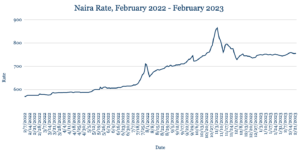

As Nigerians prepare to go to the polls on Saturday to elect a new president, a cash shortage caused by a policy to exchange old Naira notes for newly designed bills continues to cripple the economy, creating a rift in the ruling All Progressives Congress (APC) party. The note swap plan championed by incumbent President Muhammadu Buhari has led to violent protests across the country and resulted in a temporary suspension of banking operations in some states. Several governors have petitioned the Supreme Court to overturn the policy, citing severe hardship faced by people and businesses dependent on cash for survival. Buhari’s apparent intention behind the policy is to curb vote buying by politicians, turning a deaf ear to APC governors who have made repeated calls to postpone the implementation of the policy. Amid fears of the current tensions spilling over to political violence, Buhari said he’s mobilising military and security agents to monitor polling stations for evidence of vote rigging. The severe cash shortage has held the currency steady in spite of the economic turmoil, with the Naira strengthening marginally against the dollar to 755 from 756 at last week’s close. In this context, resolving the cash shortage has become more significant for the Naira outlook than the election result—with the rate likely to hold around current levels until Naira supplies recover.

Ghana’s latest ratings downgrade drives Cedi lower

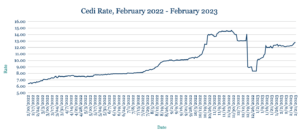

The Cedi weakened against the dollar, trading at 12.76 from 12.38 at last week’s close as Fitch Ratings cut Ghana’s foreign currency credit rating to ‘restricted default’ after the country missed a $40.6m coupon payment on one of its outstanding Eurobonds. The downgrade aligns with Fitch’s local currency rating, which was cut earlier this month. The foreign debt default was largely expected after Ghana said it would suspend payments on certain bonds as part of its restructuring plan to unlock $3bn in emergency funding from the IMF. The country faces pushback from bondholders over preferential treatment for bilateral lenders, who are being offered better terms in the debt restructuring. Against this backdrop—and with inflation remaining elevated despite a slight improvement in January—we expect the Cedi to depreciate further in the near term.

Rand sinks to lowest in more than 3 months

The Rand depreciated against the dollar, trading at 18.25 from 18.05 at last Friday’s close—its weakest level since early November. The currency is being dragged lower by broad risk-off sentiment globally and ongoing domestic concerns about the electricity crisis. In an effort to ease concerns about Eskom’s finances, South Africa’s government said it will take on more than half of the power company’s debt over the next three years to help strengthen the balance sheet and avoid the risk of default. We expect the Rand to continue trading with an 18 handle in the near term, mainly due to the risk-off mood that is impacting emerging markets FX.

Egypt issues debut $1.5bn sukuk

The Pound depreciated against the dollar, trading at 30.60 from 30.48 at last week’s close, amid broader risk-off sentiment and a stronger dollar. Egypt this week issued its debut Islamic finance bond, or sukuk, raising $1.5bn. The three-year deal priced to yield 11%, having attracted investor demand of more than $5bn. The deal provides some relief to Egypt’s finance ministry given the country’s need to boost FX inflows and repay existing debt. We expect the Pound depreciate further in the week ahead mainly due to dollar strength.

Kenyan Shilling hits new low as FX reserves dwindle

The Shilling weakened to a fresh low against the dollar, trading at 126.15 from 125.90 at last week’s close amid increased FX demand from the oil and energy sector. The currency has now lost more than 2% of its value this year. Kenya’s foreign currency reserves also dropped to a new record low $6.88bn from $6.94bn the previous week. There are signs of recovery in FX flows: Kenya secured a $27m funding deal with the European Union to boost exports to the 27-nation bloc and strengthen the overall business environment. The government is also anticipating $3.4bn in tourism-related earnings this year as it expects tourist numbers to exceed pre-pandemic levels. In the immediate term, however, we expect the Shilling to remain under pressure as importers clamour for dollars to meet month-end obligations.

Ugandan austerity plan pushes Shilling lower

The Shilling depreciated against the dollar, trading at 3700 from 3671 at last week’s close amid concerns about the country’s finances. Uganda’s government announced a raft of austerity measures to help ease its budget pressures and reverse the rising debt servicing burden, including imposing a freeze on new government hires and pay rises. Uganda will also limit foreign travel for officials and won’t take on any new loans in the next financial year at least to help cut debt costs. We expect the Shilling to weaken in the near term given tighter budgetary conditions and ongoing inflationary pressures that are weighing on the cost-of-living.

Tanzania gives go-ahead to Uganda pipeline

The Shilling was marginally weaker against the dollar, trading at 2341 from 2340 at last week’s close. Tanzania’s government this week gave the greenlight to construction of a $3.5bn oil pipeline transporting crude from Uganda to the port of Tanga for export in the face of opposition over its potential environmental impact. The project is backed by French oil company TotalEnergies, the Uganda National Oil Company and the China National Offshore Oil Corporation. We expect the Shilling to continue trading around current levels near term.

West African central bank reserves drop 19%

The Central Bank of West African States reported significant declines in FX reserves for the end of 2022 as soaring global inflation drove up the cost of energy and food imports. FX reserves fell by almost a fifth to XOF11tr from just over XOF14tr at the end of 2021. That is sufficient for 4.4 months of imports—below the central bank’s target of six months of import cover. Côte d’Ivoire, Burkina Faso, Niger and Senegal raised a combined XOF144.17bn in their latest bond auction, less than the XOF170bn targeted. Some bids were rejected following the central bank’s move last week to raise its Covid-era borrowing rate. Côte d’Ivoire borrowed for one year at an average yield of 4.71%, Burkina Faso for five years at 6.85%, Niger for seven years at 8.85% and Senegal for three years at 6.93%.

Cmeroon annual inflation at double target

Cameroon saw annual inflation hit its highest level in almost three decades at the end of 2022, reaching 6.3%—twice the 3% target for members of the Central African Economic and Monetary Community. Cameroon’s prices have been pushed higher by imported food products and agricultural inputs that have been impacted by Russia’s war in Ukraine. The country’s statistics agency also cited the XAF’s decline against the dollar for the increased import costs. The XAF had depreciated to 614.46 at the end of 2022 from 579.60 a year earlier. It is currently trading at 616.96.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.