has been put to productive use. To achieve the radical expansion of commercialised agricultural land, the onus is on the Government to fulfil the 2003 declaration.

The fourth issue to be resolved is the absence of a consistently well-financed agenda to create a self-reinforcing virtuous cycle of growth centred around increases in agricultural productivity and agro-processing to increase sustainable jobs.

Successive governments have not invested sufficiently in extension services, soil fertility management, cutting-edge mechanisation, pest and disease control, and other public goods such as quality electricity supply, durable highways and other utilities in support of agriculture and the agro-processing industries. The perception that agriculture and agro-processing are Dirty, Difficult, Dangerous; Debt-ridden and Risky remain because we have not as in Europe, Northern America and elsewhere funded a government-assisted but private-sector-led expansion to catalyse the creation and growth of allied services and industries.

This leads me to my fifth point that the architecture of our agriculture has not encouraged strong linkages between agro-processors and farms. Just as smallholder farms struggle to raise credit, small and medium-sized agro-processors are unattractive to banks because they are unable to aggregate the large volumes and the quality of raw materials required to be viable. Some local agro-processors can only source about 30percent of their raw material requirements locally. Indeed, the Ghana Industrial Policy document notes and I paraphrase, that,

“despite the favourable climatic and soil conditions for agriculture, major local raw material supplies are inadequate and costly, and local manufacturers have to rely on imported raw materials. The agro-processing industry continues to suffer from an inconsistent and inadequate supply of local raw materials.”

The situation at BOPP where the business combines the financing required for its nucleus farm with that of the smallholders who supply its mills to acquire favourably structured financing at low rates of interest is rare. However, agriculture can only respond to industry needs and unprofitable agro-processors can only benefit from the support of the financial sector when they are able to integrate their supply chains and financial strategies.

The underdeveloped agri-insurance market

The Crop Insurance Feasibility Study in 2010 on behalf of the National Insurance Commission and the gtz suggests that the foundational problem inhibiting the development of an agri-insurance market lies in a two-part vicious cycle:

- first, farmers do not demand insurance because they lack the access to finance to create viable businesses; and

- on the other hand, buying insurance has not guaranteed them access to finance.

Proof of the resultant low uptake of agri-insurance products can be seen in the National Financial Inclusion and Development Strategy: 2018–2023 for Ghana which reveals that in 2016, only 4’785 agri-insurance policies existed in a country with over 12 million citizens involved in agriculture. Depressingly, the targets for 2020 and 2023 were only 50,000 and 100,000 respectively but actual data from GAIP suggests that even those modest targets will not be met.

Those who are the solution to our food security, food independence, industrial and jobs growth have low financial literacy and little incentive to buy insurance or take on loans as long as insurance premiums and interest rates for smallholder farmers who are dependent on rain-fed agriculture and small scale agro-processors remain exorbitant because of the inhibitors and prejudices outlined above. What is required are robust public-private partnerships to create attractive products in a competitive market suited to the development of agri-business.

What exists – available agric financing programmes in Ghana

I take this opportunity to commend successive governments, the Bank of Ghana and our development partners for the implementation of initiatives – dating as far back as the First Republic of Ghana. These efforts have provided rural farmers and agricultural SMEs with better access to finance in order that they thrive. I will talk through a few of the recent ones.

- The Ghana EXIM Bank, established by the consolidation of three state-owned institutions, has been a key financier of the 1D1F programme – providing a total of GH¢417 million support to the initiative. The Ekumfi Fruits and Juices Limited (GH¢7.7m funding support), Casa de Ropa (GH¢4m funding support), Darko Farms (GH¢22.1m funding support) and the Shea Empowerment Initiative (GH¢10m funding support) are amongst the 135 agricultural and agro-processing beneficiary SMEs.

- The Financing Ghanaian Agriculture Project (FinGAP), initiated by USAID, also supported small, medium and large enterprises (SMiLEs) operating in the maize, rice and soy (MRS) value chains in northern Ghana to receive direct support from Business Advisory Service (BAS) providers and access financing at a relatively low cost from Financial Institutions.

The Project provided risk mitigation tools such as crop or weather insurance, partial credit guarantees and capacity building opportunities to selected financial institutions in order to incentivise those institutions to offer credit tailored to suit the needs of agribusinesses in the targeted value chains. The investment of over US$115million has significantly impacted the business growth, profitability, and livelihoods of over 2,846 agribusinesses and 62,000 smallholder farmers.

- The Rural And Agricultural Financing Programme (RAFIP), expended US$29.78million to consolidate the accomplishments of the Rural Finance Support Programme previously financed by IFAD and improve access to sustainable financial services in rural and agricultural communities through enhanced outreach and linkages. From 2008 to 2016, it trained and registered 60 farmer groups as cooperatives, provided 876 farmers with loans, trained 14,774 farmers on the importance of agricultural credit and micro-insurance, equipped 15 community banks with computers and financial management software for effective data management, and registered 22 credit unions with the Credit Union Association of Ghana.

- The Ghana Incentive-Based Risk Sharing System For Agricultural Lending (GIRSAL), is a private non-bank financial institution capitalised with GH¢200 million and US$14million by the government to de-risk agricultural financing by financial institutions and enhance the total amount of credit to the agricultural and agribusiness sectors through the issuance of agricultural credit guarantee instruments.

- The Outgrower And Value Chain Fund (OVCF) is fulfilling the goal of providing low-interest medium to long-term loans to commercially viable value chains and out-grower schemes. It has financed farmers engaged in cultivating eight (8) selected value chain covering; oil palm, rubber, cocoa, maize for poultry, cassava for gari, soya-sorghum-maize, pineapple and rice, with a sum of €33 million. 4,610 farmers and eight (8) Technical Operators have so far benefited from the Fund.

- The Planting for Food and Jobs (PFJ) Programme, through various funding measures such as the supply of improved seeds at a 50percent discount, the supply of 50percent subsidised fertiliser and the provision of free extension services reports that in 2020 alone PFJ supported up to 1,700,000 farmers enrolled across the country under its five (5) modules, namely;

- Food Crops;

- Planting for Export and Rural Development;

- Greenhouse Technology Villages;

- Rearing for Food and Jobs; and

- Agricultural Mechanization Services.

- The Feed the Future Ghana ‘Mobilizing Finance in Agriculture’ (MFA), is a US$19million USAID programme running from 2020 to 2024 to address the market failures limiting access to finance by smallholder farmers engaged in seven key value chains in the Northern, North East, Upper East, and Upper West Regions of Ghana. The project is helping finance agriculture in three ways:

- by expanding the existing sources of finance,

- finding new sources of finance, and

- partnering with investors, associations, tech firms and financial institutions to access finance.

Over the course of its lifespan, it is expected to achieve amongst others:

- the mobilisation of US$261million agricultural financing in debt and equity from capital markets for the target value chains; maize, soy, cowpea, groundnut, and other high-value crops, in priority geographical areas;

- directly support 81,493 M-SMiLEs in accessing financing, business management services, or other technical assistance from programme stakeholders;

- the development of ten (10) new loan products for agriculture;

- 2percent average reduction in agribusiness finance interest rates charged by supported Financial Institutions;

- 25percent average reduction in agribusiness financing turnaround time for supported Financial Institutions; and

- extending the average tenor of loans for agribusiness by 12 months

- Lastly is the establishment of the Ghana Agricultural Insurance Pool (GAIP) to protect farmers and other players in Ghana’s agricultural industry from the negative economic effects of climate change and perils associated with agriculture and agribusiness. The Pool, with insurance being provided by 15 Ghanaian insurance firms and 1 local reinsurance company, has developed a portfolio of innovative insurance products including the:

- drought index insurance,

- multi-peril crop insurance,

- poultry insurance, and

- area yield insurance

to help mitigate the financial risks associated with extreme weather events and other forms of climate change. GAIP also plans to roll out new insurance products such as livestock insurance for commercial farmers.

A lot has been done but there is more to do because the initiatives have been staggered and not executed in a coordinated manner. Consequently, agriculture and agro-processing remain moribund.

Are there lessons anywhere and what was achieved?

Elsewhere on the African continent, governments and development partners including the African Development Bank, USAID, The German Development Bank (KfW), ICCO, The European Commission, DFID, JICA, The Alliance for a Green Revolution for Africa (AGRA), Mastercard Foundation, the Bill & Melinda Gates Foundation and the Forum for Agricultural Research in Africa, have supported many initiatives in a quest to solve problems that we have to address in Ghana as well.

One, the Strengthening African Rural Smallholders (STARS) programme for example addressed challenges such as poor farming techniques, lack of credit, minimal access to markets, and limited access to appropriate financial products, that smallholder farmers in rural Ethiopia, Burkina Faso, Rwanda and Senegal faced. 22 partner microfinance institutions (MFIs) in the four countries, developed, tested and rolled out 20 tailor-made credit products using a bespoke solution – the Agriculture Credit Assessment Tool (A-CAT).

The STARS programme equipped the risk management committees within MFIs to manage agri-finance products and evaluate their risks using the A-CAT. The programme supported all 22 MFIs to attract more funding through business plan development, international brokering and B2B networking. As part of its savings mobilization strategy, the STARS programme also supported MFIs to develop more savings products.

In Rwanda, a major policy reform on agriculture finance – the land tenure regularisation programme, has resulted in the formal registration of farmers’ title to lands, and enabled several rural farmers to use their lands as collateral for loans.

What Ghanaian farmers and agro-processors require

In spite of the efforts of the Government, development partners and the financial sector over decades, resolving the bedevilling issue of poor access to capital for small and medium-scale agribusinesses remains.

Agri-businesses require radical and innovative collaboration between the financial sector, government, private investors and development partners to create a mix of financial and insurance product innovations to support their short, medium and long term needs for capital and risk mitigation. Ghana must leverage its financial sector to minimise the riskiness of loans and insurance policies for agriculture and agro-processing and improve the share of loans that pass from commercial and rural banks to agriculture and agro-processing.

Another area of agribusinesses where operators struggle to secure credit facilitation and actual loans for their operations is knowledge transfer covering the need for;

- Extension Support and Education,

- Business Support Services (incl. general management training)

- Irrigation Development

- Production Support

- Market Development

- Postharvest and other Infrastructure management, and

- Training

Without the transfer of enhanced knowledge, we are guaranteed unproductive farmers and agro-processors but this discussion is currently not on any table. Innovation is required to facilitate these investments in knowledge transfer in agriculture, aquaculture, animal husbandry and agro-processing enterprises. This list of the knowledge base that farmers and agro-processors need funding to acquire shows just how much work remains to be done by the financial sector players to help agri-businesses expand their farms and supply bases, agro-processing operations, improve productivity and grow sustainably.

Securing bridge finance is specifically needed to cover working capital requirements for up to 18 months to help farmers of biannual and annual crops and livestock acquire fertilizers, pesticides, feed and fodder; market agricultural produce and pay the wages of hired labour among others. Agro-processors on the other hand, seek such short-term finance to source raw material, production consumables and supply chain logistics.

Additionally, medium-term financing is also required to support the consolidation of growth by providing the means to fund expansion including the purchase of livestock or seedlings for perennial crops, basic agricultural equipment; the cost of repair and maintenance of key assets and buying technology to enhance efficiency and productivity. For agro-processors, such financing must be designed to help them acquire basic production equipment that can be paid off over an 18-to-36-month period with a short grace period to enable the investments and the employee exposed to the new technologies to be synchronised and become productive.

Perhaps the most difficult and yet the most important innovation in financing products that farmers and agro-processors ask for is patient capital. Agri-businesses need partners who are willing to factor in a significant moratorium period after which agri-businesses can make repayments over 36 to 84 months. This is the best way to ensure long term investments to improve soil fertility, construct infrastructure on farms, purchase complex agriculture machinery like tractors, harvesters, initiate new or expand existing projects which require heavy capital outlays or have long gestation periods and repay old inappropriate shorter-term debts.

Innovative medium to long term financial and insurance models that are transforming agricultural finance elsewhere and can similarly be adopted or more broadly applied include:

- The Agricultural Value Chain Finance (AVCF) leverages the role of off-takers within the value chain related to a farmer’s produce/enterprise to enable farmers to secure credit based on their estimated future income. Participating Banks rely on the existence of buyer contracts as security for issuing loans supported with loan guarantees, mentorship services and capacity development.

- Collateral Management Agreements allow farmers to obtain loans from a bank using produce with long storage life as collateral. The produce is only released by a custodian (usually a warehouse operator) upon Notice to the custodian by the bank, of the farmer’s repayment of the loan.

- Equipment Financing encourages smallholder farmers to consolidate their capital expenditure requirement to secure loans for the purchase of movable assets that are then used as collateral for the loan. Often, there is a close collaboration between the equipment suppliers and the bank. The relationship is further enriched where an agro-processor is a party to the transaction as an off-taker.

- Leasing grants access to the use of equipment to farmers and agricultural SMEs by the asset owners at predetermined times in exchange for periodic payments to the equipment owner, without an eventual transfer of ownership of the asset to the farmer or SME. This model of financing focuses on the value that farmers can generate through the use of the asset, without any recourse to their past credit history.

- Factoring: benefits farmers by formalising a common practice where they discount the estimated value of their harvest and exchange it for financial support from a financier. While this has long been the preserve of market queens and aggregators, the involvement of financial institutions will help what has been a vicious loan-sharking regime.

The question is what will make the financial service providers take notice of these opportunities?

What capital providers require in Ghana

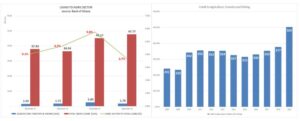

Agricredit has collapsed relative to the rest of the economy

Credit to agriculture forestry and fishing in Ghana increased from US$75.3million in 1997 to US$502.95million in 2019 however the value of credit to agriculture has dropped from about 2percent of GDP to less than 1percent in that time.

Our experience has shown that Ghanaian capital providers have a risk-aversion toward agriculture and agro-processing that generates a requirement for certain critical assurances over and above the norms required to fund traders and importers. The response to the high-risk perception of agriculture and agro-processions should provide at least these three critical conditions:

Credibility on the part of agro-processors and farmers that will create certainty about the recoverability of loans;

The terms that one bank asks from farmers who need short-term credit to pay input costs are:

- Business registration documents

- Six months’ statements from another bank

- Three years’ financial statements and cash flows

- Collateral (as may be required)

- Favourable credit bureau report

Not many smallholder farmers will get that loan. Happily, the elements for the structural realignment required to justify the allocation of resources to develop innovations are in place. Policy and law-makers must:

- Make farmers and agro-processors known

By leveraging spatial mapping data, developments in land title registration and National Identification to tie every parcel of land to an owner and whoever farms it to give lenders and insurers more confidence to become active in providing financial solutions to agriculture and agro-processing

Institutional support such as a clear strategic agenda and activation framework; and

The solution will require a hard-nosed remodelling of the structure of finance for our agriculture and agro-processing and the fiscal incentives, including targeted subsidies, to encourage private sector financing of agriculture. The first action is what Benjamin Adjei, Head of Programmes at the Food and Agriculture Organisation of the UN (FAO) told Oxford Business Group (OBG);

‘‘The government should find a way to meet the farmers halfway on loans. They should consider providing loan assurances or assistance in paying off some interest.’’

Policy-backing that provides some amount of guarantees to de-risk the funding going into agriculture and agro-processing is required

To do that, the Government must reduce the risk to the financial sector for backing agriculture and agro-processors and the path to that must involve credit and insurance providers. The first step is to leverage the relationship between agro-processors and farmers.

When Wilmar International took over the Unilever operations at BOPP an important change occurred. For Wilmar, the plantation business is a core business and it backed BOPP with passion, enhanced funding, innovation, technology and world-class technical management. As a country, we should treat agriculture in the same way – as the core to the success of the transformation of the economy just as Malaysia and Vietnam did – and back it with passion, enhanced funding, innovation, technology and world-class technical management.

Credit and insurance providers require Government to:

- Help farmers and agro-processors to scale up

promoting the concept of farmer-and-agro-processors working together in cooperatives will enable agribusinesses to consolidate their financing needs for financial institutions to support with loans backed by insurance guarantees,

additionally, government must - Promote value-chain integration between farms and agro-processors by introducing mandates which require that insurance-backed loans for farmers are tied to off-taker contracts with agro-processors to improve the likelihood that loans will not become non-performing.

These elements should be factored into our strategies to then provide capital lenders and insurers with the confidence to make available medium to long-term capital for agribusiness.

What are the opportunities in Ghana for a change in the fortunes of agribusiness?

By conservative estimates, the population of Ghana will grow by 67percent from 31 million to 52 million by 2050 in a world of 9.8 billion people up from 7.8 billion in 2020. That growth will create opportunities for an estimated US$5.8trillion of investments in agriculture over the coming three decades. To keep up with the pace of estimated global investments on a pro-rata basis, Ghana must plan to raise and deploy at least US$31billion in the agriculture and agro-processing sectors during the same period – about US$1billion a year.

Looking at the structure of the financial sector relative to its interaction with farmers and agro-processors, there are at least three bold options for consideration that I would hazard have been considered before and not activated because they are daunting avenues though they promise a revolution in agri-finance and insurance.

First, MoFA, the Bank of Ghana and MoFEP must coordinate the implementation of a framework by which local self-help organisations, credit unions and rural banks could collaborate with commercial banks and insurers to co-develop product innovations for agriculture and agro-processing. The aim would be to minimise risk to the formal sector players, and incentivise beneficiary farmers and agro-processors with appropriate carrots and sticks to motivate good behaviour.

Second, bold action would require policy and legal reforms aimed at facilitating the creation of mergers and/or JVs and/or SPVs between commercial banks and insurers on one hand, and credit unions and rural banks on the other to enable a more appropriate and effective outreach and service by commercial banks and insurers who have the financial muscle and which leverages the local knowledge and operational know-how of the community-based financial institutions. Today that is simply undone, but it should be possible.

Again, the government can implement finance and insurance policy reform to attract private individual and corporate investment in bundled agri-finance and agriculture insurance products such as agri-bonds issued at rates competitive to treasury bills or bonds depending on the type and term of investments.

This would be a new collaboration between the government, the commercial banks and insurers alongside community-based financial institutions. Such collaborations would facilitate potential and current non-institutional players such as money lenders, landlords, trade and commission agents, relatives and friends among others, to consolidate finance for agribusiness in new credit vehicles insulated through guarantees and insurance policies.

Through GAIP, the ministries of Finance and Agriculture; and the relevant partner agencies of Government should collaborate to:

- finance and roll out a government-backed agriculture insurance subsidy programme to support private agricultural insurance schemes for all farmers who are able to join cooperatives at the district level with the incentive of input subsidies tied to their insurance;

- resource the Ghana Incentive-Based and Risk Sharing System for Agric Lending (GIRSAL) to raise its guarantee for risks associated with lending and providing insurance cover to agriculture and agribusiness to at least 80percent and work to ensure all the other mitigators of waste and losses are in place to reduce Government’s and GIRSAL’s risk;

- link an efficient warehouse receipting system with the commodity exchange programme.

- streamline the security required for accessing credit by enhancing farmer traceability through legislation, and the agriculture census data; and

- implement an integrated farmer collateral registry that aligns the existing BoG collateral registry with an insurance collateral system to allow insured farmers to use their policies as collateral for credit.

In terms of focus, the Government should also decide on its priorities to direct credit to strategic agriculture and agribusiness activities, and kick off the plan of action to invest at least US$1billion in agriculture annually. The investment measures can include:

- cutting the cost of credit to primary agriculture and agribusiness with an injection of at least GH¢500 million into the banking and insurance industries to support lending at a capped rate below government’s borrowing from the capital market

- investing at least GH¢200 million per annum to improve credit to strategic agriculture, agribusiness activities, and related infrastructure through the Exim Bank

- dedicating at least 20percent of the Ghana Infrastructure Investment Fund to agricultural and agribusiness infrastructure (US$330 million)

In conclusion…

Though the conversation cannot be exhausted today, it is obvious that every player looks to the Government to take the lead to minimise the risk to creditors and insurers in providing credit for agriculture and agribusiness.

Notwithstanding the current low level of financial resources devoted to agriculture and agro-processing, the options outlined present an opportunity for Ghana to make bold decisions to transform the architecture of our economy to one that is agriculture-centred and driven for the obvious reason of creating larger, better-quality reservoirs of;

- Human Capital anchored on sustainable job creation and lifetime skills development in agribusiness and allied industries,

- Diversified Revenue based on developing robust services, science and technology sub-sectors related to agribusiness and agro-processing,

- Stable Long-term Economic Growth built on a well-integrated and resilient domestic economy, and finally,

- Competitive Advantage in agriculture as the basis for a more sustainable market development drive for Ghana’s export potential as we become more integrated into the regional and global economy.

Vietnam took only a decade to transform its rural agriculture and fishery industry into a world-class sustainable engine to fuel its economic transformation and growth. Vietnam, a country devastated by war by the close of 1979 is today an upper-middle-class income economy. The Vietnamese leadership believed they could use agriculture and agro-processing to transform their very large population to upper-middle-income status. They backed the vision with passion, enhanced funding, innovation, technology and world-class technical management. We already know the story of Malaysia and what they have done with a single crop – oil palm.

We can do the same in Ghana.

>>>The author is Senior Partner at Ishmael Yamson & Associates