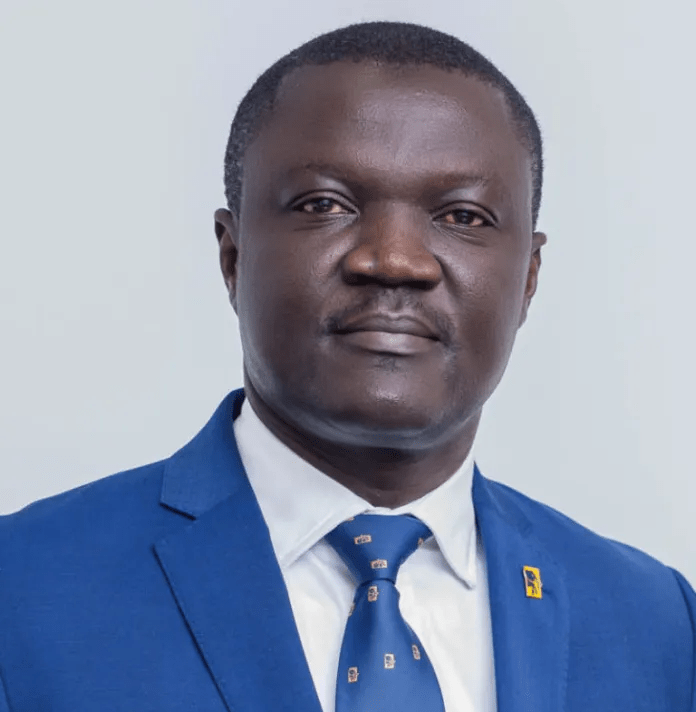

The Chief Executive Officer (CEO) for FBN Bank Ghana Limited, Victor Yaw Asante, has urged government to put in measures that ensure more people are roped into the tax net, backed by an efficient collection system, rather than introducing more taxes.

According to him, it is just a handful of Ghanaians who pay taxes well; therefore adding more will become burdensome for them and they will in turn find avenues to evade their payment.

His call comes after parliament early this month passed the Excise Duty Amendment bill 2022; the Growth and Sustainability Levy bill, 2022; the Ghana Revenue Authority bill 2022; and the Income Tax Amendment bill 2022, in efforts to rake in GH₵4billion annually as part of domestic revenue mobilisation.

The bills are also decisive in government’s quest to facilitate Board approval for the US$3billion International Monetary Fund (IMF) Programme staff-level agreement.

However, these taxes have come with stiff opposition from industry, manufacturers and trade unions in the country.

Speaking to the B&FT, Victor Asante expressed concern that these taxes will have an effect on profits of businesses – making them earn less money than usual. He indicated that taxes are a bit of a problem, and every government that institutes them must do so with caution.

He however commended government on the good identification system, adding that government can use it as a base to collect existing taxes effectively.

He revealed that most Ghanaians work in the informal sector, and a higher percentage do not pay tax. According to him, Ghana’s current ID system is a good start to see how GRA can collect taxes or identify people to honour their tax obligation as citizens.

“I would say our biggest need is to collect effectively and widen the tax, rather than introducing more taxes,” he emphasised.

Meanwhile, government justifies introducing the taxes by saying they are critical for recovery from the current economic crisis.