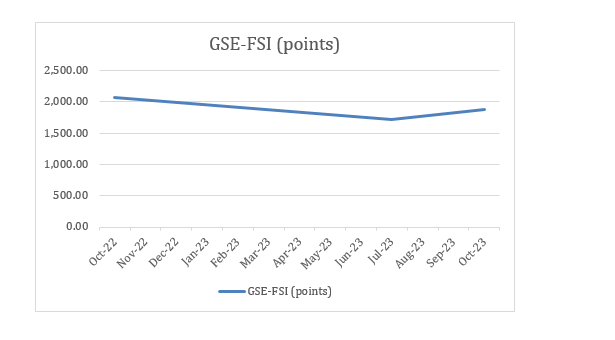

There appears to be a potential turnaround in listed financial stocks, as the GSE-FSI that tracks their performance has registered an 11.89 percent gain over the four weeks leading to close of last Friday’s – September 22, 2023 – trading.

This upturn can be attributed to overall market growth, robust first-half banking performance, and the infusion of liquidity from coupon payments from new bonds exchanged under the Domestic Debt Exchange Programme (DDEP).

The index, which stood at 1,881.49 points at the close of Friday, reflects a 5.1 percent increase in just one week. While this signifies a year-to-date loss of 8.34 percent, it represents a marked improvement compared to middle of the year.

During this one-month period, the benchmark GSE Composite Index (GSE-CI) achieved a 3.74 percent gain; closing at 3,168.35 points and resulting in a year-to-date gain of 29.64 percent. This surge propelled market capitalisation to GH¢74.15billion.

This comes as the banking sector demonstrated resilience in the first half of 2023, with data indicating improved performance. Prudential data show that as of end-June 2023, total assets of the banking industry reached GH¢242.4 billion – a 21.2 percent annual growth compared to 22.8 percent in June 2022.

Consequently, profit-before-tax surged by an impressive 51.2 percent in June 2023 compared to 20.8 percent growth during the same period of the previous year. Net income or profit-after-tax similarly increased to GH¢4.3billion, marking a significant 51.4 percent rise in June 2023.

Financial analyst Kofi Busia Kyei attributes part of this rally to increased market confidence, stemming from government’s successful fulfillment of obligations related to new bonds. He anticipates that forthcoming coupon payments under the DDEP will hold even greater significance.

“Looking forward, the next 2 or 3 coupon payments under the DDEP scheme hold immense significance. These upcoming payments, scheduled to be disbursed in the near-term, stand as more than just financial transactions; they are a litmus-test for the resurgence of Ghana’s financial markets.

“The influence of these coupon payments extends to the stock market as well. With more liquidity circulating in the economy, stock prices may experience an upward trajectory. Investors who were once cautious may re-enter the market, driving demand for equities and potentially resulting in higher share prices,” he explained.

“Their successful execution will be a resounding vote of confidence in the country’s economic outlook and government’s commitment to maintaining financial stability,” he added.

Share performance

At start of the year, Access Bank’s share price was GH¢4.01, which declined to GH¢ 2.82 by the end of August. However, Access Bank has shown signs of recovery – boasting a 9.93 percent gain in one week and a 3.33 percent gain over four weeks, bringing its share price to GH¢3.1.

Agricultural Development Bank’s (ADB) share price has remained stable at GH¢5.06.

CAL Bank, while recovering 10 percent of its share price over the last six months, saw a decline from GH¢0.65 at beginning of the year to GH¢0.55 at end of last week; reflecting a 12.7 percent loss over the past four weeks.

Ecobank (EGH) experienced a 5.09 percent decrease over the past month, but rebounded with a 7.9 percent increase in the last week. Its share price started the year at GH¢6.64 and ended at GH¢4.1 last week, while Ecobank Transnational Incorporated (ETI) remained stable over the period at GH¢0.15.

GCB commenced the year at GH¢3.94, dipped to GH¢3.15 in February and has since seen gradual improvement, remaining largely unchanged over the past four weeks at GH¢3.5 cedis.

Republic Bank’s share price has remained constant since start of the year at GH¢0.54.

Standard Chartered Bank (SCB) shares emerged as the second-most significant gainer in the segment, witnessing a remarkable 41.3 percent increase over the last four weeks and reaching GH¢19.45. However, its preference shares have remained unchanged since beginning of the year at GH¢0.9.

Societe Generale has been the standout performer in the segment, achieving gains of 9.72 percent, 75.6 percent and an astonishing 168 percent over the past week, four weeks, and three months respectively.

The Trust Bank’s share price has remained stable throughout the period, maintaining a consistent value of GH¢ 0.82.

On the insurance front, Enterprise (EGL) has retained a constant share price of GH¢2.41 since June 2023, having started the year at GH¢3.2. SIC, on the other hand, recorded a substantial 20 percent gain over the last four weeks.