Nigeria: Newly elected president pushes for a unified naira.

Ghana:Ghana reaches an agreement with banks, ahead of 30 June IMF deadline.

South Africa: Rand holds firm as investors assess impact of aborted coup in Russia.

Egypt: Persistent high inflation is a concern.

Kenya: Interest rates go up unexpectedly to combat inflation.

Uganda: Uganda expects to start oil production from Tilenga project in 2025.

Tanzania: Parliament gives final approval for 2023/24 budget.

XOF Region: Senegal raised XOF 909.6 billion from the IMF.

XAF Region: Central bank steps up the fight against inflation.

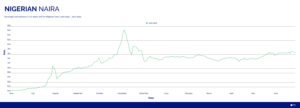

Nigerian Naira (₦)

Compiled by Ikenga Kalu

The Naira has traded around levels of USD/NGN 770 this week after closing last week around the USD/NGN 773 level. There has been some volatility in the currency pair as it seeks stability following the targeting of a unified exchange rate as outlined by President Bola Ahmed Tinubu in his inauguration speech at the end of May.

The goal of the unified exchange rate will be to increase investment in the region and promote liquidity in the banking sector. The benefits have already been observed over the past few weeks with Bloomberg reporting that Nigerian banking stocks are set for their best quarter since 2017.

We are likely to see increases in inflation in the June inflation print as the fuel price has almost tripled since May.

In the week ahead we expect some volatility to remain and trade in the region of USD/NGN 770.

Further reading:

Financial Times – Nigeria’s Bola Tinubu gets off to dramatic start

Bloomberg – Nigeria Banking Stocks Head for Best Quarter Since 2017

Ghanaian Cedi (GH¢)

Compiled by Murega Mungai

The Ghanaian cedi closed last week at USD/GHS 11.75. Going into the new week, the cedi remained relatively stable, and was at 11.76 as of Tuesday afternoon.

Results from the Ghanaian Assin North by-election on Tuesday evening saw the National Democratic Congress’ (NDC) James Gyakye Quayson win. This means that the NDC now has the same number of seats as the New Patriotic Party (NPP) in parliament. This adds challenges for President Nana Akufo-Addo’s bid to secure additional IMF funding, in a bid to address its current economic situation.

With the impending June 30, 2023 deadline for the next tranche of the $3 billion loan, Ghana reached an agreement with banks to restructure 15 billion cedi of locally issued U.S. dollar bonds and cocoa bills.

With a rising expectation of a July 26, 2023 rate hike from the U.S Federal Reserve, we can expect the cedi to depreciate against the dollar over the coming week.

Further reading:

Yahoo finance — Ghana Parliament Hung Again After Opposition Wins By-Election

Yahoo finance — Ghana agrees restructuring deal with banks on some domestic debt

South African Rand (R)

Compiled by Alex Barmuta

The South African rand closed off last week at USD/ZAR 18.315. The new week saw the rand give back some of those gains, as it eased back to the USD/ZAR 18.510 levels by Wednesday afternoon.

This is due to a weaker dollar and the recent failed mutiny in Russia, which reduces the likelihood of President Vladimir Putin attending the BRICS summit in Johannesburg in August. South Africa, as a member of the International Criminal Court (ICC) hosting the summit, would be expected to arrest Putin if he attends. Failing to do so could strain relations with the West. The rand is also benefiting from reduced power outages by state utility Eskom, as there have been some improvements in electricity generation capacity in recent weeks.

On Tuesday June 27, 2023, the JSE FTSE All Share index ended the day with a 0.4% increase, reaching a level of 74,503. Investors were focused on evaluating the global economic situation and the direction of interest rates. The possibility of additional economic stimulus in China helped alleviate concerns about a potential worldwide recession and geopolitical risks.

Considering the firmer dollar, we do not expect the rand to break below the USD/ZAR 18.00 level, and likely to continue trading in the USD/ZAR 18.20-18.50 range.

Further reading:

Reuters – South African rand jumps as investors assess Russia impact

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound remained relatively stable over the past few days and continues to trade around USD/EGP 30.90 between the close of last week and today.

Earlier this week Fitch Solutions — one of the Fitch Ratings companies — warned that persistent high inflation rates are a concern and likely to contribute to higher borrowing costs. This should also be a concern for the government when it looks to raise additional financing for the current fiscal year.

In the week ahead we expect the pound to remain stable at USD/EGP 30.90 with economic calendar events picking up toward the end of next week.

Further reading:

Egypt Independent – Fitch Solutions warns of high inflation rates in Egypt

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenyan shilling closed at USD/KES 140.33 last week, and has depreciated marginally to USD/KES 140.38 by the time of writing, another new high for the year.

The continued pressure on the shilling is largely driven by a higher demand for U.S. dollars, which remains in excess compared to KES demand. This prompted the monetary policy committee to raise interest rates at an impromptu meeting by 100 basis points — to 10.5% — in order to manage inflation.

We can expect the USD/KES to continue trading around its current levels in the coming week, as the interest rate decision is likely to bring in some much needed KES demand.

Further reading:

Marketwatch – Kenya Central Bank Raises Key Interest Rate to 10.50% to Tame Inflation

Ugandan Shilling (USh)

This Wednesday, June 28, 2023, USD/UGX traded at 3,672.00, the price remaining the same from last Friday. The Uganda National Oil Company (UNOC) anticipates that oil production from the Tilenga project will begin in the first half of 2025. The Tilenga project’s oil will be transported to the port of Tanga in Tanzania via the $3.5 billion East African Crude Oil Pipeline (EACOP).

Looking ahead, we anticipate USD/UGX strengthening due to people having been deprived of free use of their land for more than three or four years as a result of Tilenga and EACOP, according to the statement. This has resulted in the deprivation of their means of subsistence and, as a result, severe food shortages for some families.

Compiled by Yadhav Panday

Further reading:

Reuters — Uganda expects to start oil production from Tilenga project in 2025

Tanzanian Shilling (TSh)

Compiled by Kristin Van Helsdingen

The Tanzanian shilling has continued its weakening trend against the U.S. dollar last week and closed off on Friday at USD/TZS 2,397. This week, the trend has continued, and the Tanzanian shilling hit its weakest level since 2017 at USD/TZS 2,405 at the time of writing.

On Monday, June 26, 2023 parliament gave the final approval for the TZS 44.39 trillion budget that was proposed at the 2023/24 budget speech on June 15, 2023. The government is planning to spend 7% more than last year. Inflation is expected to be maintained between 3% and 7%. Real GDP growth is currently at 5.2% and is expected to rise to 6.3% by 2024. Additionally, the government is about to pass a new bill whereby tax on beer, gambling machines and cigarettes will be increased, and the revenue gained from this would be directed toward increasing the country’s economic growth.

According to the Livestock and Fisheries Deputy Minister David Silinde, meat exports rose by more than 500% in weight from 2021 to 2022. Currently, animal related products and activities contribute 7% toward the country’s gross domestic product (GDP) and this sector continues to grow.

In the week ahead, we expect the Tanzanian shilling to weaken further against hard currencies as the Bank of Tanzania continues to slowly weaken its hold on the currency’s FX value. USD/TZS is expected to be trading around 2,408, and possibly higher.

Further reading:

AFRICA PRESS – Tanzania’s parliament approves 44.39tri/- budget

REUTERS – Tanzania sees spending rising 7% in 2023/24 budget

BOWMANS – TANZANIA: 2023/24 NATIONAL BUDGET HIGHLIGHTS

AFRICA PRESS – Bill intends to enhance economic growth

IPP media – Meat exports rise 5 times in 2022

West African CFA Franc Region (XOF)

Compiled by Jean Cédric Nando KOUA

The IMF has announced that Senegal will benefit from XOF 909.6 billion as part of an economic support program.

This program aims to support the Senegalese government to improve the management of public finances by strengthening its mechanism to fight corruption, money laundering, etc., which should ultimately improve economic growth.

The Senegalese government will benefit from immediate financing of XOF 131 billion, which will enable it to correct budget deficits and boost economic growth.

Further reading:

Sika finance – Senegal: IMF approves $1.5 billion economic support program

Central African CFA Franc Region (XAF)

Compiled by Jean Cédric Nando KOUA

The central bank is tightening its policy as part of the fight against inflation.

After suspending liquidity injections and increasing the key rate four times, it decided to increase the amount of weekly withdrawals to XAF 200 billion against XAF 150 billion, an increase of 33.33%.

This liquidity takeover offer, remunerated at 0.75% over one week and 0.8% over 28 days, aims to suck up excess liquidity in the banking sector, which will have the effect of reducing forecast inflation to 6.4 % in 2023 against a community standard of 3%.

Further reading: