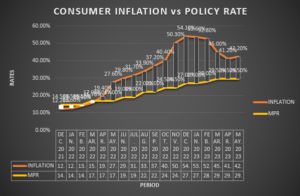

Consumer inflation in May 2023 rose to 42.2 percent from 41.2 percent the previous month, contrary to market expectations.

This sudden increase indicates a pause in the previously promising downward trend in price of goods and services, as data from the Ghana Statistical Services (GSS) had shown a gradual slowdown in the rate of price increases for the first four months of this year.

Notably, inflation experienced a significant decrease in March 2023 – dropping from 52.8 percent in February to 45 percent. Additionally, between March and April 2023 the rate of price increase slowed from 7.8 percentage points to 3.8 percentage points.

On a month-on-month basis, prices of goods and services rose for the second consecutive time, increasing by 4.8 percent in May compared to 2.4 percent in April 2023. This reversal of deflation observed in March, when prices decreased by 1.2 percent, raises concerns about inflationary pressures.

The rise was primarily driven by food inflation, which accounted for 52.9 percent of the headline inflation figure. Food inflation surged to 51.8 percent in May, up from 48.7 percent in April 2023. The month-on-month food inflation rate reached 6.2 percent. Non-food inflation stood at 34.6 percent, slightly lower than the previous month’s 35.4 percent. Month-on-month non-food inflation was recorded at 3.5 percent.

Inflation for locally produced items stood at 36.2 percent, while inflation for imported items was 43.8 percent.

Market expectations had been focused on the price effects of new and revised taxes – particularly the excise tax amendment act, which were anticipated to trigger the repricing of goods based on the May 2023 inflation data window. Additionally, the lagged impact of utility tariff adjustments and increasing food prices were seen as upside risks to inflation in the near-term – potentially moderating the pace of disinflation through Q2 2023. In February 2023, the Public Utility Regulatory Commission (PURC) raised the average end-user tariff for electricity by 18.36 percent for the second quarter, adding to the almost 30 percent increase in the first quarter.

Apakan Securities expressed caution despite the previously observed downtrend in inflation, citing possible risk factors in the near-term. The increase of value added tax (VAT) by 2.5 percent to 15 percent in the 2023 budget – along with proposed price-sensitive taxes introduced by government in April 2023 – were highlighted.

As a result, supply-side risks are expected to slow down the pace of disinflation in the coming months; potentially keeping inflation above the medium target of 8±2 percent by end of the year, according to Apakan Securities.

During its May 2023 meeting, the Bank of Ghana’s Monetary Policy Committee (MPC) acknowledged the significant decline in headline inflation since beginning of the year, reflecting a strong return to the disinflation path. The Committee noted that the percentage of items in the Consumer Price Index (CPI) basket with inflation of more than 50 percent is decreasing, indicating progress in the disinflation process. This positive trend is supported by core inflation, which is also easing rapidly.

The tight monetary policy, liquidity management operations, relative stability in the local currency and easing of ex-pump petroleum prices have contributed to the disinflation process, as stated by the Committee.

However, the May 2023 CPI rate could prompt the Bank of Ghana to raise the policy rate in upcoming July meetings. Nevertheless, the Bank expects that signing the memorandum of understanding on zero financing of the budget will eliminate fiscal dominance and facilitate faster inflation easing toward the target band. These policies are expected to provide the necessary support to reinforce the disinflation process and reset the economy on a path to recovery.