- amid rising financing cost

- issued GH¢13.64bn in new short-term debts

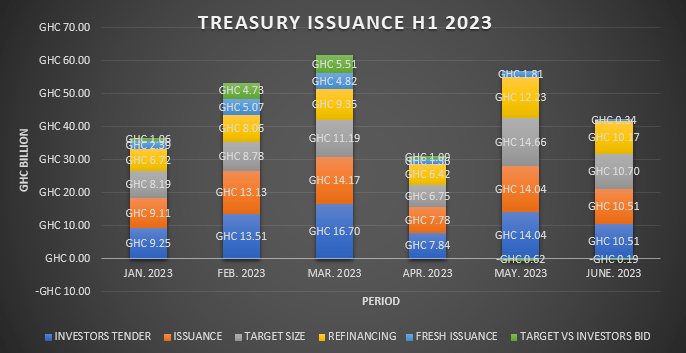

The Treasury successfully issued new short-term debts amounting to GH¢13.64billion in first-half 2023 (H1 2023), while GH¢30.55billion was utilised to refinance maturing debts.

More importantly, it exceeded its financing target for H1 2023 by approximately GH¢12.39billion – resulting in a total issuance of GH¢44.19 billion during the period, out of the GH¢47.30billion tendered by investors.

The Treasury adopted a frontloading strategy for its issuance requirement in H1, primarily in the money market. This approach was driven by limited investment options available to investors, particularly in Q1. Consequently, there was higher demand for short-term securities during this period.

Analysis by the B&FT found that the demand for T-bills experienced a significant surge in Q1 2023. This was primarily due to attractive yield levels and persistent market uncertainties that prompted investors to seek secure investment opportunities. However, it is worth noting that demand for T-bills eased in Q2.

Specifically during Q1 2023, the Treasury accepted and issued approximately GH¢36.41billion across the 91-day to 364-day bills. This was derived from a total investor bid of GH¢39.46billion, surpassing the target size of GH¢28.16billion. However, in Q, the issuance decreased to GH¢32.33billion from investors’ tender of GH¢32.39billion. Despite being slightly lower, this amount still exceeded the target size of GH¢32.11billion.

It is worth observing that the Treasury’s ability to surpass its financing target – issuing new debts and refinancing maturing debts – reflects investor confidence in the country’s economic prospects and the attractiveness of short-term securities. However, it is crucial to continue monitoring market conditions and the investment landscape to assess potential implications of future debt issuances.

The Treasury may need to adapt its strategy accordingly to ensure continued success in financing government’s operations while maintaining stability on the financial market.

Easing Treasury-bill demand

Nonetheless, in a concerning trend the demand for Treasury-bills on the primary market has continued to decline for the second consecutive month this year. The reduced momentum in investors’ demand for 91-to 364-day bills raises legitimate concerns about the Treasury’s ability to meet its debt obligations going forward, particularly amid tighter liquidity conditions in the market.

During May 2023, investors tendered GH¢14.04billion for the 91- to 364-day bills, resulting in a 4.2 percent under-subscription compared to the Treasury’s target of GH¢14.66billion. Despite falling short of the target, the Treasury was still able to issue the amount tendered. Similarly, in June 2023 investors tendered GH¢10.51billion for the 91- to 364-day bills – reflecting a 1.79 percent under-subscription, which although insignificant deviated from the Treasury’s target of GH¢10.70billion.

The market believes that lingering effects from the domestic debt exchange programme have played a significant role in stifling demand for Treasury-bills. The programme’s impact seems to be lingering longer than expected, affecting investor sentiment and reducing the attractiveness of Treasury-bills.

May 2023 stood out as the month with the highest targetted issuance by the Treasury, aiming to reach GH¢14.66billion in issuance compared to GH¢8.1billion, GH¢8.78billion, GH¢11.19billion, GH¢6.75billion and GH¢10.70billion for January to April and June, respectively. However, it is evident that the market conditions and investor sentiment did not align with those ambitious targets.

It is essential to emphasise the potential implications of this trend if it continues. The Treasury’s ability to meet its debt obligations relies heavily on investor demand for Treasury-bills. The recent decline in demand signals a need for the Treasury to reassess its debt management strategies and consider measures to stimulate investor interest.

Moreover, tighter liquidity conditions in the market could pose challenges for the Treasury in raising necessary funds through debt issuances. It will be crucial to closely monitor the market’s dynamics, including liquidity levels, investor sentiment and the effectiveness of debt management measures, to gauge the Treasury’s ability to navigate these challenges.

Yields’ uptrend sustained

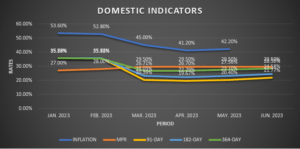

Yields on Treasury-bills resumed an upward trend throughout Q2, presenting a significant risk to government’s debt sustainability. This follows the Treasury’s implementation of cost-cutting measures in Q1-2023 to address escalating Treasury yields, reducing bids and capitalising on strong demand for bills to lower the cost of borrowing. These efforts resulted in a significant drop in yields during that period.

To provide more context, in Q1-2023 the yield on the 91-day bill decreased from 35.36 percent in Q4-2022 to 19.39 percent. The yield on the 182-day bill declined from 35.98 percent to 21.44 percent, and the yield on the 364-day bill fell from 35.89 percent to 25.66 percent. These decreases in yields were encouraging and reflected the Treasury’s successful attempt to manage borrowing costs.

However, the Treasury failed to sustain this momentum as yields resumed an upward trend in Q2-2023. Yields on Treasury-bill auctions experienced marginal increases as anticipated: the 91-day bill rose by 410 basis points (bps) to 22.97 percent while the 182-day bill increased by 400 bps to 25.44 percent from 21.44 percent. The 364-day bill also jumped, by 359 bps to 29.25 percent from 25.66 percent.

These rising borrowing costs for government due to higher yields on Treasury-bills add a further strain to an already burdened fiscal position. As the cost of government borrowing increases, it becomes increasingly challenging to manage the existing debt burden and fulfil future financial commitments.

Outlook

Market expectations suggest that yields on Treasury-bills will continue to fluctuate in the near-term, with potential for further increases.

However, it is crucial to note that the real return on Treasury-bills will remain negative until inflation returns to a single-digit figure or drops below 20 percent. The projected range for Treasury yields in the near-term is around 20 percent to 25 percent.

Despite initial anticipation of a significant drop in yields to a range of 15 percent to 18 percent by end of Q3-2023, the current trend suggests a persistent rise in yields even amid the secured IMF bailout. This poses additional challenges for government’s financial management and debt sustainability.

In light of these developments, it becomes crucial for government to reassess its debt management strategies and explore measures to address the rising borrowing costs. It may be necessary to implement policies that attract investors, enhance fiscal discipline and promote economic growth to alleviate the strain on government’s financial position.