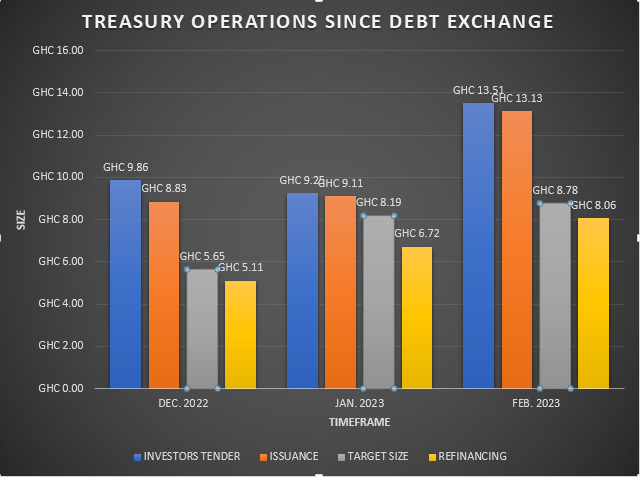

Demand for treasury bills (T-bills) surged last February with total bids for the month reaching GH¢13.51billion, thus +46 percent month on month (m/m) – the largest size in three years.

Following the exemption of treasury bills (T-bills) from the Domestic Debt Exchange Programme (DDEP) in Q4-2022, investors flocked to T-bills, increasing the demand for treasury bills from the final quarter of the 2022 to February 2023, which recorded a three-year high.

The high appetite for T-bills also comes on the back of persistent market uncertainties, investors’ limited investment options, and attractive yield levels.

In February, the treasury accepted GH¢13.13billion (+44 percent m/m) of the total bids for the month. In the previous month, treasury bills target size increased by 48.7 percent to GH¢8.18billion in Jan-2023 from GH¢5.50billion in Jan-2022, with total bids worth GH¢9.25billion tendered by investors across all the bills for Jan-2023.

However, yields on T-bills continued their three months of decline, with the 91-day bill falling 35.55 percent (-16bps m/m). Likewise, the 182-day bill dropped to 34.21 percent (-155bps m/m) while the 364-day bill settled at 34.21 percent (-160bps m/m).

Apakan Securities, an investment advisory firm, in its review of the market, said: “We expect yields to decline further in the upcoming month because of the growing demand for T-bills”.

Cumulatively, the target size for 2022 rose by 22 percent year-on-year (y/y) to GH¢68.13billion as government turned to the money market for financing of its budget after being priced out of the bond market. In 2022, investors tendered total bids worth GH¢72.94billion across the 91-day to the 364-day bills while the treasury sold a gross amount of GH¢71.06billion across the same tenors. The amount accepted by the treasury was sufficient to cover a gross maturing face value of GH¢59.27billion for the year, reflecting a maturity cover of 1.20x.

Cost-cutting move

Available information suggests that the government is attempting to drive down the interest rates of key money market instruments, particularly treasury bills across the 91, 182 and 364-day tenor, to as low as 15 percent.

This is an aggressive move aimed at reducing the cost of borrowing by taking advantage of the high demand environment for short-term maturities.

In the most recent auction on Friday, March 3, 2023, the government rejected all bids for the short-term instruments, even as the rate for the shortest-tenor bill jumped from 12.52 percent at the beginning of last year to 35.66 percent a year later.

“The strong demand for treasury bills and the rising cost of government debt resulted in a drastic decline in yields [as the government rescheduled the auction after rejecting all the bids tendered], dreading that increased borrowing costs would exacerbate its financial difficulties,” Apakan Securities said.

Official data shows that the interest rate for the benchmark security has tumbled to 24.16 percent following the last auction session on March 7, 2023. The government was able to lower the cost of its treasury bills, resulting in an oversubscription of about 121.6 percent, and generating GH¢6.15billion in revenue from the latest auction. However, the government only accepted GH¢4.52billion of the bids, which mainly came from banks. The treasury was seeking to raise GH¢2.78billion from the short tenors to refinance imminent maturities worth GH¢2.55billion.

During the last two weeks’ auctions, the Bank of Ghana reported that the government reduced the pricing of the 91-day T-bills from 35 percent to a yield of 24.16 percent, while the 182-day and 364-day bills were sold at 26.55 percent and 27.54 percent, respectively.

The results showed that the 91-day T-bill received bids worth GH¢2.73billion, but the government accepted only GH¢1.16billion. Similarly, for the 182-day bills, the bids tendered were estimated at GH¢1.526billion; however, the government accepted only GH¢1.16billion. For the 364-day bill, the bids tendered were valued at GH¢1.886billion, with the government accepting only GH¢1.882billion.

“We reckon the current relatively high interest costs do not factor in the government’s medium-term Debt Sustainability Analysis (DSA), prompting the treasury to take steps to ‘force’ interest rates down at this auction. Due to limited market access, the government has been actively tapping the treasury bill market – its only market window currently – to refinance maturing obligations and also build some buffers, leading to the continuous accumulation of a relatively high-interest burden,” Constant Capital, an investment advisory firm, said in its review of the market.