The recent bank collapses in the United States seem to have an obvious cause. Ninety percent of the deposits at Silicon Valley Bank (SVB) and Signature Bank were uninsured, and uninsured deposits are understandably prone to runs. Moreover, both banks had invested significant sums in long-term bonds, the market value of which fell as interest rates rose. When SVB sold some of these bonds to raise funds, the unrealized losses embedded in its bond portfolio started coming to light. A failed equity offering then set off the run on deposits that sealed its fate.

But four elements of this simple explanation suggest that the problem may be more systemic. First, there is typically a huge increase in uninsured bank deposits whenever the US Federal Reserve engages in quantitative easing. Because it involves buying securities from the market in exchange for the central bank’s own liquid reserves (a form of cash), QE not only increases the size of the central-bank balance sheet, but also drives an expansion in the broader banking system’s balance sheet and its uninsured demandable deposits.

We (along with co-authors) called attention to this under-appreciated fact in a paper presented at the Fed’s annual Jackson Hole conference in August 2022. As the Fed resumed QE during the pandemic, uninsured bank deposits rose from about $5.5 trillion at the end of 2019 to over $8 trillion by the first quarter of 2022. At SVB, deposit inflows increased from less than $5 billion in the third quarter of 2019 to an average of $14 billion per quarter during QE. But when the Fed ended QE, raised interest rates, and switched quickly to quantitative tightening (QT), these flows reversed. SVB started seeing an increase in outflows of uninsured deposits (some of which were coincident with the downturn in the tech sector, as the bank’s stressed clients started drawing down cash reserves).

Second, many banks, having benefited from the firehose of deposits, purchased liquid longer-term securities such as Treasury bonds and mortgage-backed securities, in order to generate a profitable “carry”: an interest-rate spread that provided yields above what the banks had to pay on deposits. Ordinarily, this would not be so risky. Long-term interest rates had not moved up much for a long time; and even if they did start to rise, bankers understand that depositors tend to be sleepy and will accept low deposit rates for a long time, even when market interest rates move up. The banks thus felt protected by both history and depositor complacency.

Yet this time was different, because these were flighty uninsured deposits. Having been generated by Fed action, they were always poised to flow out when the Fed changed course. And because large depositors can coordinate easily among themselves, actions taken by just a few can trigger a cascade. Even at healthy banks, depositors who have woken up to bank risk and the healthier interest rates available at money-market funds will want to be compensated with higher interest rates. The juicy interest-rate spreads between investments and somnolent deposits will be threatened, impairing bank profitability and solvency. As an apt saying in the financial sector goes, “The road to hell is paved with positive carry.”

The third concern is that these first two elements have been magnified today. The last time the Fed switched to QT and interest-rate hikes, in 2017-19, the increase in policy rates was less sudden and sizable, and the volume of interest-sensitive securities held by banks was smaller. Consequently, the losses that bank balance sheets needed to absorb were small, and there were no depositor runs, even though many of the same ingredients were in place. This time, the quantum of interest-rate increases, their rapidity, and bank holdings of rate-sensitive assets are all much larger, with the Federal Deposit Insurance Corporation suggesting that unrealized losses on available-for-sale and held-to-maturity bank securities holdings alone could exceed $600 billion.

The fourth concern is unwitting supervisory coordination with the industry. Clearly, too many supervisors failed to see banks’ rising interest-rate exposure, or they were unable to force banks to reduce it. Had supervision been more forceful (we still are trying to gauge the extent to which it fell short), fewer banks would be in trouble today. Another problem, however, is that supervisors did not subject all banks to the same level of scrutiny that they applied to the largest institutions (which were subject to stress tests, among other things). These differential standards may have caused a migration of risky commercial real-estate loans (think of all those half-empty office buildings during the pandemic) from larger, better capitalized banks to relatively weakly capitalized small and midsize banks.

The upshot is that while many vulnerabilities in the banking system were created by bankers themselves, the Fed also contributed to the problem. Periodic bouts of QE have expanded banks’ balance sheets and stuffed them with more uninsured deposits, making the banks increasingly dependent on easy liquidity. This dependency adds to the difficulty of reversing QE and tightening monetary policy. The larger the scale of QE and the longer its duration, the more time the Fed should take when normalizing its balance sheet and, ideally, raising interest rates.

Unfortunately, these financial-stability concerns conflict with the Fed’s inflation-fighting mandate. Markets now expect the Fed to cut rates at a time of significantly above-target inflation, and some observers are calling for a halt to QT. The Fed is again providing liquidity in large quantities through its discount window and other channels. If financial-sector problems do not slow the economy, such actions could prolong the fight against inflation and make it more costly.

The bottom line is clear: As it re-examines bank behavior and supervision, the Fed cannot afford to ignore the role that its own monetary policies (especially QE) played in creating today’s difficult conditions.

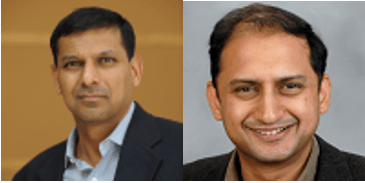

Raghuram G. Rajan, former governor of the Reserve Bank of India, is Professor of Finance at the University of Chicago Booth School of Business and the author, most recently, of The Third Pillar: How Markets and the State Leave the Community Behind (Penguin, 2020). Viral V. Acharya, a former deputy governor of the Reserve Bank of India, is Professor of Economics at New York University’s Stern School of Business.

Copyright: Project Syndicate, 2023.

www.project-syndicate.org