…Substantial but narrow

Ghana has faced various economic challenges over the years. These challenges have led the country to seek external assistance, including financial support from international organizations such as the World Bank and International Monetary Fund (IMF). The IMF is seen as the lender of last resort by providing assistance in the form of loans and policy advice to member countries facing economic difficulties. These are typically in the form of a bailout program. In the wake of the International Monetary Fund’s (IMF) approval of a $3 billion Extended Credit Facility (ECF) arrangement for Ghana, the nation’s financial markets have witnessed a mixed response, with investors cautiously navigating an environment of uncertainty[1]. The IMF bailout package aims to support Ghana’s Post-COVID-19 Program for Economic Growth (PC-PEG), which promises to restore macroeconomic stability, tackle debt sustainability, and foster inclusive growth through a series of comprehensive reforms.

Bailout announcements by the IMF can have significant implications for a country’s financial markets. Such announcements often signal that the country is facing economic difficulties, which can impact investor sentiments and market dynamics. Understanding the reaction of financial markets to these announcements is crucial for investors, regulators, and policymakers in assessing market responses, identifying potential risks, and formulating appropriate measures to promote market stability. Indeed, financial market participants respond differently to the announcement of major policies or events like an IMF bailout. To evaluate the market response to such a policy, one of the key markets to evaluate is the capital market. Over the years, in the finance and economics profession, there is an understanding that financial markets are efficient in processing and reflecting all available information- this means that asset prices fully incorporate all relevant information and respond rapidly to new information- this is called the Efficient Market Hypothesis (EMH) or the concept of market efficiency. So, if markets are efficient, investors will quickly assimilate this information, leading to an immediate adjustment in asset prices.

This adjustment can be observed through abnormal returns – this measures the deviation of actual returns from expected returns based on market conditions. In the context of this study, the IMF bailout announcement represents new information with financial implications for the country; hence, there is a potential impact of this new information on Ghana’s financial markets. To assess this impact, the study considers the concept of market reactions and the subsequent drift in asset prices – this describes an event study approach. Event studies commonly used in finance, examine the impact of specific events on asset prices and market behavior. The event in focus here is the IMF bailout announcement, which can serve as a catalyst for market participants to reassess their investment strategies and reallocate their portfolios. During negative events, investors may exhibit flight-to-quality behavior, seeking safer assets such as government bonds as a means of preserving capital and reducing risk exposure. This can lead to changes in bond prices and subsequent positive abnormal returns in the government bond market.

Methods

In this note, we use the event study methodology to investigate the impact of the recent IMF bailout announcement on May 17, 2023, on Ghana’s financial markets including Equity, Forex, and Bond markets. These financial markets contribute to the mobilization of capital, facilitate price discovery, and support economic growth. Specifically, we compute normal returns using the market model, which we then use to determine abnormal returns. Furthermore, we add the abnormal returns throughout the event window to obtain the cumulative abnormal returns, and we average the abnormal returns across the event window to get the aggregate abnormal returns.

Data and summary statistics

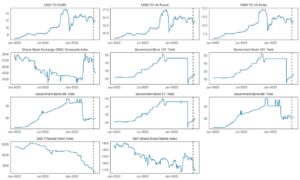

We collect daily data on the three main markets. For the Equity market, we use the price index of the Ghana Stock Exchange (GSE) Composite Index, the Ghana Stock Exchange Financial Stock Index, and the S&P Ghana Broad Market Price Index. For the Forex market, we use the CEDI TO EURO, CEDI TO UK Pound, and CEDI TO US Dollar exchange rates, and for the bond market, we use the 3-month, 6-month, 5-year, 10-year, and 15-year Government Bond Yield for the debt market. We obtained data from DataStream. We chose May 17, 2023, as the event date given that the bailout announcement was on this day. We employ a 90-day estimation window. As a result, we obtained daily closing price data of the selected indices for the period December 28, 2022, to June 31, 2023.

Figure 1 depicts the historical daily closing price series of the markets examined. From figure 1, we observe that the investors reacted to the announcement evidenced by the fluctuations on the announcement day which lays a good foundation to further investigate the impact of the bailout announcement. Figure 2 shows the returns of the financial markets on the event day with results showing that all markets except the bond market recorded negative returns on the day of announcement.

Figure 1: Historical closing prices of Ghana’s financial markets.

Figure 2: Returns on event day in financial markets.

Table 1 reports returns of the various markets over the estimation window. The Ghana Stock Exchange (GSE) has experienced fluctuations in the aftermath of the IMF announcement. Seven days following the bailout announcement, the GSE Composite Index witnessed a decline of 5.36%, reflecting a cautious approach by investors. A similar downward trend continued over a 15-day period, with a 6.44% decrease. However, a glimmer of hope emerged when examining the three-month and six-month performance, which demonstrated gains of 6.42% and 4.66% respectively. Nonetheless, the overall performance remains subdued with a mere 0.12% increase over the past year. Over a longer-term horizon of five years, the index has recorded a notable decline of 25.93%. Another prominent indicator, the S&P Ghana Broad Market Index, exhibited a similar pattern of volatility and mixed performance. The index witnessed negative returns of 5.78% and 6.07% over seven and fifteen days respectively following the bailout announcement. However, the negative trend somewhat stabilized, as the index only experienced a marginal decline of 0.66% over the three-month period, signaling a potential recovery. Within the financial sector, the GSE Financial Stock Index, which measures the performance of financial institutions, faced its own challenges. The index witnessed a decline of 2.02% over the seven days and 4.00% over fifteen days following the announcement. Furthermore, it experienced significant drops of 14.91% and 18.60% over the three-month and six-month periods, reflecting the hurdles faced by Ghana’s financial institutions.

Meanwhile, currency markets witnessed considerable volatility as the Ghanaian Cedi experienced depreciation against major international currencies. Seven days following the announcement, the Cedi depreciated by 7.69% against the US Dollar, with a depreciation of 8.83% and 8.78% against the Euro and the UK Pound respectively. The longer-term trend revealed substantial depreciation, particularly against the US Dollar, where the Cedi recorded a 142.59% decline over the past year.

Government bond yields portrayed a mixed picture across different maturities. Short-term bond yields experienced fluctuations, with the three-month and six-month yields displaying mixed results. However, longer-term bonds demonstrated increased yields, signaling market expectations of potential inflation and associated risks pertaining to the country’s debt sustainability.

In the case of volatility after the announcement shows Ghana Composite GSE index has experienced higher volatility with a volatility measure of 23.99, indicating relatively larger price fluctuations. The S&P Ghana BMI, has shown a lower volatility of 8.29, suggesting relatively smaller price swings. Within the financial sector, the GSE Financial Stock Index has exhibited moderate volatility, with a volatility measure of 4.85, indicating moderate price fluctuations. Overall, the post announcement 7 days volatility indicates varying levels of volatility across different financial assets in Ghana. Higher volatility was observed in the Ghana Composite GSE index, while the currency markets displayed relatively low volatility. Bond yields showed a mix of low and moderate volatility, depending on the maturity period. Investors should consider these volatility measures when assessing risk and making investment decisions. The response of Ghana’s financial markets to the IMF bailout announcement reflects a cautious sentiment among investors. While some sectors experienced short-term volatility, there are glimmers of hope indicating a potential recovery in the medium to long run. The success of the IMF bailout and the PC-PEG program will hinge on the implementation of the proposed reforms, including fiscal consolidation, structural changes, and debt restructuring. Restoring investor confidence and stability in the financial markets will be crucial for Ghana’s long-term economic growth and development.

Table 1: Returns and volatilities of the Ghana financial markets.

| Assets | Return | Volatility | ||||||

| 7 Days | 15 Days | 1 Month | 3 Months | 6 Months | 1 Year | 5 Years | 7 Days | |

| Ghana Stock Exchange Composite Index | -5.36% | -6.44% | -3.74% | 6.42% | 4.66% | 0.12% | -25.93% | 23.99 |

| S&P Ghana Broad Market Index | -5.78% | -6.07% | -5.06% | -0.66% | -5.72% | -7.50% | -39.23% | – |

| GSE Financial Stock Index | -2.02% | -4.00% | -3.93% | -14.91% | -18.60% | -23.48% | -46.09% | 23.99 |

| CEDI TO EURO | -8.83% | -10.05% | -9.66% | -11.72% | -21.99% | 47.00% | 115.64% | 8.29 |

| CEDI TO UK Pound | -8.78% | -8.49% | -8.10% | -10.33% | -20.86% | 44.22% | 117.01% | 4.85 |

| CEDI TO US Dollar | -7.69% | -8.47% | -8.86% | -12.55% | -25.52% | 41.45% | 142.59% | 0.21 |

| Government Bond 3M Yield | 0.81% | -2.14% | 3.31% | -40.74% | -38.63% | 13.57% | 50.80% | 0.25 |

| Government Bond 6M Yield | 0.52% | -8.77% | 1.96% | -32.24% | -31.68% | 19.82% | 58.68% | 0.23 |

| Government Bond 5Y Yield | 2.27% | 9.76% | 12.50% | -51.09% | -53.36% | -2.17% | 36.78% | 0.13 |

| Government Bond 10Y Yield | 2.17% | 11.90% | 61.51% | -48.91% | -52.45% | 0.63% | 45.96% | 0.20 |

| Government Bond 15Y Yield | 2.17% | 11.90% | 17.50% | -48.91% | -53.92% | 0.00% | 45.96% | 1.49 |

Results – impact of IMF bailout announcement on Ghana’s financial markets

As indicated earlier, we apply the Fama et al. (1969) event study methodology to investigate the reaction of Ghana’s financial markets to IMF bailout announcement. Specifically, we investigate the significance of market reactions over the event window using various tests generally applied in the finance literature. Subsequently, we start our estimation by calculating the aggregate of abnormal returns (AARs) and cumulative aggregate of abnormal returns (CAARs) for the event windows of seven days prior the event [-7,-1], event day [0,0], and seven days after the event day [+1,+7]. Afterward, we examine the significance of AARs and CAARs over the event days and event windows using various tests.

First, we examine the AARs of Ghana’s stock market, and the results are presented in Table 2. The result shows there is a significant negative AARs (4.4%) on the IMF bailout announcement day. This is notable given that there were no significant AARs for the four days prior to the event day. The negative AARs on the event day were short-lived as the next day showed no significant impact while some investors cashed in marginally 2 days after the event with an AAR of 0.3%. We observe no significant AARs thereafter except on the 6th day where there was a loss of 0.3%. This suggests that Ghana’s stock market negatively reacted to the IMF bailout on the day of the announcement and a few days afterward.

Afterward, we consider the CAARs of the Ghana stock market, the results in Table 3 show that the stock market exhibits significant negative CAARs on the event and subsequent days. The significant drift observed in the stock market after the IMF bailout announcement suggests that investors reacted negatively to the news. It could be interpreted that investors perceived the bailout as an indication of economic challenges or uncertainties, which influenced their selling behavior and resulted in declining stock prices. This is in line with the general literature in finance that documents a negative effect of IMF bailout announcements on stock returns.

Table 2: Aggregate of abnormal returns of Ghana’s stock market.

| Days | AARs | BST | WST | GST |

| -7 | 0.002 | 0.270 | 0.577 | 0.642 |

| -6 | 0.000 | -0.017 | -0.577 | -0.514 |

| -5 | -0.002 | -0.325 | -0.577 | -0.514 |

| -4 | 0.001 | 0.075 | 0.577 | 0.642 |

| -3 | 0.003 | 0.381 | 1.732* | 1.797* |

| -2 | -0.002 | -0.262 | -0.577 | -0.514 |

| -1 | 0.001 | 0.082 | 0.577 | 0.642 |

| 0 | -0.044 | -6.455*** | -1.732* | -1.669* |

| 1 | -0.001 | -0.173 | -0.577 | -0.514 |

| 2 | 0.003 | 0.365 | 1.732* | 1.797* |

| 3 | -0.003 | -0.388 | -0.577 | -0.514 |

| 4 | -0.005 | -0.768 | -0.577 | -0.514 |

| 5 | -0.001 | -0.153 | -0.577 | -0.514 |

| 6 | -0.003 | -0.426 | -1.732* | -1.669* |

| 7 | 0.000 | -0.047 | 0.577 | 0.642 |

Notes: AARs denote the aggregate of abnormal returns of day t. BST denotes Binomial sign test (Boehmer et al., 1991), GST denotes the Generalized sign test (Cowan, 1992), and WST refers to the Wilcoxon signed rank test (Kolari and Pynnönen, 2010). All test statistics reported are the t-statistics. ***, **, and * indicates significance at the 1%, 5% and 10% level, respectively.

Table 3: Cumulative aggregate of abnormal returns of Europe and European countries

| Days | CAR | BST | WST |

| t -1 | -0.022 | -4.470*** | -0.774 |

| t +1 | -0.023 | -4.649*** | -2.091** |

| t +2 | -0.014 | -3.586*** | -1.195 |

| t +3 | -0.011 | -3.298*** | -1.517 |

| t +4 | -0.010 | -3.288*** | -2.006** |

| t +5 | -0.009 | -3.063*** | -1.854* |

| t +6 | -0.008 | -2.996*** | -2.162** |

Notes: CAARs denotes cumulative aggregate of abnormal returns of day t (event day). BST denotes Binomial sign test (Boehmer et al., 1991), and WST refers to the Wilcoxon signed rank test (Kolari and Pynnönen, 2010). All test statistics reported are the t-statistics. ***, **, and * indicates significance at the 1%, 5% and 10% level, respectively.

Next, we examine the AARs of Ghana’s Forex market. Table 4 shows that the Forex market exhibited negative AARs on the event day and subsequent day. These positive AARs suggest that there was an upward movement or appreciation in the value of the Ghanaian currency following the IMF bailout announcement. However, it is important to note that the CAARs in Table 5 exhibited a negative value on the event and subsequent days. CAARs take into account the cumulative effect of abnormal returns over a specific period. The negative AARs and CAARs suggest that the cumulative effect resulted in an overall decline in the currency market after the IMF bailout announcement and showed a downward drift. This could be influenced by factors such as market dynamics, investor sentiment, or other economic factors that unfolded beyond the immediate announcement period.

Table 4: Aggregate of abnormal returns of Ghana’s Forex market.

| Days | AARs | BST | WST | GST |

| -7 | 0.000 | 0.009 | 0.577 | 0.943 |

| -6 | -0.011 | -8.548** | -1.732* | -1.414 |

| -5 | -0.002 | -5.588** | -1.732* | -1.414 |

| -4 | 0.007 | 7.640** | 1.732* | 2.121** |

| -3 | -0.011 | -36.514*** | -1.732* | -1.414 |

| -2 | -0.058 | -65.458*** | -1.732* | -1.414 |

| -1 | 0.012 | 30.304*** | 1.732* | 2.121** |

| 0 | -0.038 | -69.591*** | -1.732* | -1.414 |

| 1 | -0.028 | -66.204*** | -1.732* | -1.414 |

| 2 | 0.018 | 31.524*** | 1.732* | 2.121** |

| 3 | 0.005 | 6.625** | 1.732* | 2.121** |

| 4 | 0.000 | -0.217 | -0.577 | -0.236 |

| 5 | 0.018 | 18.286*** | 1.732* | 2.121** |

| 6 | 0.015 | 100.174*** | 1.732* | 2.121** |

| 7 | -0.003 | -3.715* | -1.732* | -1.414 |

Notes: AARs denotes aggregate of abnormal returns of day t. BST denotes Binomial sign test (Boehmer et al., 1991), GST denotes the Generalized sign test (Cowan, 1992), and WST refers to the Wilcoxon signed rank test (Kolari and Pynnönen, 2010). All test statistics reported are the t-statistics. ***, **, and * indicates significance at the 1%, 5% and 10% level, respectively.

Table 5: Cumulative aggregate of abnormal returns of Ghana’s Forex market.

| Days | CAR | BST | WST |

| t -1 | -0.013 | -0.900 | -0.383 |

| t +1 | -0.033 | -2.298** | -2.308** |

| t +2 | -0.016 | -1.369 | -1.104 |

| t +3 | -0.011 | -1.061 | -0.555 |

| t +4 | -0.009 | -0.953 | -0.374** |

| t +5 | -0.004 | -0.515 | 0.166* |

| t +6 | -0.002 | -0.199 | 0.581** |

Notes: CAARs denotes cumulative aggregate of abnormal returns of day t (event day). BST denotes Binomial sign test (Boehmer et al., 1991), and WST refers to the Wilcoxon signed rank test (Kolari and Pynnönen, 2010). All test statistics reported are the t-statistics. ***, **, and * indicates significance at the 1%, 5% and 10% level, respectively.

Finally, we examine the AARs of Ghana’s bond market with the results presented in Table 6. From the table, even though there was a negative AARs a day prior to the announcement, the results show a positive AARs in the government bond market on the event day and the following week. This suggests higher AARs on the bonds following the IMF bailout announcement. Similarly, the cumulative abnormal returns (CAARs) in Table 6 also showed positive returns on the event day of the announcement and subsequent days. CAARs consider the cumulative effect of abnormal returns over a specific period. The positive CAARs indicate that the government bond market experienced an overall increase in yields during and after the IMF bailout announcement period. This positive returns in the government bond market can be attributed to the government offering higher yields due to the need for funds to finance its fiscal activities. This explains the increased demand for government bonds given that the investors followed the herd from the stock market where there were negative returns to the bond market to enjoy higher returns.

Table 6: Aggregate of abnormal returns of Ghana’s fixed income securities market.

| Days | AARs | BST | WST | GST |

| -7 | -0.016 | -0.748 | 0.447 | -1.727* |

| -6 | 0.035 | 2.872** | 2.236** | 0.885 |

| -5 | 0.002 | 1.847 | 1.342 | -0.421 |

| -4 | 0.005 | 4.810*** | 2.236** | 0.885 |

| -3 | 0.011 | 6.607*** | 2.236** | 0.885 |

| -2 | 0.025 | 4.904*** | 2.236** | 0.885 |

| -1 | 0.009 | 6.783*** | 2.236** | 0.885 |

| 0 | 0.009 | 6.774*** | 2.236** | 0.885 |

| 1 | 0.011 | 6.515*** | 2.236** | 0.885 |

| 2 | 0.010 | 6.746*** | 2.236** | 0.885 |

| 3 | 0.012 | 6.370*** | 2.236** | 0.885 |

| 4 | 0.006 | 6.258*** | 2.236** | 0.885 |

| 5 | 0.075 | 2.629* | 2.236** | 0.885 |

| 6 | 0.011 | 6.541*** | 2.236** | 0.885 |

| 7 | 0.007 | 6.388*** | 2.236** | 0.885 |

Notes: AARs denotes aggregate of abnormal returns of day t. BST denotes Binomial sign test (Boehmer et al., 1991), GST denotes the Generalized sign test (Cowan, 1992), and WST refers to the Wilcoxon signed rank test (Kolari and Pynnönen, 2010). All test statistics reported are the t-statistics. ***, **, and * indicates significance at the 1%, 5% and 10% level, respectively.

Table 7: Cumulative aggregate of abnormal returns of Ghana’s fixed income securities market.

| Days | CAR | BST | WST |

| t -1 | 0.009 | 0.167 | 0.844 |

| t +1 | 0.010 | 0.186 | 1.220** |

| t +2 | 0.010 | 0.223 | 1.376 |

| t +3 | 0.011 | 0.273 | 1.560 |

| t +4 | 0.010 | 0.281 | 1.302** |

| t +5 | 0.021 | 0.647 | 1.696* |

| t +6 | 0.019 | 0.653 | 1.924** |

Notes: CAARs denotes cumulative aggregate of abnormal returns of day t (event day). BST denotes Binomial sign test (Boehmer et al., 1991), and WST refers to the Wilcoxon signed rank test (Kolari and Pynnönen, 2010). All test statistics reported are the t-statistics. ***, **, and * indicates significance at the 1%, 5% and 10% level, respectively.

Conclusion

This note examines the reaction of Ghana’s financial markets to the IMF bailout announcement and documents several interesting findings. The reaction of Ghana’s financial markets to the IMF bailout announcement demonstrates the complexity and diversity of market responses to significant events. The stock market exhibited negative AARs and CAARs, indicating a decline in stock prices and negative market sentiment. Conversely, the currency market showed positive AARs on the event day and subsequent days, suggesting an appreciation in the value of the Ghanaian currency. However, the cumulative abnormal returns for the currency market were negative, indicating an overall decline. Overall, the stock market reflected a negative sentiment, while the currency and government bond markets experienced mixed responses with currency market performance being more short-lived and the bond market demonstrating relative strength. In other words, the IMF bailout announcement had mixed effects on Ghana’s financial markets with a negative effect on the stock market while the forex market reaction remained mixed. The bond market however saw higher returns, indicating higher returns the government show positive sign that the market still trusts that the government to follow through the IMF program to bring back macroeconomic stability and to honor its future debt obligations. This seems positive for the government as investors seem to still have confidence in the government in the foreseeable future.

The reaction of Ghana’s financial markets to the IMF bailout announcement carries important policy implications for both investors and regulators. Firstly, investors need to focus on diversification and risk management strategies to mitigate potential losses in the stock market during periods of economic uncertainty. This emphasizes the significance of having a well-diversified portfolio across different asset classes, sectors, and geographic regions. By spreading their investments, investors can reduce exposure to specific market risks and better withstand adverse events. Secondly, regulators should closely monitor and manage the currency market to ensure stability. The positive response in the currency market immediately following the announcement indicates the importance of maintaining a stable exchange rate. Regulators should implement effective monetary policies, including interventions in the foreign exchange market, if necessary, to mitigate excessive volatility and prevent speculative attacks on the currency. Thirdly, policymakers should strive for alignment between economic policies, monetary measures, and fiscal reforms. The contrasting reactions across different markets highlight the interdependencies within Ghana’s financial system. By coordinating these policies effectively, regulators can create a cohesive and stable environment that promotes investor confidence and market resilience. This includes implementing prudent fiscal policies, maintaining a sound banking sector that enhance the overall competitiveness and attractiveness of Ghana’s economy. Finally, efforts should be made to improve investor education and communication. Providing timely and accurate information to investors is essential in managing expectations and minimizing panic-driven decisions. Regulators can enhance financial literacy programs, disseminate clear and accessible market updates, and establish channels for effective communication with investors. This will empower investors to make informed decisions based on a comprehensive understanding of the situation, reducing the likelihood of market disruptions caused by misinformation or irrational behavior.

Reference

Abuelfadl, M., Yamani, E.A.-T., 2023. The Joint Response of Currency and Stock Markets to IMF News During the Coronavirus Pandemic. Available at SSRN 4374922.

Ali, E.B., Anufriev, V.P., Amfo, B., 2021. Green economy implementation in Ghana as a road

map for a sustainable development drive: A review. Sci Afr 12, e00756.

Boehmer, E., Masumeci, J., Poulsen, A.B., 1991. Event-study methodology under conditions of event-induced variance. J financ econ 30, 253–272.

https://doi.org/https://doi.org/10.1016/0304-405X(91)90032-F

Dreher, A., 2004. Does the IMF cause Moral Hazard? A critical review of the Evidence.

Fama, E.F., 1970. Efficient Capital Markets: A Review of Theory and Empirical Work. J Finance 25, 383–417. https://doi.org/10.2307/2325486

Fama, E.F., Fisher, L., Jensen, M.C., Roll, R., 1969. The Adjustment of Stock Prices to New

Information. Int Econ Rev (Philadelphia) 10, 1–21. https://doi.org/10.2307/2525569

Kern, A., Nosrati, E., Reinsberg, B., Sevinc, D., 2023. Crash for cash: Offshore financial

destinations and IMF programs. Eur J Polit Econ 102359.

Krahnke, T., 2023. Doing more with less: The catalytic function of IMF lending and the role of program size. J Int Money Finance 135, 102856.

Lane, T., Phillips, S., 2000. Does IMF financing result in moral hazard?

Lau, S.T., McInish, T.H., 2003. IMF bailouts, contagion effects, and bank security returns.

International Review of Financial Analysis 12, 3–23.

Owusu-Manu, D.-G., Jehuri, A.B., Edwards, D.J., Boateng, F., Asumadu, G., 2019. The impact of infrastructure development on economic growth in sub-Saharan Africa with special focus on Ghana. Journal of Financial Management of Property and Construction.

Peprah, W.K., 2022. The Story of Ghana in an Abstract: Before IMF Bailout Request in 2022.

Yamani, E.A.-T., Abuelfadl, M., 2023. The Joint Response of Currency and Stock Markets to IMF News During the Pandemic Evidence from Emerging Countries. Available at SSRN

4424782.

The writer is a Lecturer in Finance at the University of Ghana Business School and Director and Co-founder of Imperium Analytics & Quants Solutions Ltd. He is also a Patron of Young Investors Network.Email: [email protected]

[1] Source: https://www.imf.org/en/News/Articles/2023/05/17/pr23151-ghana-imf-executive-board-approves-extended-credit-facility-arrangement-for-ghana