A combination of domestic imbalances and external shocks led to macroeconomic challenges in Ghana in 2022 with a spill over into 2023. The economy has since been riddled with persistent inflationary pressures, increasing public debt stock, interest rate hikes, and accelerated Cedi depreciation. The economy has also seen elevated financing needs, but limited access to external capital markets, as well as the domestic financial markets has constrained financing capacity.

The central bank in an attempt to curb surging inflation has increased the Monetary Policy Rate (MPR) from 14.5percent to 30.0percent over the period since January 2022. Also, the government engaged the IMF on July 1, 2022, and has since been able to secure an IMF Executive Board approval for 2.24 billion dollars Special Drawing Rights (SDR) (about USD 3 billion) in a 36-month Extended Credit Facility (ECF) arrangement.

This decision enabled an immediate disbursement equivalent to SDR 451.4 million (about US$600 million). The ECF arrangement builds on the government’s post-COVID-19 Program for Economic Growth, which aims at restoring macroeconomic stability and debt sustainability which includes wide-ranging reforms to build resilience and lay the foundation for stronger and more inclusive growth.

Following the government’s initial engagement with the Bretton Woods Institution (the International Monetary Fund – IMF), the Minister of Finance on behalf of government launched a Domestic Debt Exchange Programme (DDEP), the objective of which was to reduce the excessive burden created by public debt on the economy and reach the debt sustainability targets defined by the IMF staff for the period through 2028 and beyond. Particularly, government aims to reduce total public debt-to-GDP ratio to 55percent in present value terms.

Since the launch of the DDEP on December 5, 2022, investor sentiment on the debt capital market, especially towards government and pseudo-government debt instruments has dampen. Data from the Ghana Fixed Income Market (GFIM) indicates that volumes traded across all assets on the debt market in December 2022 came down to GH¢11.41billion from GH¢22.56billion in November and GH¢22.46billion in October. As of end of July 2023, there had been recorded a cumulative total of GH¢46.42billion in volume traded on the fixed income secondary market whereas the same period in 2022 had recorded GH¢230.68billion.

In light of the loss of investor confidence in the debt capital market, some investors may potentially explore alternative investment vehicles, such as equities and investments in the real sector, in an attempt to seek new opportunities for wealth growth. One option they might consider is investing in real assets such as Gold (bullion), which could introduce a fresh dimension to their portfolio.

While gold is generally not considered a strategic asset, there are certainly tactical reasons to consider such as preserving wealth with a relatively near cash asset that can potentially help move around undesirable risk during market corrections, global political stress, or persistent dollar weakness. Not only does gold make attractive ornaments but the precious metal has for centuries been a desirable investment, prized for its rarity and durability amongst other factors. It has demonstrated impressive performance as an investment asset, returning high yields to investors over the past hundreds of decades.

Data from Bloomberg indicates that gold has since the turn of the century delivered an average annual return of approximately 9.64percent. This performance is particularly notable when compared to the average returns of other investment assets, such as stocks and bonds, which have experienced greater volatility and risk over the same period.

Another key factor driving gold’s success as an investment option is its ability to serve as a hedge against inflation and economic uncertainty. Gold has maintained its purchasing power over long periods of time and has built a reputation as a reliable store of value.

In terms of wealth preservation, around US$200 would have bought you an ounce of gold towards the end of 1990. If you had bought an ounce of gold, and kept US$200 as cash, the gold would now be worth around 650percent more. However, the cash would not have increased in value and, due to inflation, its real value would be worth less.

Gold’s ability to hold value has consequently made it a popular choice for investors who are seeking to diversify their portfolios and protect their wealth against the risks of inflation and financial market instability. Another advantage of investing in gold is that it has a low correlation with other investment assets, meaning that it tends to behave differently than stocks, bonds, and other traditional investments. This can help to further diversify an investor’s portfolio and reduce overall risk.

Gold has been tagged as a safe haven asset due to its ability to appreciate in the face of economic uncertainty. For example, during the global financial crisis of 2008-2009, gold prices surged as investors sought to preserve value of their investments in the face of economic turmoil. Similarly, during the COVID-19 pandemic, gold prices rose sharply as investors sought to hedge against the economic impacts of the pandemic.

Additionally, physical gold and gold-backed instruments is a globally recognized asset that can be easily bought and sold on financial markets around the world, providing investors with greater liquidity and flexibility.

Moreover, as a precious metal, gold is also increasingly in demand for both industrial uses and for making jewellery. However, its supply is limited due to the capital-intensive nature of mining and refining, making it a desirable investment as the investor is guaranteed long term positive return. The scarcity of gold and its finite supply can contribute to its value and provide a certain level of scarcity premium.

How to invest in gold

Gold is a unique investment that has captivated human civilization for more than five millennia. Its beauty and timeless appeal are evident in its periodic symbol, Au, derived from the name of the Roman goddess of the shining dawn, Aurora.

Throughout history, civilizations have prized and traded this precious metal, from the tombs of the pharaohs, and the legendary city of El Dorado to the shores of Gold Coast. Gold’s influence on our collective history and culture is undeniable, making it a valuable and sought-after investment to this day. There are several ways to consider when deciding to invest in Gold, some of which include:

- Physical gold: An investor looking to take a gold position may consider acquiring gold in the form of coins, bullion, or jewellery. The investor may however, pay a premium over the spot price of gold to cover the cost of storage, insurance and transportation.

- Gold funds that own the metal: Investors can also gain exposure to gold through mutual funds and exchange-traded funds (ETFs). Gold mutual funds invest in the stocks of companies that are involved in the production or exploration of gold, while gold ETFs invest in physical gold or gold futures contracts. Both of these investment vehicles offer a convenient way to invest in gold without the logistics concerns of owning physical gold. They are often more liquid than physical gold and may have lower fees and expenses.

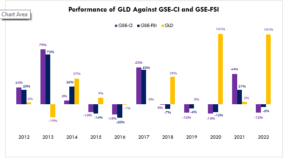

There is an ETF listed on the Ghana Stock Exchange (GSE), NewGold ETF, trading under the ticker symbol “GLD”. Data from the GSE indicates that GLD has over the past decade performed very well on the stock market, out-performing majority of the stocks listed on the market.

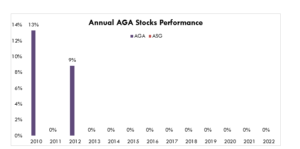

- Gold Mining Stocks: Investing in gold mining companies is another way to gain exposure to the gold market. When gold prices rise, mining company stocks tend to follow suit. However, these stocks may also be influenced by factors specific to the company’s operations, making them subject to additional risks. The mining gold stocks listed on the GSE include AngloGold Ashanti Limited (AGA) and Asante Gold Corporation (ASG).

Generally, gold’s timeless appeal, historical performance, and ability to preserve wealth make it a compelling asset for investors seeking to navigate economic uncertainties and diversify their investment portfolios. It is important however to note that, gold is not immune to market forces and its price can be affected by various factors, such as supply and demand, interest rates, and global events. As a result, investing in gold should be considered as part of a balanced investment portfolio and with an understanding of the potential risks involved.

>>>the writer is a Senior Analyst, Fincap Securities