Nigeria: Nigeria’s president takes early action on vow to reboot the economy.

Ghana: Ghana sees improved gold production amid upward price pressures.

South Africa: Positive GDP figures may have triggered surprising rand rally.

Egypt: Budget approved as privatisation targeted.

Kenya: Kenya’s forex reserves rise after World Bank funding.

Uganda: Uganda Central Bank holds key lending rate at 10%.

Tanzania: Tanzania score B+ from Fitch Ratings.

XOF Region: : Senegal budgetary resources increase by 17% in April 2023.

XAF Region: Cameroon released oil and gas production figures in April 2023.

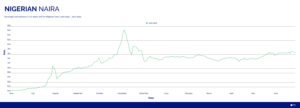

Nigerian Naira (₦)

Compiled by Ikenga Kalu

The naira remained relatively stable at USD/NGN 767 over the previous week as the market awaited subsequent signals following the president’s promises of unifying Nigeria’s multiple exchange rate system. On June 14, 2023, news filtered into the market that the Central Bank of Nigeria (CBN) had officially floated the naira which saw the NGN fall to as low as USD/NGN 755. The CBN had maintained multiple exchange rates for years to cater to different segments of the demand to subsidize access to FX for imports. While this recent devaluation is likely to boost investor confidence in the Nigerian economy it is also expected to bring higher import costs and increased inflation. We expect demand from the interbank market to trickle into the parallel market and pile further pressure on the naira in the coming weeks.

Further reading:

Premium Times — Nigeria’s dollar bonds surge after Tinubu’s plan to unify exchange rates, scrap subsidies

BusinessDay — Nigeria officially floats naira as I&E rate hits N755/$

Ghanaian Cedi (GH¢)

Compiled by Sakina Seidu

This week, the Ghanaian cedi traded within the range of USD/GHS 11.65 and USD/GHS 12.00 following positive sentiments on the back of a recent IMF staff visit. According to the Ghana Statistical Service, May inflation figures showed a 2.4% increase from 41.2% in April to 42.2% in May as the spike in food costs and the recently implemented taxes applied upward pressure on the price of consumer goods. Ghana has regained its position from South Africa as the largest gold producer on the continent following a 32% boost in gold production. This was achieved due to both the country’s domestic gold purchase program and the expansion of production at the country’s existing mines. In the long term, we expect the extra forex earnings from the increased gold production and positive sentiments from subsequent IMF FX inflows to support the cedi.

Further reading:

Modernghana — Ghana tops Africa with 32% increase in gold production

Bnnbloomberg — Ghana surprise uptick in inflation

South African Rand (R)

Compiled by Alex Barmuta

The USD/ZAR closed last week at 18.6925, down from last week’s open of 19.4895. The new week saw the same trend, as momentum carried the rand to the 18.50 levels against the dollar, at the time of writing.

Some of the contributors towards the rand’s somewhat surprising rally, include an improved local sentiment, as rotational power cuts eased, and the recent release of better-than-expected GDP data showing South Africa narrowly avoided a recession. That being said, there is no single catalyst to the ZAR rally; many analysts believe that the rand was simply too oversold, on the back of the recent concerns around South Africa’s ties to Russia.

Looking ahead, a break and close below the 18.40 level, could see the USD/ZAR rate test the 18.10 structure area, followed by the psychological 18.00 level.

Further reading:

Moneyweb — Rand back below R19/dollar on better sentiment

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound traded at USD/EGP 30.89 in midweek trading, after closing off last week at USD/EGP 30.95. Some minor depreciation was observed toward the end of last week before returning to levels below 30.90 that we have seen in recent weeks.

This week the Egyptian parliament approved the 2023/2024 budget with an expenditure just under 3 trillion pounds ($95 billion). The government continues to target privatization of state owned entities to assist with meeting current debt obligations and also seeks investments of $10 billion over the next four years.

Worth noting is the increase in expenditure for the food subsidy programme which has risen from 90 billion pounds in 2022/2023 to 127 billion pounds for 2023/2024. Egypt continues to face high levels of inflation and is largely reliant on imports for basic food and fuel. Inflation increased from 38.6% in April, 2023 to 40.3% in May, 2023.

In the week ahead we expect the pound to remain relatively stable between USD/EGP 30.85 and USD/EGP 30.95.

Further reading:

Aljazeera – Egypt approves budget amid privatisation drive, economic crisis

Reuters – Egypt’s core inflation rises to 40.3% in May

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenyan shilling hit a new record low this week of USD/KES 139.11/139.80 from last week’s levels of 138.80 against the dollar. The country remains a net importer and therefore dollar demand from manufacturers and energy sectors has led to more pressure on the shilling. We expect the inflation rate this month will also increase as prices of food products such as wheat and cooking oil are expected to increase. The World Bank however, expects GDP to grow at 5%, 0.2 percentage points higher than last year’s increase, signaling a rebound of the economy after the pandemic. The usable foreign exchange reserves increased to $7.532 billion U.S. dollars which is 4.15 months of import cover versus $6.512 billion the previous week and is attributed to the World Bank loan of $1 billion (139.3 billion Kenyan shillings). We expect the shilling to remain stable in the coming week with the support of the foreign exchange reserves.

Further reading:

The-star — More pressure on households as shilling hits new record low

Ugandan Shilling (USh)

Compiled by Yadhav Panday

USD/UGX was trading at 3,710.00 on Wednesday, June 14, 2023 down 5% from last week friday. The Bank of Uganda maintained its benchmark interest rate at 10% on June 13, 2023, its highest level since 2019, citing the desire to keep policy tight to consolidate the disinflationary process. Uganda’s annual inflation rate fell for the fourth month in a row, to 6.2% in May 2023, down from 8% in April. Uganda’s economic growth is expected to be in the range of 6% – 6.5% in the fiscal year 2023/2024, up from an estimated 5.5% – 6.0% in 2022/2023.

Looking ahead, we expect USD/UGX to weaken in the coming week as a stable exchange rate and lower food prices helped inflation fall.

Further reading:

Morningstar — Uganda Central Bank Holds Key Lending Rate at 10%

Tanzanian Shilling (TSh)

Compiled by Kristin Van Helsdingen

The Tanzanian shilling continued its weakening trend and closed off last week around USD/TZS 2,374. This week the shilling weakened even further and is currently trading at USD/TZS 2,385. The shilling has depreciated 2.3% against the U.S. dollar year to date.

On Friday, June 9, 2023, Fitch ratings assigned Tanzania a “B+” with its “Outlook Stable” after assessing the country’s macroeconomic position. Fitch expects the country’s real GDP growth to increase from 4.7% in 2022 to 5.2% in 2023 and then to 6% in 2024. Inflationary targets have been met as they have remained below 5% and are expected to remain like this in the medium term. The future potential risks that Fitch have pointed out include the lack of full independence of the central bank as well as the dependence of the country on weather given the importance of their agriculture sector on their economy.

Despite the positive feedback from Fitch Ratings, we expect the Tanzanian shilling to continue weakening in the week ahead as the shilling finds its position in the market. The country’s reserve bank seems to have let go of their strong hold on controlling the FX rate that was seen in the beginning months of the year. We expect USD/TZS to be trading around 2,390 in the week ahead.

Further reading:

Fitch Ratings – Fitch Assigns Tanzania ‘B+’; Outlook Stable

West African CFA Franc Region (XOF)

Compiled by Jean Cédric Nando KOUA

Senegal recorded an increase in its budgetary resources, which stood at XOF 1,149 billion in April 2023, an increase of 17% since the beginning of the year.

This increase is due to an 11.4% increase in tax revenue, driven mainly by direct taxes, customs duties, and registration fees which generated an additional XOF 102.3 billion to reach XOF 998.6 billion in April 2023.

It should also be noted the considerable contribution of nontax revenue which increased by 78.1% to XOF 86.8 billion.

All these factors have enabled the Senegalese government to reduce the budget deficit.

Further reading:

Sika finance – Senegal: 17% increase to XAF1,149 billion in budgetary resources at the end of April

Central African CFA Franc Region (XAF)

Compiled by Jean Cédric Nando KOUA

Cameroon has released its oil and gas production figures.

At the end of April 2023, oil production stood at 8.01 million tons, which represents a drop of 2.2% compared to April 2022.

Additionally, natural gas production increased by 4.53% to reach 916.01 million m3 in April 2023.

Sales of oil and gas production generated XAF 269.22 billion net of revenue, which represents an increase of 31.19% compared to the same period in 2022.

This increase in gas revenues will greatly contribute to reducing Cameroon’s budget deficit.

Further reading: