*Jan-May contribution to trades up 16%

*domestic participation nears parity

A capital flight-to-safety occasioned largely by the Domestic Debt Exchange Programme (DDEP) has seen pension funds increase their net position on the equities side of the Ghana Stock Exchange (GSE), as they contributed 16 percent to trading activity between January and May 2023.

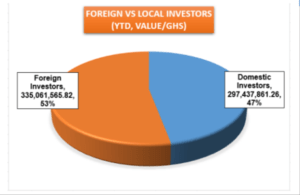

This compares favourably to the four percent recorded during the comparable period of 2022 and has contributed to the increase in domestic investor participation – which approached parity with offshore investor participation, rising to 47 percent during the period under consideration. Last year, it was 39 percent.

Commenting on the development, Head of Research-Databank Group, Alex Boahen, said it did not come as a surprise as pension funds – which held six percent of the domestic Treasury debt prior to the restructuring – “had their fingers burned” as a result of the DDEP, which he noted shattered the illusion of a risk-free nature for debt securities.

There have been campaigns to raise the level of pension funds’ participation in equities, including reforms to raise the regulatory threshold. This, however, had been greeted with apathy as corporate trustees continued to shy away from listed stocks – citing volatility and illiquidity on the market.

“In the past, pension funds and other institutional investors were excessively defensive; primarily focusing on the fixed-income market despite the law permitting a significant allocation to equities. However, they rarely utilised this option as bonds were providing returns of approximately 25 percent. The trustees ensured a conservative approach by fund managers, deeming additional risk unnecessary. Nevertheless, introduction of the DDEP changed this perspective as it revealed the possibility of government default,” he said.

“When the DDEP was announced, a scarcity of investment opportunities became apparent with the bond market becoming unattractive and Treasury bills being oversubscribed,” he added.

This comes as the total assets under management (AUM) of the nation’s three-tier pension scheme reached GH¢39.6billion by the end of December 2021, marking a significant increase from the GH¢33.5billion recorded in 2020.

This represents a growth of GH¢6.1billion and an 18 percent expansion compared to the previous year. Of this, pension funds can invest a maximum 75 percent of their assets in government debt instruments and 10 percent in the ordinary shares of listed companies.

Drivers

Stocks with defensive qualities – those that tend to provide stable earnings and consistent returns, even during an economic downturn. Chief among them has been oil marketing company (OMC) stocks, especially Total as well as MTN and Benson Oil.

Databank’s Head of Research explained that as these stocks offering dividend yield above 6 percent, coupled with the likelihood of capital gain – the difference between the price the stock was bought for and what it was sold for – ensure that they offer a compelling argument against the new bonds, which have an average yield of nine percent.

These stocks were better able to withstand rising costs compared to their peers, and OMCs in particular enjoy a fair degree of pricing freedom – with regular reviews reflecting the cost changes. At close of the second trading week in June, Total had a share price of GH¢6.45 – a 61.3 percent appreciation over the GH¢4 with which it began the year.

MTN – which Mr. Boahen said had transformed into a utility company, as its call, data and mobile money services were akin to water and electricity – had seen a 33 percent year-to-date rise in its share as it traded for GH¢1.19.

While Benso Oil did not fit the bill directly, as its primary product – crude palm oil – experienced elevated prices and a significant portion of its revenue came from exports in US dollars. The palm oil producer had seen its share price jump by 84.4 percent since turn of the year, to hit GH¢14.11 at end of the second week in June.

Mr. Boahen emphasised that investing in such companies acts as a hedge against inflation and currency instability, as they are less likely to erode in value.

He further mentioned that banking stocks did not perform as well due to uncertainties surrounding their capitalisation positions and outcomes of the International Monetary Fund (IMF) deal. Additionally, banks are unable to pay dividends during this interim period.

Regarding the underperformance of banking stocks, he stated: “That’s why the banking stocks have not done as well, and we expect thin trading there until there is clarity on their capitalisation positions and how well the IMF deal plays out. Banks also cannot payout dividends in the interim”.

The GSE Financial Stocks Index (GSE-FSI) had experienced some marginal gain by the middle of June, reaching 1,684.87 points. This translates to a one-week gain of 0.58 percent, a four-week loss of 0.19 percent and a year-to-date loss of 17.91 percent. The Accra bourse’s Composite Index (GSE-CI) had recorded an 8.14 year-to-date gain with its market capitalisation at GH¢ 67.29billion.