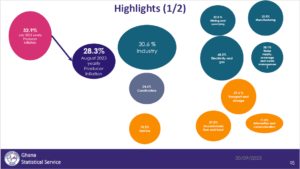

The Producer Price Index (PPI) for August 2023 exhibited a notable year-on-year decline to 28.3 percent compared to 32.9 percent in the previous month, data from the Ghana Statistical Service (GSS) have revealed.

This figure, while substantial, marks a 4.6 percentage point reduction compared to the preceding month as inflation subsided from its July 2023 level. Additionally, the month-on-month shift in the PPI between July and August 2023 registered a modest -0.4 percent.

The PPI serves as a fundamental economic gauge, capturing the average shift over time in the prices received by domestic producers for their goods and services. It plays a pivotal role in assessing inflationary forces within the nation’s production sectors.

A more granular analysis of the data reveals a noteworthy deceleration in inflation trends for August 2023. This presents a potential relief for businesses and consumers grappling with mounting costs. However, specific sectors such as Electricity and Gas continue to grapple with pronounced inflationary pressures, while others – notably Information and Communication – exhibit relative stability.

Sector-specific analysis:

Industry PPI

Within the industry sector, excluding construction, the year-on-year producer inflation rate stood at 30.6 percent for August 2023. Accompanying this was a slight monthly adjustment rate of -0.6 percent, suggesting a degree of stabilisation within this sector.

Delving into sectoral specifics, the Electricity and Gas sub-sector registered the highest year-on-year producer price inflation rate, an imposing 68.3 percent. This figure underscores mounting costs within the energy sector, a pivotal area for the nation’s economy. Following closely was the Water supply, sewerage, waste management and remediation activities sub-sector, displaying a robust 38.1 percent rate. In stark contrast, the Manufacturing sub-sector posted the lowest year-on-year producer inflation rate, standing at 23.5 percent.

On a monthly basis, specific sub-sectors exhibited minimal variation. Both the Water supply, sewerage, waste management and remediation, as well as the Electricity and Gas sub-sectors, recorded no month-on-month shift in inflation during August 2023. The Mining and quarrying sub-sector observed a slight dip, registering a minor -0.3 percent inflation rate. Meanwhile, the Manufacturing sector demonstrated the most muted monthly inflation, recording a rate of -1.0 percent for August 2023.

Construction PPI

The construction sector witnessed a notable upswing in the year-on-year producer inflation rate, reaching 24.6 percent for August 2023 in comparison to the prior month. The monthly change rate for this sector was relatively more significant at 6.8 percent, indicating pronounced shifts in pricing dynamics.

When scrutinising data by sub-sector, civil engineering emerged with the highest year-on-year producer price inflation rate at 27.2 percent. This is reflective of heightened costs associated with infrastructure development projects. Following closely was the construction of buildings sub-sector, registering a rate of 20.0 percent. In contrast, the specialised construction sub-sector reported the lowest year-on-year producer inflation rate at 7.0 percent.

From a monthly perspective, the civil engineering sub-sector recorded the highest inflation rate – standing at 9.9 percent. This surge is potentially linked to ongoing infrastructure development initiatives. Specialised construction activities followed with a modest inflation rate of 0.8 percent. In contrast, the construction of buildings sub-sector displayed the most subdued month-on-month inflation, posting a rate of 0.4 percent for August 2023.

Service PPI

In the services sector, the year-on-year producer price inflation rate was tallied at 15.5 percent for August 2023, with no variation in the monthly rate. This sector holds immense significance within Ghana’s economic landscape, encompassing a spectrum of industries.

When dissecting data within the services sector, the Transport and Storage service sub-sector exhibited the highest year-on-year producer price inflation rate, standing at a robust 37.3 percent. This is indicative of the impact from heightened transportation costs on the nation’s economy. The Accommodation and food sub-sector closely trailed behind, recording a rate of 27.0 percent. In contrast, the Information and Communication sub-sector reported the lowest year-on-year producer inflation rate, standing at 11.0 percent.

From a monthly vantage point, the Transport and Storage sub-sector experienced the most pronounced inflation rate, registering 0.2 percent. This shift may be influenced by fluctuations in fuel and logistics costs. The Accommodation and food service sub-sector followed with a more modest inflation rate of 0.1 percent. The Information and Communication sub-sector maintained a consistent monthly inflation rate, displaying no variation in August 2023.