Improving women’s access to credit and loans for sustainable livelihoods and increasing agricultural productivity remain a challenge in Ghana and Africa as a whole.

In northern Ghana, a majority of the population (mostly women) involved in subsistence agriculture – who have the zeal to engage in either farming or petty trading – to help with upkeep of the home are confronted with a lack of access to finance or credit that often hinders productivity.

Lack of access to funds, unavailability or high cost of financial credit renders their efforts useless and make them unable to thrive.

These challenges are however more pronounced among women in northern Ghana as a result of gender roles and socio-cultural practices.

It is also evident that rural dwellers, especially in northern Ghana, are confronted with difficulty in accessing formal financial services due to socio-cultural and institutional practices.

With sensitisation from financial institutions, Non-Governmental Organisations and farming organisations like Rujo agritrade, most of the farming communities – especially women – have adopted the savings culture to address their issues instead of relying on government and other agencies whose requirements are cumbersome to the poor farmers.

With sponsorship from the CGIAR Research programme on Legumes and Dry lands Cereals (CRP-GLDC) and working with ICRISAT, the project – implemented by Savannah Agricultural Research Institute of the Council for Scientific and Industrial Research (CSIR-SARI) in collaboration with Ministry of Agriculture (MOFA) and SEND Ghana – identified that most smallholder women farmers in the project communities have limited or no access to land, labour, inputs or credit due to less power invested in them.

Also, financial institutions often charge high interest rates with the required collateral for credit; making it difficult for the women to afford, and hence having to rely on the piece of land around their house.

In empowering women to access funds for their crop-production, CSIR-SARI with backstopping from International Crops Research Institute for the Semi-Arid Tropics (ICRISAT) put in place the Village Savings and Loans Associations (VSLAs) in five districts of Ghana to mitigate the plight of the vulnerable.

The districts are: Tolon-Kumbungu, Mion, West Mamprusi, Bawku Municipal and Nadowli.

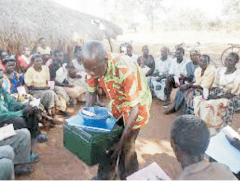

The Village Savings and Loan Association (VSLA) is a group of people who collectively support a structured process for saving money and offering loans at a local-level.

It is a community-based initiative wherein members of the group democratically prepare their own constitution for how the VSLA will be managed, and the rules for members to abide by.

It provides a simple and accountable system for savings and loans for communities which do not have ready access to formal financial services such as banks or microfinance institutions.

Here, the members meet weekly – and each buys at least one share per agreement by the group in the constitution; and, in most groups, they limit the number of shares an individual can buy each week to five.

This is to increase financial security and reduce the effects of poverty among women groups in rural areas so they become financially independent, and also strengthen the groundnut seed production system at the community level.

Since the initiative’s introduction, it has so far registered some impressive results with about 150 members. Notably, an interesting smartphone-based accounting system was introduced to ease and secure the financial records of participating groups.

Speaking in an interview with B&FT, the Gender and Social Scientist on the SARI/TL III project, Mr. Desmond Adogoba, said one of the main interventions of SARI is to help improve the household income of target communities through accessing their own savings to embark on any developmental agenda to generate income and become financially independent.

He added it was also to strengthen and engage them in the seed systems, where they can generate funds to purchase the quantity of certified and quality seeds needed for their production without any difficulty.

He said the TLIII project being carried out via the VSLA seeks to ensure availability and access to affordable legumes through the use of good agricultural practices to increase farmers’ yields.

He said the project is also to bridge the productivity gap between the smallholder farmers, and to improve on household decision-making as well empower women financially.

“We have been providing technical training to the women groups, whereby we teach them community seed production to ensure best agro practices that will enable the farmers to maximise their crop yields,” he said.

The support, he noted, has enabled the farmers to cultivate five acres of Nketie sari each as part of their community seed production; as well as become involved in multiplication of the new varieties to help strengthen the community seed delivery system.

Dr. Jummai Yila, Gender research scientist at ICRISAT, said the project is meant to ensure women have access to the improved varieties being developed by SARI.

Mariama Kadiru, a beneficiary in the Tolon district, said the support has helped to ensure financial freedom and also improve her business.

According to her, the initiative has helped them access finance to support their businesses and their children’s education.

Alimata Isshaka, another beneficiary at Nadowli West district said: “It has helped pay the children’s fees and also support my husband to buy fertiliser for his crop production”.

Issahaka Lalbila, from the Bawku West district and husband of a beneficiary, said it has provided capital for his wife to start a business and be able to contribute in the family’s upkeep.

There is therefore a need to encourage more rural dwellers, especially farmers and petty traders, to cultivate the habit of saving for their businesses and the future. This will also complement government and other private sector support to boost their businesses, and also generate some revenue for upkeep of the family.

With this approach, the group will not find it difficult accessing finances to inject into their businesses; and also investors will have some confidence in them to provide support that cushions their businesses.