Data released by the universal banks in the country during the second quarter (Q2) of 2023 affirmed stronger industry performance relative to the second quarter (Q2) of 2022. Prudential financial data released by the banks during the first-half of 2023 attested to the accelerated pace of the industry’s recovery from the shackles of the recent debt restructuring programme – specifically, the domestic debt exchange programme (DDEP)) implemented by the government. Indeed, the industry demonstrated its resilience and robustness during the period under review.

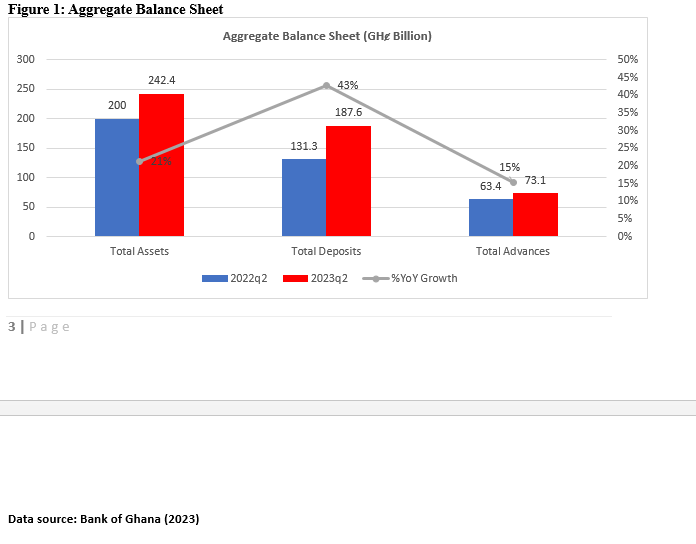

The industry’s aggregate balance sheet during Q2 of 2023 depicted impressive performance comparative to Q2 of 2022. The GHȼ242.4billion recorded in Q2 of 2023 fairly reflected robust growth in total assets, which were integrally funded by sustained growth in deposits and increased capital levels. The significant boost in total deposits (43 percent growth during the comparative period) is an ample manifestation of the benefits that banks could derive from strong financial literacy campaign. The year-on-year growth in the industry’s total assets – between 2022 Q2 and Q2 of 2023 – was estimated at 21.20 percent. Financial intermediation was enhanced by the boost in total advances, which increased from approximately GHȼ63.4billion during Q2 of 2022 to GHȼ73.1billion during Q2 of 2023, representing 15.30 percent growth during the period.

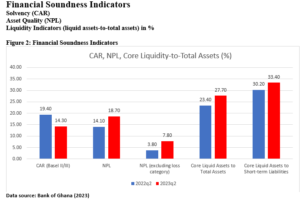

The industry’s soundness and resistance to vulnerabilities inherent in the broader financial system during Q2 of 2023 manifested in the strong performance of key indicators, such as core liquid assets to total assets and core liquid assets to short-term liabilities. The industry’s core liquid assets to total assets ratio increased to 27.70 percent in Q2 of 2023 from 23.40 percent during Q2 of 2022. The industry’s performance was not quite distinct in the analysis of the core liquid assets to short-term liabilities ratio; the 33.40 percent recorded during Q2 of 2023 was superior to the 30.20 percent recorded in Q2 of 2022.

The soundness of the foregoing key indicators is positively linked to significant improvement in the performance of the industry’s profitability and balance sheet, and points to an industry that is characteristically resilient and stable, with the capacity to absorb shocks while deepening financial intermediation and inclusion.

The cascading effects of the government’s debt restructuring programme on the broader economy reflected on the industry’s high non-performing loans’ (NPLs’) ratio in 2023 Q2 (18.70 percent) comparative to 2022 Q2 (14.10 percent). Even when the loss category is excluded, the NPL ratio for Q2 of 2023 (7.80 percent) remained higher than the ratio for 2022 Q2 (3.80 percent). The implication is that conscious efforts of government toward practical implementation of programmes that would enhance economic stimulation are needed to stem the tide of loan defaults. The foregoing would complement the risk management strategies of banks for recovery.

The industry’s capital adequacy ratio in Q2 of 2023 (14.30 percent) was a far-cry of the ratio recorded during 2022 Q2 (19.40 percent). Although the ratio for 2023 Q2 (14.30 percent) fell short of the Bank of Ghana’s regulatory requirement of 16.60 percent (as at December 2022), it was in excess of the minimum capital adequacy ratio (8 percent) and capital conservation buffer (2.5 percent) requirements under Basel III (10.5 percent).

Recall, the capital adequacy ratio reflects better capital-to-risk-weighted-assets ratio, and resonates strong capitalisation and improved financial resilience of institutions within the banking industry. Due to the industry’s strong capital position, the capital adequacy ratio suggests, in the event of any credit risk concentration shocks, banks would still maintain capital adequacy ratios above the minimum regulatory capital requirement under Basel II and III.

Performance of the industry’s income statement during the period under review was very strong; the reduction in total cost to gross income ratio (from 79.20 percent during Q2 of 2022 to 78.70 percent in 2023 Q2) was quite encouraging. Similarly, the marginal decrease in operational cost to gross income ratio to 52.8 percent in Q2 of 2023 from 53.9 percent during 2022 Q2 and sharp rise in net interest margin – from 10.10 percent during 2022 Q2 to 13.40 percent in Q2 of 2023 – were refreshing.

These developments are indicative of the (positive) strategic measures rolled-out by the banks to control cost while maximising revenues and profits to achieve organisational targets and objectives. Overall, the industry’s strategies ensured considerable growth in revenues relative to operating expenses during the first-half of 2023.

The general financial condition of the industry is exemplified in the quality of banks’ assets anchored by the quality of loan and investment portfolios and efficient credit administration programmes. The foregoing is indicative of strong risk mitigation measures for capital and loan formation, and indicative of financial stability of the banking industry. The average return on equity ratio for Q2 of 2023 (37.6 percent) was in excess of the ratio for 2022 Q2 (21.9 percent), and indicative of how banks in the industry are efficiently and effectively generating profits from the investments of shareholders.

The industry’s return on assets – before tax – witnessed marginal increase during the period under review – from 4.60 percent during Q2 of 2022 to 5.50 percent in 2023 Q2. The higher ratio attests to the productiveness and efficiency of the banks in the management of their respective balance sheets to ensure consistent and effective profit generation.

Core liquidity ratios of the industry during the period under review remained strong. This affirmed the availability of high-quality liquid assets to fund short-term cash outflows. The relatively high liquidity ratio in Q2 of 2023 relative to 2022 Q2 buttressed the banks’ preparedness for potential market-wide shocks to avert any short-term liquidity disruptions that may plague the market.

Indicators of the industry’s profitability, such as return on assets (ROA), return on equity (ROE) and net interest margin, among others, showed significant improvement and high level of operational efficiency during 2023 Q2 relative to Q2 of 2022. Generally, investors perceive return on equity as a better metric for effective assessment of the market value and growth of institutions in the banking industry.

The impeccable performance of the industry – including comparatively high ROE – during 2023 Q2 is envisaged to be sustained through the second half of the current financial and beyond. This growth potential is expected to serve as unique attractive tool for investors to the banking industry to shore up capital and investment in the financial sector, and attract investors to other sectors within the larger Ghanaian economy.

It is refreshing to state that banks in the industry have taken proactive steps to strengthen their risk management practices and internal control mechanisms. These initiatives have strategically positioned the industry toward containment and mitigation of potential solvency challenges that may emanate from loan concentration. The banks are not oblivious to their critical role in preserving stability of the country’s financial system; and therefore, are consistently dialoguing and collaborating with the Bank of Ghana (BoG) and other key stakeholders to ensure sustained stability of the banking industry.

Conclusion

Banks operating in the country are responding positively to the economic recovery; they remain ready to transact business with well-meaning Ghanaians – including individuals, households, and different categories of businesses, especially small and medium-sized enterprises (SMEs). Further, the banks are strategically-positioned to resist any potential economic shocks and financial crises through improved operational performance, adequate capitalisation, and improved government policies and programmes toward economic stimulation and accelerated growth. Stated differently, institutions in the banking industry are strategically-positioned to better withstand potential episodes of financial stress while providing improved financial services to people within the economy and beyond.

The sustained growth in deposits and higher capital levels speak to the potential for financial deepening and credit growth. Undoubtedly, the banking industry projects positive outlook in the immediate, medium and long term. Sustained reforms and operating strategies are reflecting in profitable, sound, solvent and resilient banking industry which remains ready to anchor accelerated growth through prudent lending to individuals and businesses in key and strategic sectors of the Ghanaian economy. Indeed, the resilience of banks remains robust as evidenced in the industry’s spectacular performance during the first-half of 2023. This assertion is ably supported by strong capital position, attributed largely to higher profitability during the review period.