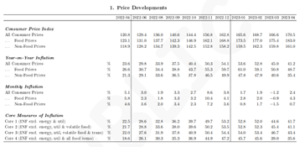

Price Development (Inflation)

The data you provided is from the Bank of Ghana’s summary of economic and financial data for May 2023. It includes information about price developments in various categories, including the Consumer Price Index (CPI) and different measures of inflation.

Source:BankofGhana

- Consumer Price Index (CPI): The CPI measures the average change in prices of goods and services consumed by households. The data shows the CPI for all consumer prices, food prices, and non-food prices for different months from April 2022 to April 2023. For example, in April 2022, the CPI for all consumer prices was 120.8, while in April 2023, it increased to 170.5.

- Year-on-Year Inflation: Year-on-year inflation compares the CPI of the current month with the CPI of the same month in the previous year. The data provides year-on-year inflation rates for all consumer prices, food prices, and non-food prices for different months. For instance, in April 2023, the year-on-year inflation rate for all consumer prices was 41.2%, indicating a significant increase compared to the previous year.

- Monthly Inflation: Monthly inflation measures the percentage change in CPI from one month to the next. The data shows the monthly inflation rates for all consumer prices, food prices, and non-food prices. For example, in May 2023, the monthly inflation rate for all consumer prices was 2.4%, indicating a moderate increase in prices compared to the previous month.

- Core Measures of Inflation: Core inflation excludes volatile components, such as energy, utilities, and certain food items, to provide a more stable measure of underlying inflation trends. The data includes four different core inflation measures: Core 1, Core 2, Core 3, and Core 4. Each measure progressively excludes additional components. For example, Core 1 excludes energy and utilities, while Core 4 excludes energy, utilities, and all food items. The data shows the percentage changes in these core inflation measures for different months.

These inflation measures provide insight into the overall price trends in the economy, with the core measures specifically focusing on the underlying inflationary pressures. Higher inflation rates indicate a general increase in prices, which can impact consumer purchasing power and economic stability.

Impact Analysis

the implications for the economy, businesses, and individuals can be analyzed as follows:

- Economy: a. High year-on-year inflation rates indicate a significant increase in prices compared to the previous year. This can lead to a decrease in purchasing power and erode the value of money, impacting consumers’ ability to afford goods and services. b. Monthly inflation rates, although moderate in some cases, can still contribute to price volatility and uncertainty in the economy. c. Rising inflation can lead to reduced consumer spending, as individuals may prioritize essential items and cut back on discretionary purchases. This can affect overall economic growth and demand.

- Businesses:

- a. Businesses may face challenges in managing costs and maintaining profitability as input prices, such as food prices and non-food prices, increase. Higher costs can squeeze profit margins, especially if businesses are unable to pass on the increased costs to consumers. b. Increased inflation rates may lead to changes in consumer behaviour, with individuals becoming more price-sensitive and seeking lower-priced alternatives. This can create challenges for businesses in pricing their products competitively and retaining customers. c. Inflation can also impact investment decisions, as businesses may be hesitant to make long-term investments in an environment of uncertainty and rising costs.

- Individuals: a. Higher inflation erodes the purchasing power of individuals, as the prices of goods and services increase faster than wages and salaries. This can lead to a decline in real income and a reduced standard of living. b. Individuals may face difficulties in meeting their daily expenses, especially if inflation outpaces income growth. Basic necessities, such as food, may become more expensive, impacting household budgets. c. Savers and retirees may be adversely affected by inflation, as the value of their savings and fixed-income investments may decline in real terms.

Overall, the implications of high inflation rates include reduced consumer purchasing power, increased cost pressures on businesses, and challenges in maintaining economic stability. It is important for policymakers to monitor and manage inflation to ensure a favourable economic environment for businesses and individuals alike.

Rea Sector

The data provided is from the Bank of Ghana’s summary of economic and financial data for May 2023. It includes information about real sector indicators, including the Composite Index of Economic Activity (CIEA), Gross Domestic Product (GDP), and the Bank of Ghana Confidence Surveys.

- Composite Index of Economic Activity (CIEA): The CIEA is a measure of economic activity in the country. The data shows the nominal index of the CIEA, which indicates the overall level of economic activity, and its annual growth percentage. For example, the nominal index increased from 2708.6 in December 2021 to 3194.3 in April 2023, with annual growth percentages ranging from 10.7% to 12.8% during this period. Additionally, the data provides the annual growth percentage for the real CIEA, which adjusts for inflation. The real CIEA experienced fluctuating growth rates, ranging from positive 5.0% to negative 7.2% during the specified months.

- Gross Domestic Product (GDP): The GDP measures the total value of goods and services produced in the country. The data provides information on both the nominal and real GDP. The nominal GDP is measured in billions of Ghanaian Cedis (GHC), while the real GDP is adjusted for inflation using 2013 prices. However, some of the data points are missing in the table you provided. The quarterly year-on-year growth rates of real GDP are provided for different sectors, including overall GDP (including and excluding oil), agriculture, industry, and services. These growth rates indicate the percentage change in each sector’s contribution to GDP compared to the same quarter in the previous year.

- Bank of Ghana Confidence Surveys: The Bank of Ghana conducts surveys to gauge consumer and business confidence in the economy. The data includes the Consumer Confidence Index and the Business Confidence Index. These indices measure the level of confidence consumers and businesses have in the economic environment. The indices are reported for different months, although some data points are missing in the table you provided. Higher values indicate increased confidence, while lower values indicate reduced confidence.

Overall, these real sector indicators provide insights into the performance and sentiments of the Ghanaian economy. The CIEA and GDP data reflect the level of economic activity and growth in different sectors. The Bank of Ghana Confidence Surveys give an indication of how consumers and businesses perceive the economic conditions and their outlook for the future.

Impact Analysis

implications for the economy, businesses, and individuals can be analysed as follows:

- Economy: a. Composite Index of Economic Activity (CIEA): The increasing nominal index and positive annual growth percentages suggest overall economic expansion. This indicates a growing economy with increased production and economic activity. b. Real CIEA: The fluctuating growth rates for the real CIEA indicate varying levels of inflation-adjusted economic activity. Negative growth rates suggest potential economic contraction or slowdown, which may be a concern for the economy. c. Gross Domestic Product (GDP): The nominal and real GDP figures provide insights into the size and value of the economy. The quarterly year-on-year growth rates for different sectors of the economy indicate the contributions of agriculture, industry, and services to overall economic growth.

- Businesses: a. Increasing CIEA and GDP: A growing economy implies potential market expansion and increased business opportunities. This can be advantageous for businesses looking to expand their operations and reach a larger customer base. b. Fluctuating real CIEA growth rates: Businesses need to be mindful of the inflation-adjusted growth rates as they can affect consumer demand and market conditions. Negative growth rates may indicate a decline in purchasing power and potential challenges in maintaining profitability. c. Sector-specific growth rates: The growth rates for agriculture, industry, and services can provide insights into the performance of different sectors. Businesses operating in these sectors can assess their growth potential and adjust their strategies accordingly.

- Individuals: a. Economy-wide impact: Economic growth and expansion can have positive effects on individuals, including potential job opportunities, increased wages, and overall improvement in living standards. b. Inflation-adjusted growth: Fluctuating real CIEA growth rates can impact individuals’ purchasing power and affordability of goods and services. Negative growth rates may indicate potential inflationary pressures and higher prices, which can affect individuals’ ability to meet their daily needs. c. Consumer and business confidence: The Bank of Ghana Confidence Surveys provide insights into the sentiments of consumers and businesses. Higher consumer confidence may lead to increased consumer spending, while higher business confidence may encourage investment and expansion.

Overall, the implications of the data suggest a mixed economic landscape with both positive and challenging aspects. The growing economy and positive growth rates indicate potential opportunities for businesses and improved living conditions for individuals. However, the fluctuating real CIEA growth rates and varying sector-specific performance require vigilance, as they can affect inflation, consumer purchasing power, and business profitability. Monitoring consumer and business confidence levels is also important, as they can influence economic activity and investment decisions.

Interest Rates

The data provided is from the Bank of Ghana’s summary of economic and financial data for May 2023. It includes information about interest rates for secondary market bonds, both old bonds and new bonds.

- Old Bonds: The data presents the interest rates for various old bonds in the secondary market. These bonds have different maturities ranging from 2 years to 20 years. The interest rates are expressed as percentages per annum. For example, the 2-year note had an interest rate of 17.46% in April 2022, while the 10-year bond had an interest rate of 21.97% in April 2022. The interest rates for each bond fluctuate over time.

- New Bonds (Post DDEP): The data also provides interest rates for new bonds in the secondary market, which were issued after the Debt and Debt Exchange Program (DDEP). These new bonds have maturities ranging from 4 years to 15 years. The interest rates for these bonds are expressed as percentages per annum.

Implications:

- Secondary market bond interest rates indicate the yield or return investors would earn by holding these bonds until maturity.

- Higher interest rates for old bonds generally reflect higher perceived risk or inflation expectations.

- Interest rates for new bonds reflect prevailing market conditions and the terms of issuance.

- Investors seeking higher yields may be inclined to invest in bonds with higher interest rates.

- The interest rates for bonds in the secondary market can influence borrowing costs for the government and other issuers.

It’s important to note that the data you provided only includes interest rates for specific months, and some data points are missing. Therefore, the full picture of interest rate trends and their implications would require a more comprehensive analysis.

Impact Analysis

Based on the data provided on interest rates for secondary market bonds, the implications for the economy, businesses, and individuals can be analyzed as follows:

- Economy: a. Bond Market Conditions: The interest rates on bonds reflect market conditions and investor sentiment. Higher interest rates on bonds may indicate higher perceived risk, inflation expectations, or tightening monetary policy. This can have implications for the overall cost of borrowing, investment decisions, and government debt management.

- Businesses: a. Cost of Borrowing: Interest rates on bonds affect the cost of borrowing for businesses that issue or purchase bonds. Higher interest rates can make borrowing more expensive, which can impact business investment, expansion plans, and overall profitability. b. Financing Options: The availability of bonds with different interest rates and maturities can provide businesses with financing options. They can choose to issue or invest in bonds based on their specific financing needs, risk appetite, and interest rate expectations.

- Individuals: a. Savings and Investment: Individuals who invest in bonds can earn returns based on the bond’s interest rate. Higher interest rates on bonds can provide individuals with higher returns on their investments, especially if they hold the bonds until maturity. b. Cost of Borrowing: If individuals or households are seeking loans or credit, higher bond interest rates can indirectly impact the cost of borrowing for personal loans, mortgages, or other forms of credit.

- Government and Debt Management: a. Debt Servicing: The interest rates on government bonds impact the cost of debt servicing for the government. Higher interest rates can increase the cost of borrowing for the government, potentially leading to higher fiscal deficits or reduced government spending in other areas. b. Debt Sustainability: Bond interest rates also affect the government’s debt sustainability. If interest rates are high, the government’s ability to manage and repay its debt may become more challenging, potentially impacting the overall fiscal health of the economy.

It’s important to note that the data provided in terms of interest rates for secondary market bonds reflects specific periods and may not capture the full range of interest rate dynamics. Interest rates can be influenced by various factors, including inflation, monetary policy decisions, market conditions, and investor sentiment. Therefore, a comprehensive analysis of interest rate trends and their implications would require a more in-depth examination of the economic and financial landscape.

Foreign Exchange

The data provided is from the Bank of Ghana’s summary of economic and financial data for May 2023. It includes information about foreign exchange rates, both domestic currency movements and international currency movements, as well as the Real Effective Exchange Rate (REER) and currency indices.

- Domestic Currency Movements: a. USD/GHC: This represents the exchange rate between the US Dollar (USD) and the Ghanaian Cedi (GHC). The data shows the exchange rates for different months, indicating how many Cedis are needed to buy one US Dollar. The year-to-date percentage change reflects the depreciation or appreciation of the Ghanaian Cedi against the US Dollar during the specified period. b. GBP/GHC: This represents the exchange rate between the British Pound (GBP) and the Ghanaian Cedi (GHC). Similar to the USD/GHC rate, it shows the exchange rates and year-to-date percentage changes. c. EUR/GHC: This represents the exchange rate between the Euro (EUR) and the Ghanaian Cedi (GHC). Similarly, it shows the exchange rates and year-to-date percentage changes.

- Real Effective Exchange Rate (REER): The REER is an indicator that measures the value of a country’s currency relative to a basket of other currencies, adjusted for inflation. The REER index reflects the relative strength or weakness of the Ghanaian Cedi against a basket of currencies. The data shows the REER index for different months, indicating fluctuations in the value of the Ghanaian Cedi.

- International Currency Movements: a. GBP/USD: This represents the exchange rate between the British Pound (GBP) and the US Dollar (USD). It shows the exchange rates and year-to-date percentage changes. b. EUR/USD: This represents the exchange rate between the Euro (EUR) and the US Dollar (USD). Similarly, it shows the exchange rates and year-to-date percentage changes. c. GBP/EURO: This represents the exchange rate between the British Pound (GBP) and the Euro (EUR). It also shows the exchange rates and year-to-date percentage changes.

- US Dollar Index and Emerging Market Currency Index (EMCI): The US Dollar Index measures the value of the US Dollar against a basket of major currencies. The EMCI represents the value of emerging market currencies relative to a basket of major currencies. The data provides the indices for different months, reflecting changes in the values of the US Dollar and emerging market currencies.

Implications:

- Domestic Currency Movements: The exchange rate data indicates the value of the Ghanaian Cedi relative to other currencies. Depreciation (negative percentage change) suggests that the Cedi has weakened against those currencies, which can impact the cost of imports, inflation, and the competitiveness of Ghana’s exports.

- Real Effective Exchange Rate (REER): Changes in the REER index reflect the competitiveness of the Ghanaian economy and its trade balance. A higher REER index suggests a relatively stronger currency, which can affect export competitiveness.

- International Currency Movements: The exchange rate data between major currencies can have implications for international trade, investment flows, and currency conversions. Changes in exchange rates can impact the costs of imports and exports and influence tourism, remittances, and foreign direct investment.

It’s important to note that exchange rates are influenced by various factors such as monetary policy, inflation, economic fundamentals, market sentiment, and global economic trends. The data you provided offers insights into the movement of exchange rates, but a comprehensive analysis would require considering additional factors and trends in the global currency markets.

Impact Analysis

Based on the data provided on foreign exchange rates, the implications for the economy, businesses, and individuals can be analysed as follows:

- Economy: a. Domestic Currency Movements: Changes in domestic currency exchange rates can have implications for the economy. Depreciation of the domestic currency (such as the Ghanaian Cedi) against major currencies like the US Dollar, British Pound, and Euro can affect the cost of imports, potentially leading to higher inflation. It may also impact the competitiveness of exports, as they become relatively cheaper in foreign markets. b. Real Effective Exchange Rate (REER): Fluctuations in the REER index indicates changes in the competitiveness of the domestic currency. A higher REER index suggests a relatively stronger currency, which can make exports more expensive and imports relatively cheaper. This can impact the trade balance and the overall competitiveness of the economy.

- Businesses: a. International Trade: Exchange rate movements can significantly affect businesses engaged in international trade. A depreciation of the domestic currency can make exports more competitive and boost export-oriented industries. Conversely, it may increase the cost of imported goods and impact businesses that rely on imported raw materials or components. b. Currency Risk: Businesses with exposure to foreign currency transactions, such as importers, exporters, or multinational corporations, need to manage currency risk. Exchange rate fluctuations can impact their profitability, pricing decisions, and overall financial performance.

- Individuals: a. Purchasing Power: Exchange rate movements can influence individuals’ purchasing power, especially for imported goods and travel abroad. A depreciation of the domestic currency can make imported products more expensive, potentially reducing individuals’ ability to afford certain goods or services. b. Remittances and Foreign Exchange Transactions: Individuals who receive remittances from abroad or engage in foreign exchange transactions may be affected by exchange rate fluctuations. Changes in exchange rates can impact the value of remittances received or the cost of exchanging currencies.

- Investment and Financial Decisions: a. Foreign Investment: Exchange rate movements can influence foreign direct investment (FDI) decisions. A depreciating currency may make a country more attractive to foreign investors, as their investments can yield higher returns when converted back to their home currencies. b. Tourism and Travel: Exchange rate fluctuations can affect the cost of travel and tourism. A depreciating currency can make a country more affordable for foreign tourists, potentially boosting tourism revenues.

It’s important to note that exchange rates are influenced by various factors, including monetary policies, economic fundamentals, global market conditions, and investor sentiment. Exchange rates can be volatile and subject to sudden changes. Therefore, businesses and individuals should consider these factors and closely monitor exchange rate movements when making economic, investment, or financial decisions.

Commodity Prices

The data provided is from the Bank of Ghana’s summary of economic and financial data for May 2023, specifically related to commodity prices.

- Cocoa Price:

- International USD per tonne: This represents the international price of cocoa in US dollars per metric tonne. It shows the price of cocoa on the international market.

- Year-to-Date Chg %: This indicates the percentage change in cocoa prices compared to the start of the year. Positive values indicate an increase in price, while negative values indicate a decrease.

- Gold Price:

- International USD per fine ounce: This represents the international price of gold in US dollars per fine ounce. It shows the price of gold on the international market.

- Year-to-Date Chg %: This indicates the percentage change in gold prices compared to the start of the year. Positive values indicate an increase in price, while negative values indicate a decrease.

- Brent Crude Oil Price:

- International USD per barrel: This represents the international price of Brent crude oil in US dollars per barrel. It shows the price of crude oil on the international market.

- Year-to-Date Chg %: This indicates the percentage change in Brent crude oil prices compared to the start of the year. Positive values indicate an increase in price, while negative values indicate a decrease.

Realized prices are also provided for cocoa, gold, and Brent crude oil. These prices reflect the actual prices realized by producers or traders after accounting for factors such as quality, market conditions, and any applicable discounts or premiums.

Implications:

- Cocoa Price: Cocoa is a crucial commodity for Ghana, which is one of the world’s largest cocoa producers. The international cocoa price can impact the country’s export earnings and the income of cocoa farmers. Positive year-to-date changes indicate a potential increase in export revenue and income for cocoa producers.

- Gold Price: Ghana is also a significant gold producer. The international gold price influences the revenue generated from gold exports and can impact the profitability of gold mining companies. Positive year-to-date changes suggest a favourable environment for gold exporters and mining operations.

- Brent Crude Oil Price: Although Ghana is not a major oil producer, changes in Brent crude oil prices can still have indirect effects on the economy. Higher oil prices can affect transportation costs, fuel prices, and inflation levels, which can impact businesses and individuals.

Overall, fluctuations in commodity prices, such as cocoa, gold, and Brent crude oil, can have implications for Ghana’s export earnings, foreign exchange reserves, government revenue, inflation levels, and the profitability of relevant industries. These price movements can also influence investment decisions, trade balances, and the overall economic performance of the country.

Impact Analysis

Based on the data provided on commodity prices, the implications for the economy, businesses, and individuals can be analysed as follows:

- Economy: a. Cocoa Price: Cocoa is a significant agricultural commodity for Ghana, and its price has implications for the country’s economy. An increase in international cocoa prices can lead to higher export earnings, benefiting the economy through increased foreign exchange reserves, higher government revenue (through taxes and export duties), and improved trade balance. This can contribute to economic growth and development, particularly in rural areas where cocoa farming is prevalent. b. Gold Price: Ghana is also a major gold producer. Fluctuations in international gold prices can impact the country’s export earnings, foreign exchange reserves, and revenue from gold mining activities. Higher gold prices can lead to increased export revenues and support economic growth, while lower prices may have the opposite effect. c. Brent Crude Oil Price: Although Ghana’s oil production is not as significant as its cocoa and gold sectors, changes in Brent crude oil prices can still have indirect effects on the economy. Higher oil prices can increase the cost of imported oil and petroleum products, potentially leading to higher inflation and increased production costs for businesses. Lower oil prices, on the other hand, can have a positive impact on businesses and consumers by reducing energy costs.

- Businesses: a. Export-Oriented Sectors: Businesses involved in the production and export of cocoa and gold can benefit from higher international prices. Increased revenues from commodity exports can lead to improved profitability, investment opportunities, and expansion possibilities for these sectors. b. Mining Companies: Gold mining companies in Ghana can be directly influenced by changes in international gold prices. Higher prices can lead to increased revenues and profitability, making mining operations more economically viable. Conversely, lower prices may affect profitability and investment decisions in the sector.

- Individuals: a. Farmers: Cocoa farmers can benefit from higher international cocoa prices as it directly affects their income. Increased prices can provide better remuneration for farmers, leading to improved livelihoods and economic well-being. b. Consumers: Fluctuations in commodity prices, such as cocoa and oil, can indirectly impact consumers. Higher cocoa prices may lead to increased costs for chocolate products and other cocoa-related goods. Similarly, changes in oil prices can affect fuel costs and, consequently, transportation and commodity prices, potentially influencing overall consumer prices.

- Government: a. Revenue Generation: Higher commodity prices, such as cocoa and gold, can contribute to increased government revenue through export taxes, royalties, and corporate taxes from the mining and agricultural sectors. This revenue can be used for public infrastructure development, social welfare programs, and investments in key sectors of the economy. b. Fiscal Management: Commodity price fluctuations can affect government budget planning and fiscal management. Revenue projections and spending plans may need to be adjusted based on changes in commodity prices to ensure fiscal stability and effective resource allocation.

It’s important to note that commodity prices are influenced by global market dynamics, supply and demand factors, geopolitical developments, and investor sentiment. Therefore, it is essential for businesses and individuals to closely monitor commodity price movements and adapt their strategies accordingly.

External Sector

The figures from the Bank of Ghana’s summary of economic and financial data for May 2023, focusing on external sector developments:

- Trade Account:

- Total Exports (million USD): The value of goods and services Ghana sold to other countries. It shows an increasing trend from 4,417.8 million USD in 2022:03 to 5,648.9 million USD in 2023:04.

- Total Imports (million USD): The value of goods and services Ghana purchased from other countries. It shows an increasing trend from 3,544.9 million USD in 2022:03 to 4,048.5 million USD in 2023:04.

- Trade Balance (million USD): The difference between total exports and imports. It indicates a positive trade balance, with an increase from 872.8 million USD in 2022:03 to 1,600.4 million USD in 2023:04. This suggests that Ghana’s exports exceed its imports.

2. Balance of Payments:

- Current Account Balance (million USD): The net balance of trade in goods and services, remittances, and other international transactions. It shows a positive balance, increasing from -554.4 million USD to 661.4 million USD. This implies that Ghana earned more from exports and remittances than it spent on imports and foreign payments.

- Capital and Financial Account Balance (million USD): The net balance of capital inflows and outflows, including foreign direct investments and portfolio investments. It shows a negative balance, decreasing from -451.4 million USD to -955.6 million USD.

3. Gross International Reserves (GIR):

- GIR (million USD): The total amount of foreign currency reserves held by the central bank. It decreased from 8,801.1 million USD to 5,216.0 million USD.

- GIR (Import Cover): The number of months of import expenditures that can be covered by the foreign exchange reserves. It declined from 3.9 months to 2.4 months.

4. Net International Reserves (NIR) (million USD):

- NIR: The total international reserves minus the liabilities of the central bank. It decreased from 5,145.1 million USD to 2,214.4 million USD.

These figures indicate that Ghana experienced a positive trade balance, with exports exceeding imports. However, the overall balance of payments shows a negative current account balance and capital and financial account balance. The decline in gross international reserves and net international reserves suggests a decrease in the country’s foreign exchange holdings. It is essential for Ghana to closely monitor and manage its external sector to maintain a healthy balance of payments and ensure adequate foreign exchange reserves for economic stability.

Impact Analyses

The implications of the external sector developments outlined in the Bank of Ghana’s summary of economic and financial data for May 2023 are as follows:

- Economy:

- Positive trade balance: The economy benefits from a surplus in trade, indicating that the value of exports exceeds the value of imports. This can contribute to economic growth and improved foreign exchange reserves.

- Negative overall balance of payments: The negative current account balance and capital and financial account balance suggest that more money is flowing out of the economy than coming in. This may put pressure on the country’s foreign exchange reserves and require careful management of external transactions.

2.Businesses:

- Export opportunities: The increasing value of total exports presents opportunities for businesses engaged in exporting goods and services. They can take advantage of favourable international prices and demand for Ghanaian products.

- Import costs: The rising value of total imports implies increased costs for businesses reliant on imported goods and materials. They may need to manage their procurement strategies and potentially face higher input costs.

- Individuals:

- Remittances: The positive current account balance highlights the inflow of remittances, which can benefit individuals and households. Remittances can support consumption, savings, and investments, contributing to improved living standards.

- Exchange rates: The fluctuations in exchange rates, particularly the depreciation of the domestic currency against major international currencies, such as the USD, GBP, and EUR, can have implications for individuals. It may affect the cost of imported goods, travel expenses, and the purchasing power of individuals who receive income in foreign currencies.

Overall, these external sector developments signify the need for prudent management of trade, foreign exchange reserves, and capital flows. It is crucial for the government, businesses, and individuals to monitor and respond effectively to maintain a favourable balance of payments, support export-oriented businesses, manage import costs, and mitigate the impact of exchange rate fluctuations on the economy and individuals’ financial well-being.

Government Fiscal operation

The figures from the Bank of Ghana’s summary of economic and financial data for May 2023 related to government fiscal operations, including the figures:

- Government Broad Budget (% of GDP):

- Total Revenue & Grants: In May 2023, the government’s total income, including domestic revenue and grants, accounted for 3.0% of Ghana’s Gross Domestic Product (GDP). Over time, the total revenue and grants have shown an increasing trend, rising from 10.7% in September 2021 to 15.8% in December 2022.

- Domestic Revenue: Domestic revenue, derived from within the country, such as taxes and fees, constituted 2.9% of GDP in May 2023. It has gradually increased from 10.5% in September 2021 to 15.7% in December 2022.

- Tax Revenue: Tax revenue, a significant component of domestic revenue, amounted to 2.4% of GDP in May 2023. It has seen a similar upward trajectory, growing from 8.4% in September 2021 to 12.4% in December 2022.

- Total Expenditure: The government’s total spending, including both recurrent and capital expenditure, accounted for 3.7% of GDP in May 2023. The expenditure levels have shown a gradual increase, climbing from 16.9% in September 2021 to 24.1% in December 2022.

- Capital Expenditure: Capital expenditure, focused on infrastructure development and long-term projects, represented 0.4% of GDP in May 2023. It has experienced moderate growth, rising from 2.3% in September 2021 to 3.3% in December 2022.

- Primary Balance: The primary balance, which excludes interest payments on debt, stood at -0.1% of GDP in May 2023. This indicates a slight surplus in the government’s finances, as it has improved from -1.6% in September 2021.

- Overall Balance: The overall balance, which includes interest payments on debt, reached -0.8% of GDP in May 2023. Although it represents a deficit, there has been some progress in reducing it, as it was -7.1% in September 2021.

- Net Domestic Financing: The government’s net borrowing from domestic sources to finance its budget deficit or repay maturing debts amounted to 0.8% of GDP in May 2023. This figure has declined from 4.4% in September 2021.

- Public Debt:

- Total Public Debt: Ghana’s total public debt, including both external and domestic debt, was approximately 52.2 billion USD or 434.6 billion GHC in May 2023. It represents around 71.2% of GDP, indicating a relatively high debt-to-GDP ratio.

- External Debt: The portion of public debt owed to foreign creditors amounted to approximately 28.9 billion USD or 240.2 billion GHC, equivalent to 39.4% of GDP.

- Domestic Debt: The portion of public debt owed to domestic creditors reached around 194.4 billion GHC, accounting for 31.9% of GDP.

These figures reflect the government’s fiscal operations and debt levels. They provide insights into the government’s revenue generation, expenditure patterns, budget deficit, and debt sustainability. Monitoring these figures is crucial for assessing the government’s fiscal health, ensuring prudent financial management, and promoting long-term economic stability.

Impact Analysis

The implications of the government fiscal operations figures for the economy, businesses, and individuals are as follows:

- Economy:

- Revenue and Expenditure: The government’s increasing total revenue and grants indicate higher income generation, which can contribute to funding public services, infrastructure development, and social programs. However, the growing total expenditure implies increased government spending, which can impact the fiscal deficit and overall debt levels, potentially leading to macroeconomic challenges if not managed effectively.

- Debt Levels: The high public debt-to-GDP ratio suggests a significant burden on the economy. It may limit the government’s ability to allocate resources for development projects, affect investor confidence, and increase borrowing costs. Managing and reducing debt levels over time is crucial for maintaining economic stability and sustainability.

- Businesses:

- Taxation: The rising tax revenue as a percentage of GDP implies increased tax burdens on businesses. This may impact their profitability, cash flow, and ability to invest in growth initiatives. Businesses need to carefully manage their finances, plan for tax obligations, and adapt to any changes in tax policies or rates.

- Government Spending: Capital expenditure is an important driver of economic growth as it supports infrastructure development. Businesses can benefit from government investments in sectors such as transportation, energy, and telecommunications. Monitoring government expenditure priorities can help businesses identify potential opportunities or challenges.

- Individuals:

- Public Services: Adequate government revenue is essential for providing public services such as healthcare, education, and social welfare. Higher revenue and effective expenditure management can lead to improved service delivery, benefiting individuals and communities.

- Debt and Borrowing: The level of public debt can indirectly impact individuals through its effect on interest rates, inflation, and overall economic stability. It may influence borrowing costs for individuals, including mortgage rates and consumer loans. Monitoring debt levels can provide insights into potential macroeconomic risks that could affect personal finances.

Overall, the government fiscal operations figures reflect the financial health of the country and have implications for the broader economy, businesses, and individuals. Maintaining a balance between revenue generation, expenditure management, and debt sustainability is crucial for promoting economic growth, attracting investments, and ensuring the well-being of individuals and businesses.

Monetary Indicators

The data from the Bank of Ghana’s summary of economic and financial data for May 2023 provides insights into the monetary indicators.

- Monetary Aggregates:

- Reserve Money: The figures for Reserve Money show a gradual increase over time, with values ranging from GHC 47.2 billion in April 2022 to GHC 69.2 billion in April 2023. This suggests an expansion of the money supply in the economy.

- Narrow Money (M1): Narrow Money, which includes currency in circulation and demand deposits, exhibits some fluctuations but remains relatively stable. The values range from GHC 66.9 billion in June 2022 to GHC 97.5 billion in April 2023.

- Broad Money (M2): Broad Money shows a consistent upward trend, indicating an expansion of the overall money supply. The figures range from GHC 106.5 billion in June 2022 to GHC 150.5 billion in April 2023.

- Total Liquidity (M2+): Total Liquidity, which includes M2 and foreign currency deposits, also demonstrates a general increase over time. The values range from GHC 145.2 billion in June 2022 to GHC 207.5 billion in April 2023.

- Sources of M2+:

- Net Domestic Assets: The figures for Net Domestic Assets, representing the central bank’s claims on the government and private sector, show an upward trend. The values range from GHC 143.7 billion in April 2022 to GHC 217.9 billion in April 2023.

- Net Foreign Assets: Net Foreign Assets, representing the central bank’s foreign assets and liabilities, exhibit some fluctuations but show a slight decline over time. The values range from -1.2 billion GHC in April 2022 to -10.4 billion GHC in April 2023.

- Private Sector Credit (PSC):

- PSC (nominal): The data shows a relatively stable level of credit provision to the private sector. The values range from GHC 54.2 billion in April 2022 to GHC 64.9 billion in April 2023.

- PSC (Real, in 2021 prices): When adjusted for inflation, the figures for real private sector credit demonstrate fluctuations. The values range from GHC 380.5 million in April 2022 to GHC 470.2 million in November 2022.

Overall, the monetary indicators reflect the growth in money supply, credit provision, and the balance between domestic and foreign assets. The increasing money supply and credit growth can have implications for inflation, economic activity, and financial stability. Monitoring these indicators helps policymakers, businesses, and individuals assess the liquidity in the economy, credit availability, and potential risks associated with monetary and credit expansion.

Impact Analysis

Based on the data provided, the implications for the economy, businesses, and individuals can be analyzed as follows:

- Economy:

- Increase in money supply: The expansion of monetary aggregates, such as Reserve Money, Narrow Money (M1), and Broad Money (M2), suggests an increase in the overall money supply in the economy. This can stimulate economic activity and investment, as there is more money available for consumption and investment purposes.

- Credit provision to the private sector: The stable levels of private sector credit (PSC) indicate that businesses have access to financing for their operations and expansion. This can support business growth, job creation, and overall economic development.

- Businesses:

- Access to credit: The availability of credit, as indicated by the private sector credit figures, can benefit businesses by providing them with the necessary funds to invest in new projects, expand operations, and meet working capital requirements.

- Economic stability: The overall stability in monetary indicators, such as Reserve Money and Narrow Money, suggests a relatively stable economic environment. This stability can provide businesses with greater predictability in terms of interest rates, inflation, and overall market conditions.

- Individuals:

- Increased liquidity: The expansion of monetary aggregates, particularly in Narrow Money and Broad Money, can result in increased liquidity in the economy. This means that individuals may have more money available for spending and saving.

- Access to financing: Stable levels of private sector credit indicate that individuals may have access to loans and credit facilities for personal use, such as purchasing homes, cars, or financing education.

Overall, the implications of the monetary indicators suggest a favorable economic environment with increased liquidity and access to credit. However, it is important to note that these implications may vary depending on other macroeconomic factors, such as inflation, exchange rates, and fiscal policies. Monitoring these indicators over time can provide a more comprehensive understanding of the economic landscape and its implications for businesses and individuals.

Negative Implications

While the data provided generally indicates positive trends in monetary indicators, there are also potential negative implications that should be considered:

- Inflationary pressures: The increase in monetary aggregates, such as Reserve Money and Broad Money, could lead to inflationary pressures if not properly managed. Excessive money supply growth without a corresponding increase in productivity or output can result in rising prices, reducing the purchasing power of individuals and eroding the value of savings.

- Debt sustainability: The figures related to public debt show an increasing trend, with the total public debt as a percentage of GDP reaching relatively high levels. This suggests a potential risk to debt sustainability, as higher debt burdens can limit the government’s ability to allocate resources to essential services, invest in infrastructure, or respond to economic shocks. It may also result in higher interest payments, diverting funds from other productive areas.

- External vulnerabilities: The figures for net foreign assets show a decline over time. This indicates a potential vulnerability in the external sector, as a negative net foreign asset position implies a reliance on external financing or a depletion of foreign reserves. External vulnerabilities can expose the economy to risks associated with exchange rate fluctuations, capital outflows, or changes in global market conditions.

- Unequal access to credit: While private sector credit levels appear stable, it is important to assess whether the credit is distributed equitably across various sectors and businesses. Unequal access to credit can hinder the growth and development of small and medium-sized enterprises (SMEs) or emerging industries, leading to economic disparities and limited job creation.

It’s crucial to note that the implications mentioned above are based on the provided data and general economic principles. The actual impact on the economy, businesses, and individuals may vary depending on the broader economic context, government policies, and other factors specific to the country’s circumstances.

Monetary Sector 2

The data provided in the Bank of Ghana’s summary of economic and financial data for May 2023, specifically in the section on monetary indicators, highlights the following trends:

- Monetary Aggregates: The annual growth rates of monetary aggregates show the following patterns:

- Reserve Money grew at a high rate initially (33.8% in April 2022) but has moderated over time (28.9% in April 2023).

- Narrow Money (M1) experienced positive growth rates, ranging from 11.7% to 44.1% during the period.

- Broad Money (M2) also exhibited positive growth rates, ranging from 13.0% to 43.1%.

- Total Liquidity (M2+) experienced substantial growth rates, ranging from 19.1% to 45.6%. This growth was driven in part by a significant increase in foreign currency deposits (ranging from 39.7% to 134.4%).

- Sources of Change in M2+: The data reveals the following contributions to the growth in M2+:

- Net Domestic Assets showed significant growth rates, ranging from 50.3% to 81.9%. Claims on the government, both net and gross, contributed notably to this growth, with contributions ranging from 28.6% to 45.3%.

- Claims on the private sector had a relatively smaller impact, with contributions ranging from 0.9% to 2.5%.

- Claims on the public sector contributed between 11.0% and 23.5% to the growth in M2+.

- Other items net, which includes factors like non-performing loans and other adjustments, contributed between 1.5% and 19.9% to the changes in M2+.

- Net Foreign Assets: The data indicates a substantial decline in net foreign assets over the period. The growth rates range from -104.1% to -803.0%, implying a significant decrease in foreign reserves or an increase in foreign liabilities. A negative value suggests that foreign liabilities exceed foreign assets.

- Private Sector Credit (PSC):

- PSC experienced positive growth rates ranging from 19.8% to 58.1%, indicating an expansion of credit to the private sector.

- The PSC-to-GDP ratio showed an upward trend, ranging from 7.4% to 12.1%, reflecting the importance of credit in supporting economic activity.

- However, when adjusted for inflation (real PSC in 2021 prices), the growth rates were relatively modest, ranging from -15.2% to 12.0%, indicating that the increase in credit may be partially offset by inflationary pressures.

Negative implications based on these trends could include:

- The decline in net foreign assets raises concerns about the country’s external position and its ability to manage external shocks or meet international obligations.

- The modest growth in real PSC suggests that inflationary pressures may be impacting the affordability and effectiveness of credit in stimulating economic activity.

It’s important to note that these implications are based on the data provided and general economic principles. The actual impact on the economy, businesses, and individuals may be influenced by other factors such as government policies, external conditions, and structural characteristics of the economy.

Impact Analysis

Based on the data provided in Bank of Ghana’s summary of economic and financial data for May 2023, the following implications can be drawn for the economy, businesses, and individuals:

- Economy:

- The growth in monetary aggregates, such as Narrow Money (M1) and Broad Money (M2), suggests an expansion in the money supply. This can stimulate economic activity and investment.

- The decline in net foreign assets indicates potential challenges in managing external obligations and foreign exchange reserves. It highlights the need for prudent management of the country’s external position.

- Businesses:

- The positive growth in Private Sector Credit (PSC) implies increased access to credit for businesses. This can support their investment and expansion plans, leading to potential business growth and job creation.

- The high growth rates in credit to the private sector suggest improved liquidity and financial support for businesses, which can facilitate their operations and promote economic productivity.

- Individuals:

- The growth in monetary aggregates and credit to the private sector may translate into increased availability of funds for individuals to access credit, make purchases, and invest in personal ventures.

- The expansion in Private Sector Credit (PSC) can provide individuals with opportunities to obtain loans for various purposes, such as purchasing homes, vehicles, or starting their own businesses.

However, it’s important to note that these implications are based on the data provided and general economic principles. The actual impact on the economy, businesses, and individuals may vary depending on various factors, including government policies, market conditions, and individual financial circumstances.

Banking Sector Indicators

The data provided in Bank of Ghana’s summary of economic and financial data for May 2023 regarding banking sector indicators can be explained as follows:

- Aggregate Balance Sheet:

- Total Assets: The total assets of the banking sector increased from GHC 194.3 billion in April 2022 to GHC 238.2 billion in April 2023. This represents an annual growth rate ranging from 22.6% to 43.7%. The significant growth in total assets indicates the expansion of the banking sector’s operations and increased financial intermediation.

- Total Deposits: Total deposits in the banking sector rose from GHC 127.2 billion in April 2022 to GHC 184.0 billion in April 2023. The annual growth rate ranged from 19.1% to 46.5%. The growth in deposits reflects the confidence of individuals and businesses in the banking system and their willingness to save and entrust their funds to banks.

- Total Advances: The total advances (loans) provided by banks increased from GHC 60.2 billion in April 2022 to GHC 72.4 billion in April 2023. The annual growth rate ranged from 20.2% to 57.5%. This indicates an expansion in lending activities by banks, which can stimulate economic growth and support businesses and individuals in accessing credit.

- Financial Soundness Indicators:

- Solvency:

- Capital Adequacy Ratio: The Capital Adequacy Ratio, which measures the capital strength and stability of banks, ranged from 12.6% to 21.3%. A higher ratio indicates better solvency and a higher ability to absorb potential losses.

- Asset Quality:

- Non-Performing Loans (NPLs): The percentage of non-performing loans in the banking sector ranged from 14.0% to 18.0%. A higher NPL ratio suggests potential credit risks and challenges in loan recovery.

- Management Efficiency:

- Total Cost to Gross Income Ratio: The ratio of total costs to gross income ranged from 76.4% to 87.5%. A lower ratio indicates better cost management and operational efficiency.

- Operational Cost to Gross Income Ratio: This ratio ranged from 49.9% to 59.9%. It measures the efficiency of managing operational costs relative to gross income.

- Net Interest Margin: The net interest margin ranged from 9.8% to 14.1%. A higher margin indicates better profitability from lending activities.

- Earnings and Profitability:

- Return on Assets (ROA) – Before Tax: ROA ranged from 3.1% to 5.6%. It measures the bank’s profitability in relation to its total assets.

- Return on Equity (ROE) – After Tax: ROE ranged from 14.6% to 36.8%. It indicates the profitability generated for shareholders’ equity.

- Liquidity Indicators:

- Core Liquid Assets to Total Assets: This ratio ranged from 25.1% to 29.3%. It measures the proportion of highly liquid assets to total assets, indicating the bank’s ability to meet short-term obligations.

- Core Liquid Assets to Short-term Liabilities: This ratio ranged from 30.4% to 35.5%. It assesses the bank’s liquidity position in terms of its ability to cover short-term liabilities with liquid assets.

These indicators provide insights into the financial health, performance, and risk management of the banking sector. They are crucial for assessing the stability and efficiency of banks and their ability to support economic growth and financial intermediation.

The implications of the data from Bank of Ghana’s summary of economic and financial data for May 2023, specifically regarding banking sector indicators, are as follows:

- Economy:

- Total Assets of the banking sector have shown steady growth, reaching 238.2 billion GHC in May 2023, with an annual growth rate of 22.6%.

- Total Deposits have increased to 184.0 billion GHC, reflecting an annual growth rate of 44.7%.

- Total Advances (loans) provided by banks have reached 72.4 billion GHC, growing at an annual rate of 20.2%.

- The Capital Adequacy Ratio, a measure of solvency, stands at 14.8%, indicating the banking sector’s ability to withstand potential losses and ensuring financial stability.

- Businesses:

- The availability of Total Advances indicates increased access to credit, providing businesses with the necessary funds for operations, expansion, and investment. This is reflected in the growth of 20.2% in Total Advances.

- The Net Interest Margin of 14.1% suggests that banks are earning profits from lending activities, potentially affecting borrowing costs for businesses.

- Individuals:

- Total Deposits of 184.0 billion GHC provide individuals with a secure and reliable place to save money and earn interest.

- The growth in Total Advances implies that individuals have access to credit for personal loans, mortgages, and other financial needs.

It is important to note that the Non-Performing Loans (NPLs) rate stands at 18.0%, indicating a portion of loans that are in default or close to default. This may have implications for both businesses and individuals, as it could lead to stricter lending criteria and potentially higher borrowing costs.

Overall, a strong banking sector, with adequate capitalization, liquidity, and sound asset quality, is crucial for the economy, businesses, and individuals. It promotes economic growth, facilitates business activities, provides financial services to individuals, and supports savings and investment. However, monitoring and managing NPLs are essential to mitigate risks and ensure the stability of the banking sector.

Capital Market Performance

The data from Bank of Ghana’s summary of economic and financial data for May 2023:

- GSE Composite Index (GSE-CI):

- The GSE Composite Index measures the performance of the Ghana Stock Exchange (GSE) as a whole.

- The All Share Index, which is a component of the GSE-CI, started at 2691.2 in April 2022 and declined to 2741.5 in April 2023.

- The Monthly Change in Index shows the fluctuations in the index value on a monthly basis. For example, in October 2022, the index experienced a decrease of 48.9 points, while in March 2023, it recorded a significant increase of 337.3 points.

- The Year-to-date Growth percentage indicates the overall performance of the index since the beginning of the year. It started at -3.5% in April 2022 and ended at 12.2% in April 2023.

- Market Capitalization:

- Market Capitalization represents the total value of all listed companies’ shares on the stock exchange.

- For the GSE Composite Index, the Market Capitalization started at 63.8 billion GHC and increased to 68.3 billion GHC in April 2023.

- The Year-to-date Growth percentage shows the change in market capitalization from the beginning of the year. It started at -1.1% and ended at 5.8% in April 2023.

- GSE Financial Stock Index (GSE-FSI):

- The GSE Financial Stock Index focuses specifically on the financial sector companies listed on the Ghana Stock Exchange.

- The Financial Stock Index started at 2209.7 in April 2022 and declined to 1758.3 in April 2023.

- Similar to the All Share Index, the Monthly Change in Index shows the monthly fluctuations in the value of the financial stock index.

- The Year-to-date Growth percentage for the Financial Stock Index started at 2.7% and ended at -14.3% in April 2023.

- Ghana Fixed Income Market (GFIM):

- The GFIM represents the market for fixed income securities in Ghana.

- The Volume Traded refers to the total volume of fixed income securities traded on the market. It ranged from 5.6 billion GHC to 24.9 billion GHC during the period.

- The Value Traded represents the total value of fixed income securities traded, which ranged from 3.3 billion GHC to 24.1 billion GHC.

- The Number of Trades indicates the total number of transactions executed in the fixed income market, ranging from 17.8 thousand to 56.5 thousand.

These indicators provide insights into the performance of the capital market in Ghana. Changes in stock indices and market capitalization reflect the overall market sentiment and investor confidence. The trading volume and value in the fixed income market indicate the level of activity and liquidity in the bond market.

Impact Analysis

Based on the data provided from Bank of Ghana’s summary of economic and financial data, the following implications can be drawn for the economy, businesses, and individuals:

- Economy:

- The performance of the GSE Composite Index (GSE-CI) is crucial for assessing the overall health of the capital market in Ghana. The index experienced a year-to-date growth rate of -3.7% in May 2023, indicating a decline in market performance compared to the beginning of the year.

- The All Share Index of the GSE-CI stood at 2,741.5, reflecting a monthly change of -3.9%. This suggests a decrease in the value of shares across the market during the reported month.

- The GSE Financial Stock Index (GSE-FSI) recorded a year-to-date growth rate of -0.8%, indicating a relatively stable performance for financial stocks.

- The Financial Stock Index of the GSE-FSI was reported at 1,758.3, with a monthly change of -48.4%. This signals a decline in the value of financial stocks during the specified month.

- Businesses:

- The capital market’s performance directly affects businesses, especially those listed on the Ghana Stock Exchange. The decline in the GSE Composite Index and the GSE Financial Stock Index may imply a challenging investment climate and reduced investor confidence, which can impact the valuation and attractiveness of listed companies.

- The market capitalization of the Ghana Stock Exchange grew by 5.8% year-to-date, reaching 68.3 billion GHC. This indicates an increase in the overall value of listed companies, potentially reflecting expansion and growth in the business sector.

- The Ghana Fixed Income Market (GFIM) experienced a decline in trading activity, with lower volumes and values traded during the reported period. This may suggest reduced investor interest in fixed income securities, which could impact businesses seeking debt financing through bond issuances.

- Individuals:

- The performance of the capital market can directly affect individual investors’ portfolios. The negative year-to-date growth rates in the GSE Composite Index and the GSE Financial Stock Index may lead to lower investment returns for individuals holding stocks.

- The availability of a liquid and active fixed income market provides individuals with investment options beyond equities. However, the decrease in volumes and values traded in the GFIM may limit individuals’ access to fixed income securities as investment instruments.

- The overall economic health, influenced by the performance of the capital market, can have indirect effects on individuals. Job creation, economic stability, and improved living standards are outcomes that can be positively impacted by a thriving capital market.

It’s important to note that the implications may vary depending on the specific circumstances, economic conditions, and individual investment strategies. Investors and businesses are advised to seek guidance from financial experts or advisors to make informed investment decisions.