Have you visited Ghanaian real estate classifieds websites Meqasa or JiJi and wondered who exactly buys those houses? You’re not alone. Many listed prices are prohibitive. Even an apartment listed at 50,000 USD is equivalent to over 376,000 Ghana Cedis. Many houses are priced over 500,000 USD which is overly expensive for most Ghanaian households.

But an expensive house is not absolute. It is a relationship between a house’s listed price and your income. So maybe that house is not expensive, it’s your income that is too low. Aside from low incomes, the high cost of finance, high transaction costs, and the persistently depreciating Ghana Cedi make houses in Ghana very unaffordable to most households.

How affordable are house prices in Ghana?

The cheapest newly built house by a formal real estate developer was US$20,573. Only 23.3% of households in urban areas can afford such a house. Such a house is typically far from any central business district, elevating transport costs and commuting time.

I think housing affordability should always be defined to include transportation costs. It will be a more realistic measure since housing decisions are typically not independent of transport costs.

Compared to Cote D’Ivoire, 54.2% of households in urban areas can afford the cheapest house by a formal private developer priced at US$15,364.

Cost build-up for a house

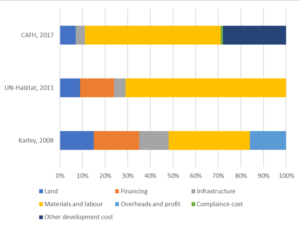

Let’s examine the breakdown of the cost components of homes developed by private developers.

Available research shows that materials and labour costs are the most significant cost component in building a home in Ghana.

On labour costs, it is not just the wages of tradespersons. There is a lot of dishonesty—you get charged for no or little work done. Building materials get stolen. Getting an honest person can be a tough challenge.

Author’s construct based on (CAHF, 2017; Karley, 2008; UN-Habitat, 2011)

The higher costs are building materials. Prices of iron rods, roofing sheets, and cement have persistently increased. Earlier in 2021, prices of iron rods increased by over 40% to reach GH$5,450.00 from GH$3,880.00 per ton. Cement prices have similarly witnessed persistent increases. Price instability of building materials worsens the probability of cost overruns.

Building materials are particularly costly because over 90% used in the country are imported either as finished or semi-finished products.

UN-Habitat (2011)

These income sanitary wares, paint, clinker, doors, cement, iron rods, padlocks, among many others. Indeed, apart from sand, stones, timber and water, nearly everything else has some imported elements.

One must pay taxes (duty, VAT and several levies), freight charges, insurance, and bank transfer charges on building materials imported into the country. It simply means that a substantial proportion of the house price is taxes on building materials used in its construction.

The cost of financing is also a big part of why houses are so expensive.

But why are houses so wickedly expensive in Ghana?

I am not in any way justifying the prices of real estate in Accra. I will actually like to know the mark-up of developers. Could the opaque real estate market allow developers, agents, and investors to charge high monopolistic rents?

Back to why house prices are so high, these can be summarised into four based on the factors of production needed to build houses (land, labour and capital).

- High cost of finance

The interest rates banks charge on loans affect the costs of houses built. Developers use a combination of equity and debt to build homes. Suppose a developer borrows money from a financial institution to build. In that case, the final sale price includes the cost of the loan. The interest charge is transferred to the homebuyer, which means the homebuyer eventually pays for the interest.

How much is this interest on construction finance? In 2021, banks charged from 15.97% to 24.89% per annum. So, a developer who borrows 5 million Ghana Cedis to develop an estate will have to pay a total nominal simple interest of 4 million Ghana Cedis in four years at 20% per annum. The actual future value of 5 million Ghana Cedis borrowed today in 4 years is 10,368,000 Ghana Cedis at 20% p.a.

This amount will be priced into the sale prices of the houses. The developer may also price in the holding costs (the time it will take before the homes are purchased).

Because of the high cost of construction finance, many developers avoid bank loans.

Watch out for our upcoming paper on residential financing innovations by Ghanaian housing developers.

On top of the interest on the developer’s loan, the homebuyer typically needs a mortgage to buy a house. These costly mortgages averaged 23% per annum in 2020, worsening housing unaffordability.

For a 100% mortgage of 50,000 US dollars for 20 years at 20% p.a, one will pay over 200,000 dollars in interest alone. Crazy, isn’t it?. That is four times the loan amount.

Why are banks charging so much interest on mortgages and generally loans for property development? One primary reason is the insecurities in the land market, which makes the rights associated with landed property not very transactable.

The recently introduced government subsidised mortgages may help. These are going for 11-21.1% per annum and are accessible by only government workers.

- Incomes are too low

You most likely receive a salary or wage. How much is it? Incomes are generally too low to afford houses. Level 25, one of the highest on the single spine, will earn you less than 7,000 Cedis per month.

Accra has the highest average income per family at 63,027 Cedis per year. Income inequalities are also vast, with 20% of households earning 58.6% of total income earned in the Greater Accra region.

The highest income per individual recorded in the Ghana Living Standard Survey 7 survey was 12,000 Ghana Cedis per month. Of course, it does not mean that people are not earning more than this figure.

But even for a family earning 16,000 cedis monthly (192,000 cedis gross annually), they will struggle to afford a house priced at 200,000 USD (house price to income ratio of 8.0).

Households who earn the average income in Accra of GHS5,252.30 (700 US dollars) gross monthly can’t even go near a house priced at 50,000 US Dollars (383,371 Ghana Cedis) (house price to income ratio of 6.1). Throw in the cost of mortgages at 20% per annum, and the unaffordability reaches critically low levels.

Incomes in Ghana are too low. And low income limits the space for technological innovation. Even if you use whatever technology, the opportunity to make housing affordable is determined by the meagre incomes.

As the director of Lakeside Estates, in an earlier interview, pointed out:

It is easy to build a million-dollar house. Building a 30,000-dollar house is difficult.

Salah Kweku Kalmoni (2020)

Graham concludes this way on housing unaffordability in Sub-saharan African countries. He worked as the international consultant on five African National Urban Housing Profiles (Malawi, Ghana, Zambia, Liberia and Lesotho) and did additional work in Sierra Leone and Ethiopia.

The main issue is, however, not that housing in Anglophone Sub-Saharan Africa is too expensive; it is that incomes are too low.”

- Depreciation of the cedi against the US dollar

The other part of the problem is the depreciating cedi. Its effects cut across the cost of building materials, labour and bank loans. The crucial problem with the depreciating Ghana Cedi is that over 90% of building materials are imported as finished or semi-finished products.

Importing most building materials exposes their prices to foreign currency exchange volatilities, import duties, and other taxes.

The depreciating cedi also increases the developer’s holding costs. If it takes a house 8 months to sell, its price must be revised upwards for the developer to stay in business by the time it does. Otherwise, the sale price will struggle to build again due to the cedi’s fall. That’s why houses are priced in US dollars.

In just 6 years (2016-2022), data from the Center for Affordable Housing Finance shows that the cedi’s depreciation caused the cost of building a 55 sq. meter house to increase by 88%. It grew from 156,000 Ghana Cedis to 293,895 Ghana Cedis. If the currency continues to fall against the US Dollar, it will worsen by the year’s end.

So we really need to talk about the impact of the falling cedi on housing affordability.

- High transaction costs in housing development

Significant transaction costs plague building houses in the country. These are hidden costs. Try obtaining planning permits or registering your plot of land at the Lands Commission. The process is overly bureaucratic and time-consuming. It recently took me about 1 year to register my land deeds. I shouldn’t mention the facilitation fees one may have to pay to get things done in good time. Developers also face these challenges.

During construction, theft, dishonesty and poor craftsmanship abound. If it is not bags of cement that gets stolen, the quantity of paint needed is overestimated. Ask any developer, and they will tell you.

Godwin, you will be surprised to know that some workers steal even nails and put it in their hair when leaving the project site. That may not seem much, but if you have 4 or more staff doing that over a few weeks. . .it accumulates,Says Mr Gabby Mattouk, former CEO of Paraku Estate, in my recent interview with him.

As a developer narrated to me recently, I was shocked at this trick sand and stone dealers use. Instead of a full tipper truckload of sand, they will only heap the sand as if the bucket is full. In essence, instead of the 3 trips, you needed, now you need 5 trips of sand because each trip is lesser than the usual.

I bet you didn’t know that!

As for poor craftsmanship, it is not only masons or carpenters who do shabby work. Anyone in the construction process can do messy work, causing you to redo the work.

“My biggest problem in this country on innovation in construction is not materials, it’s about labour and the labour skills. .. because it’s usually still the old hammer, look they’re cutting the timber over there. Go and see “chuku chuku.”. . . come and see our carpenter here spend half a day to go take the measurements. Some don’t even know how to use the square.”says Mr Osei Baffour, CEO of GHS Estates, whom I interviewed in 2020 as part of PhD research.

Let’s turn to taxes on imported building materials and facilitation at the ports. A large part of the cost of importing building materials is actually that most building materials are imported. Compounding the problem is the depreciating cedi.

Why not follow me on Twitter for updates?

Reducing the housing unaffordability in Ghana

I am reluctant to sound prescriptive or as if there is some bullet. Some strategies like increased government funding for affordable housing (incl. public-private partnership arrangements) state the obvious. I will skip such. See here if you’re interested in a wide range of affordable housing strategies.

- Improving labour productivity and specialisation to increase incomes

Everyone is practically a jake of all trades. However, worthwhile incomes can not be realised if the Ghanaian labour remains underemployed, provides low-value services, and produces low-value products. Better incomes require high-value jobs. The economy needs to transition to this phase.

- Improvements and standardisation of tradespersons’ skills

It is crucial to standardise the skills of masons, bricklayers, carpenters, plumbers, tilers, electricians, etc. One should not just get up one day and say he is a carpenter. The apprenticeship must have basic standards across the country and not be left to the caprices of the master. Poorly skilled masters train and transfer terrible skills and workmanship to others.

After training, each tradesperson should have compulsory insurance to cover their liabilities. You can’t ruin someone’s project and go scot-free. Compulsory insurance will help weed out unprofessional tradespersons.

A carpenter, for example, becomes riskier to insure because their insurer must pay for damages every time. Insurance premiums will increase where such persons are so expensive or no insurance company will insure them.

- Land tenure security

We can’t talk about housing affordability without the insecurities in the land market. You’re most likely going to pay multiple times for the same piece of land and build an unnecessary fencing wall to protect it. Sometimes it is not even because you cannot afford the price of the land; it is that you fear losing it after the purchase. Property rights are highly insecure, even if you have a title or deed. It ties in with the cost of finance.

Banks are equally concerned about the insecurities in the land market. These risks are priced into those expensive interest rates they charge.

I think the process of land registration should be reversed. The seller (with alludial or freehold interest) has the legal responsibility to register the land. This means before any land can be sold, it must already be registered.

Anyone interested in a piece of land must contract a conveyancer with insurance indemnity to transact on their behalf.

If anything goes wrong, the insurance will compensate the buyer. In contrast, the insurance premium of the conveyancer increases accordingly to prevent collusive behaviour between the conveyancer and the landlord.

It will make land transactions more secure and safeguard the lessee’s interest.

- Lower transaction costs and market transparency

Many masons are around, but try finding a good one and realise something. It is hard! Obtaining the necessary government permits is cumbersome. Those who abide by the rules are punished which all kinds of fees. Long bureaucracy and facilitation fees contribute to making housing expensive. Why can’t one apply for a permit and monitor its status online?

- Currency stabilisation

This is easier said than done. Bawumia promised everything but with limited success. That notwithstanding, halting the rapid depreciation of the cedi is crucial to attaining affordability.

References

- Centre for Affordable Housing Finance in Africa. (2017). Housing Finance in Africa: A review of some of Africa’s housing finance markets. South Africa

- Karley, N. (2008). Ghana Residential Property Delivery Constraints and Affordability Analysis. Housing Finance International, 22(4), 22–29.

- UN-HABITAT. (2011). Ghana Housing Profile. Nairobi