Is it enough for the Monetary Policy Committee of the Bank of Ghana to change its policy rate stance now? This question looms as the Committee prepares for its July meetings scheduled from July 19 to July 21, 2023.

In the last three meetings the Committee decided to hike the policy rate twice, in the January and March sessions, while maintaining the rate in May 2023.

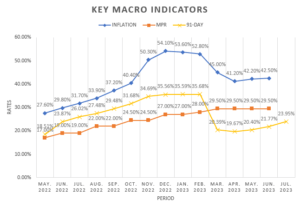

With a cumulative increase of 250 basis points (bps), the policy rate reached a record high of 29.5 percent in Q1-2023. The aim was to reinforce disinflation and anchor inflation expectations. To further tighten financing conditions, the MPC also increased the cash reserve ratio (CRR) by 200 bps, setting it at 14 percent.

While the Committee observed a significant decline in headline inflation since beginning of the year – surpassing 12 percent, a setback occurred in June 2023 for the second consecutive month. Inflation rose to 42.50 percent from a previous increase to 42.2 percent in May 2023, contradicting the downward trend observed in the first four months of the year.

This reversal, exacerbated by mounting food costs, raises concerns about effectiveness of the current policy rate stance, which had decreased inflation from 54.1 percent in December 2022 to 41.2 percent in April 2023.

As the MPC meetings approach, market analysts hold mixed opinions on the Committee’s possible stance. Of three random market observers, two anticipate a cautious hike in the policy rate while one expects it to be held at 29.50 percent to support growth and general economic activity.

The differing views reflect uncertainty surrounding the recent inflationary trend and potential risks in the economic outlook.

Apakan Securities remains cautious and highlights the uncertainties brought by recent developments in food prices. They state: “While we remain optimistic about headline inflation declining toward a range of 20 percent to 30 percent by end of the year, the recent developments in food prices herald mounting uncertainties for the July 2023 inflation outlook”.

The challenges in this year’s food harvest season further compound the concerns. According to the Ministry of Food and Agriculture, crop yields are expected to decline by about 7 percent due to the impact of climate change and increasing fertiliser cost.

Apakan Securities believes these factors will contribute to elevated food costs, adding to inflationary pressures and potentially necessitating a resumption of interest rate hikes by the MPC.

Constant Capital also suggests that the disinflation trend observed in the first quarter may have ended due to unfavorable base effects; higher food prices and a surge in imported inflation. They project that the increase in June 2023 inflation will motivate the MPC to resume a contractionary monetary policy stance by hiking the policy rate to rein-in inflationary pressures.

In contrast to other market observers, GCB Capital expects the Committee to maintain the policy rate at 29.50 percent; thus supporting growth and general economic activity. They anticipate the disinflation process to resume in July 2023, considering the recent reversal as temporary.

“Core inflation appears broadly contained, and the balance of risks weighs more heavily on near-term growth than inflation amid the stringent austerity environment. Additionally, interbank GHS liquidity levels are beginning to tighten, as reflected in the marginal increases in the interbank interest rate over the last five weeks,” GCB Capital stated.

While the disinflation process may resume in July 2023, food prices remain a significant source of price pressure. Inflation rates in divisions such as personal care and miscellaneous goods, furnishing and household equipment, housing and utilities, and alcoholic beverages and narcotics continue to exceed the national average.

However, the disaggregated data indicate easing inflation across these divisions, with their contribution to the overall inflation print continuously declining. Non-food inflation is on a downward trajectory. In contrast, food prices appear to be sticky, influenced by seasonality effects and unfavourable pricing dynamics – resulting in elevated food inflation.

GCB Capital emphasises that while there are expectations of inflation resetting on a downward path from July 2023 due to lagged impacts and favourable base effects, it flags simmering food price pressures as a near-term upside risk to inflation. These pressures could moderate the pace of disinflation.

The disinflation process has been supported by tight monetary policy, additional liquidity management operations to address excess liquidity, relative stability in the local currency and easing of ex-pump petroleum prices. Additionally, the Bank of Ghana signing a Memorandum of Understanding on zero financing to the budget aims to eliminate fiscal dominance, fostering faster inflation easing toward the target band. These policies are expected to serve as an anchor, reinforcing the disinflation process and guiding the economy toward recovery.