Environmental social governance (ESG) is not only critical to operators in the extractives industry, it has also become a critical component of the banking sector across the world. Whereas in the extractives industry ESG bordered on environmental preservation and the protection of livelihoods, in the banking and finance sectors it is about sustainable investments. Thus, ESG has become a key strategy for the banking sector to plan and limit potential risks to sustain their future profitability and sustainability.

Consequently, central bank reserve managers – especially in the developing world – are seeking ways to incorporate ESG factors into their fixed-income investments. In fact, developments on the global scene suggest that incorporating ESG into both for-profit and non-profit business is becoming a standard or strategic practice.

Challenges to ESG

Over the last few years, central bank reserves have collectively grown to over US$14trillion, yet only one in six central banks consider ESG factors in making investment decisions. In 2021, the World Bank did a study on why reserve managers need to incorporate ESG into their portfolios. The study found that implementing ESG in investment approaches presents four main challenges.

First, a uniform definition of ESG is still lacking and investors consider many factors under the broad term ‘ESG’. Second, investors lack consistent accounting frameworks and disclosures; thus constraining their ability to compare and assess investments across all areas of ESG. Third, empirical research on the impact of applying ESG on financial returns is still inconclusive, especially in the fixed-income space. Fourth, estimating whether impact investment will achieve its desired effects is still difficult.

Of specific concern in the banking sector is incorporating ESG principles into safety, liquidity and reserve management. The participation of central bank boards in this decision is critical, as it can guide management and staff throughout the implementation phase of an ESG approach.

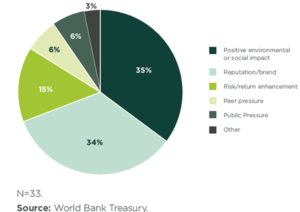

According to the World Bank study, central banks are not only considering ESG for financial reasons but also to manage reputational risk and set the pace for prudent investment decision. However, the study notes that pressure from the public or peer institutions is not a significant motivation for central banks to consider ESG, as illustrated in the pie-chart below.

Nevertheless, it appears that ESG implementation in reserve management is gradually gaining ground. The study further found that incorporating financially relevant ESG factors into investment risk analysis and investing prudently in thematic bonds is the best approach.

Additionally, central banks can start following standard market practices like monitoring ESG scores of companies and building impact reports. This is because ESG scores can strengthen the risk management framework of banks. Finally, building impact reports can improve understanding of ESG investing for internal and external stakeholders. In the west, stakeholders are becoming strong advocates for adopting ESG principles. Thus, companies applying ESG stand a better chance of attracting investments through the stock market and other forms of investments. Conversely, companies which fail to apply ESG principles will be shunned by investors – a trend that could negatively impact sustainability and profitability.

ESG in the global banking sector

Globally, more than 2,703 banks representing over 45 percent of banking assets worldwide have joined the Principles for Responsible Banking framework. The banks are now developing strategies and practices to align with the UN Sustainable Development Goals and Paris Climate Agreement. Many banks have also been involved in regulatory discussions around green finance and sustainable investing.

Increasingly, sustainability is being embedded in market offerings – with potential investors having options to choose from a growing variety of ESG-linked funds, bonds and assets. In response, retail banks are creating new sustainable banking and investing products and services; such as green home improvement loans, carbon neutral banking, and sustainable exchange traded funds.

Wealth management arms are also moving toward ESG informed investing, while capital markets are adopting ‘green underwriting’. ESG reporting appears to be driving current and future investments. However, many banks still maintain a portfolio of profit-generating businesses that are classified as ‘brown’ assets. These banks need to balance their ESG ambitions against shareholders’ desire for strong returns. In addition to financial viability, future deals will increasingly be viewed through an ESG and social policy lens as stakeholder scrutiny increases. Thus, ESG is no longer wishful thinking as it is becoming mandatory for businesses to demonstrate they are applying environmentally and socially sound operations.

Bank of America

ESG is thus beneficial to the future sustainability of banking and finance. For instance, since 2013 the Bank of America has now issued five corporate green bonds – raising a total of US$6.35billion for renewable energy projects. The Bank of America recently issued a corporate green bond of US$2billion, making it the first bank in the USA to issue five corporate green bonds. These bonds help to fund renewable energy projects to accelerate the transition to a low-carbon economy through lending, investing, capital raising, advisory services and developing financing solutions for clients around the world.

Renewable energy is an area wherein ESG is most relevant, with many companies in the extractives sector investing more in renewable energy to reduce carbon emissions. An example is Newmont’s agreement with Caterpillar to produce equipment that use battery or other non-combustible sources of energy for operation. By demonstrating this commitment to reducing carbon emissions, Newmont could be attracting more investors while enhancing its brand as a good corporate citizen in host countries and communities.

As indicated in previous articles, the increasing significance of ESG in business operations has become a standard reporting factor – and compliance with the Reporting Initiative (GRI); United Nations Global Compact; Task Force on Climate-related Financial Disclosures (TCFD); CDP; and Sustainability Accounting Standards Board (SASB) is becoming the norm in banking.

ESG response in Ghana

Fortunately, in Ghana both the central bank and commercial banks have demonstrated their commitment to incorporating ESG principles into their operational frameworks, according to Mr. Osei Gyasi, Head of Banking Supervision-Bank of Ghana (BoG),

During the 26th National Banking Conference, Mr. Gyasi disclosed that all 23 universal banks underscored their commitment to implement or comply with ESG principles. “As part of the efforts to promote sustainable banking, the BoG issued a monitoring guidance and reporting template to be completed by banks, which is used in monitoring levels of ESG principles implementation. Furthermore, a Ghana Banking Survey undertaken by PwC in 2022 found that 62 percent of 21 out of 23 commercial bank executives confirmed the existence of plans to incorporate ESG principles in future.

Benefits of ESG compliance

Stanbic Bank Ghana has reported improvements in its banking operations since incorporating the Bank of Ghana sustainable banking principles across its operations. The ESG and Sustainability Manager for Stanbic Bank, Joseph Amo Adjei, announced this at the Integrated Environmental, Social, and Governance (IESG) programme launch by the International Finance Corporation (IFC), in Accra.

The IESG is an initiative of the IFC in partnership with the Swiss State Secretariat for Economic Affairs, SECO. The programme is also expected to give financial institutions tools needed to better address and assess risks, and improve their sustainability and long-term performance. Through the ESG programme for Ghana, IFC and the Bank of Ghana are supporting banks in the country to implement the Sustainable Banking Principles and incorporate them across their operations. The principles, launched in 2019, are designed to help financial institutions respond to risks, increase transparency and promote sustainability.

Speaking on the significance of ESG in the banking and finance sectors, Mr. Amo Adjei said Stanbic Bank had to adopt ESG principles to qualify for a KFW grant to support the bank’s SME clients at the height of COVID-19. The €6million grant was used to support Stanbic’s SME clients (especially clients in the private educational sector) who were hardest hit by the pandemic. Thus, there is a medium- to long-term benefit from integrating ESG to sustain the future of both banks and their clients.

According to Mr. Thomas Dankwah, Executive Director-Hanssen Global UK &Ghana Ltd., (a partner of Microsoft Partner Network Ghana, Allianz Insurance Alliance) banks need to support their clients in adopting ESG principles for future profitability and sustainability. In this regard, banks like Standard Chartered Bank, Ecobank, Barclays UK and Absa bank are providing ESG support to their clients across the globe.

The indications are that while ESG is gaining significance in the banking and financial sectors, there is a need for all banks to strengthen corporate governance. The 2017 banking failure in Ghana was largely due to the allocation of banking licences for individuals to operate banks without due process.

One of the key issues was weak governance structures by management of the seven collapsed banks. The poor governance practice resulted in unsustainable lending and imprudent investments, which brought the banks to their knees. The sector’s resuscitation with GH¢21billion by government is one of the major causes of Ghana’s current economic woes. Never again should the Bank of Ghana allow banks to operate without monitoring and evaluating the health of their corporate governance structures and ESG principles.

Reference

Bouyé, E, Klingebiel, D & Ruiz, M. 2021. What challenges do central banks face to implement environmental, social and governance investing?