Nigeria: Further inflationary pressures loom in view of electricity tariff hike.

Ghana: Ghanaian economy shows signs of recovery.

South Africa: May inflation figures come in better than expected.

Egypt: Private sector minimum wage to be introduced.

Kenya: The European Union and Kenya trade deal includes tariff-free access to the EU for Kenyan exporters.

Uganda: Uganda’s economy at risk as country’s public debt and interest payments to creditors continue to rise.

Tanzania: Tanzanian shilling stable as Bank of Tanzania reins in forex flows.

XOF Region: The cost of bank credit reached 6.75% in March 2023.

XAF Region: Cameroon has raised XAF 10 billion to improve public finance management.

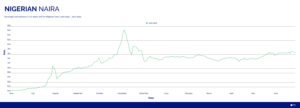

Nigerian Naira (₦)

Compiled by Ikenga Kalu

The naira depreciated marginally from USD/NGN 767 to USD/NGN 769 over the course of the week as demand gradually outstrips supply. Just a few weeks after officially removing the much-debated subsidy on gasoline, the federal government announced a planned 40% hike in the electricity tariff to kick off from July, 01 2023. The electricity tariff, which is priced off the official USD/NGN rate, became necessary for an upward review following the unification of the various official CBN FX windows and the consequent depreciation of the currency. The increase in the prices of both fuel and power are highly likely to push inflation further upwards in the coming months as Nigerians face higher prices of goods and services. We expect the naira to fall further against the U.S. Dollar as a result.

Further reading:

Nairametrics – Unified FX Rates: Electricity tariffs to rise by 25% in December

Ghanaian Cedi (GH¢)

Compiled by Sakina Seidu

The Ghanaian cedi appreciated slightly from USD/GHS 11.83 to 11.82 over the last week buoyed by positive news from the IMF report released on the Ghanaian economy after the agency’s recent visit.

In efforts to boost the cedi’s value, a reform strategy has been put in place to help improve the economy with focus on expenditure controls, revenue growth, and improved revenue collection by the electricity and energy sector. Feelers in the market hinted towards a decline in retail demand in the retail FX segment as clients adopted a wait and see approach in expectation of a rate drop on the back of renewed confidence in the economy.

In the coming weeks, with expectation of a hike in U.S. dollar interest rates for the month of July, the USD/GHS rate may continue to appreciate.

Further reading:

IMF — IMF staff concludes visit to Ghana

B&FT — IMF deal: Ofori-Atta talks up urgent reforms

Myjoyonline — Pressure on cedi to continue

South African Rand (R)

Compiled by Alex Barmuta

The South African rand closed off last week at USD/ZAR 18.1567. The new week saw the rand give back some of those gains, as it eased back to the USD/ZAR 18.40 levels as of Wednesday afternoon.

A firmer dollar can be seen as a factor towards the dampening of the recent USD/ZAR downtrend. The U.S. dollar showed some gains after U.S. housing data was released, indiciating housing market could be heading towards a recovery.

Data released on Wednesday showed that inflation data for May (year-on-year) eased to 6.3% – down from 6.8% last month, and under the initial estimates of 6.5%. There has also been a reduction in loadshedding, allowing local businesses to experience fewer disruptions compared to earlier this year.

Considering the firmer dollar, we do not expect the rand to break below the USD/ZAR 18.00 level, and likely to continue trading in the USD/ZAR 18.20-18.50 range.

Further reading:

Nasdaq – South African rand, stocks weaken as US dollar firms

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound remained stable over the past week and traded at USD/EGP 30.89 on Wednesday after closing last week at USD/EGP 30.90.

A minimum wage has been announced in the country of $97 per month for private sector workers and will be introduced from July 2023. The announcement follows several months of persistently high inflation with annual urban inflation above 32% in May 2023 and no signs of further devaluation in the pound after several devaluations last year.

In the week ahead we expect interest rates to remain on hold and for the pound to continue the present trend of trading around the USD/EGP 30.90 level.

Further reading:

The New Arab – Egypt to raise minimum wage for private sector to $97 per month

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenyan shilling traded between USD/KES 139.36 – 140.360 this week from USD/KES 139.11/139.80 the previous week, a new high for the year. The increasing USD/KES rate is likely due to the mismatch between U.S. dollar supply and demand across Kenya. In other news, the European Union and Kenya are set to announce a trade deal which will give Kenya tariff-free access to the European Union, its biggest export market (such as agricultural products such as tea, coffee, cut flowers, peas, and beans). This will also attract investment and financing in the medium to long term from the European Union. We expect the shilling to remain under slight pressure due to the demand for U.S. dollars from the manufacturing and energy sectors.

Further reading:

DW.com – EU trade deal: Kenya opens its market to European goods

Ugandan Shilling (USh)

Compiled by Yadhav Panday

This Wednesday, June 21st, USD/UGX traded at 3,701.00, up 0.16% from last Friday. In the previous four weeks, USD/UGX increased by 0.64%. Uganda’s economy could be drastically affected as the country’s public debt and interest payments to creditors continue to rise, which further limits spending on the most productive sectors.

Looking ahead, we expect the USD/UGX to rise in the coming weeks among possible reactions by the World Bank to the passage of the 2023 Anti-Homosexuality Act.

Further reading:

Monitor – Uganda walks a tightrope as public debts soars

Tanzanian Shilling (TSh)

Compiled by Kristin Van Helsdingen

USD/TZS remained stable this past week with the average daily rate remaining in a narrow range between 2,387 and 2,389. Currently, the Tanzanian shilling seems to have weakened against the U.S. dollar and is trading at 2,395 at the time of writing.

On Tuesday, June 20, 2023, the Bank of Tanzania (BoT) warned local businesses against transacting in U.S. dollars. The BoT reminded the public that the Tanzanian shilling is the only currency that should be used and all pricing should be made in terms of shillings. This law is in order to give the BoT more control over its forex pricing.

This week, the Tanzanian government is said to be debating the proposed budget for the next fiscal year. This will continue until next Tuesday and thereafter, the members of parliament will be able to vote for or against the proposed budget.

As the BoT keeps a keen watch on the USD/TZS currency pair, we expect the Tanzanian shilling to remain relatively stable with a slight dip. USD/TZS is expected to be trading around the USD/TZS 2,390 level.

Further reading:

AFRICA PRESS – Tanzania’s Central Bank bans dollar payments

AFRICA PRESS – Budget debate kicks off today

West African CFA Franc Region (XOF)

Compiled by Jean Cédric Nando KOUA

Of note this week is that the cost of bank credit has risen sharply in the XOF region. Between March 2022 and March 2023, the cost rose from 6.28% to 6.75%, mainly due to the numerous increases in the central bank’s key interest rate in order to reduce inflation.

Cash loans and home loans are the most affected, with percentage point rises of 1.2 and 0.17 respectively, taking rates to 6.73% and 6.75% respectively.

Further reading:

Sika finance – Rising cost of bank credit in the WAMU: Borrowers face rising rates

Central African CFA Franc Region (XAF)

Compiled by Jean Cédric Nando KOUA

Cameroon has signed a XAF 10 billion financing agreement with the African Development Bank.

This financing should be used for the implementation of the public finance governance support project. The objective of this project is to further improve the collection and securing of tax revenue, limit budgetary risks by intensifying controls and systematizing audits and to fight against corruption.

The implementation of such a project should enable Cameroon to improve its public finance management.

Further reading:

Sika finance – Cameroon: CFA 10 billion from the AfDB to improve public finance management