The Cedi depreciated against the dollar, trading at 12.27 from 12.21 at last week’s close as FX demand increased. As the government completed its domestic debt exchange programme with an 80% participation rate, Fitch Ratings cut Ghana’s local credit rating further into junk territory at ‘restricted default’ from its previous C level (the foreign currency rating remains at C). This followed the recent default on local bonds that were due to mature in early February. Annual inflation slowed marginally in January to 53.6% from 54.1% a month earlier. We expect the Cedi to remain under pressure in the near term as dollar demand continues to outweigh supply.

Nigeria election run-off risk means depreciation stalled

Nigeria’s political backdrop remains tense a week before the presidential election amid ongoing scarcity of cash caused by the central bank’s push for new Naira notes in exchange for old ones. After the Supreme Court intervened to extend a deadline for swapping the notes, the central bank doubled down by declaring that 1,000, 500 and 200-denomination notes would no longer be recognised as legal tender. That move was also halted by the court pending the outcome of a lawsuit brought by three state governors contesting the initial note exchange plan. Meantime, prices are soaring, with annual inflation in January at the highest since September 2005 at 21.8%.

The country could face an extended period of uncertainty, with polls predicting a tight race between the three main candidates, with Labour Party candidate Peter Obi as favourite to win. His victory would mark be the first time since the end of military rule in 1999 that neither of the two main political parties has held power. However, candidates can only win in the first round by getting at least 25% of votes in more than two-thirds of the country’s states. The two main parties claim Obi’s popularity is spread too thinly across the country. A run-off scenario would mean an additional 21 days to conduct a second ballot, with many business activities suspended pending final outcome.

While extended political uncertainty could stall foreign investment into the country, reduced domestic business activity may ultimately ease pressure on the Naira as FX demand stalls. The Naira was marginally weaker against the dollar this week, trading at 758 from 754 at Friday’s close. We expect further gradual depreciation once business resumes fully after the elections.

Power crisis keeps Rand under pressure

The Rand was marginally weaker against the dollar, trading at 17.95 from 17.91 at last Friday’s close. South Africa’s annual inflation rate eased slightly in January to 6.9% from 7.2% in December, marking the third straight month of declines and the slowest pace of price increases since May. While food prices accelerated 13.4% in January—the highest since April 2009—a drop in fuel prices brought the overall rate down. Business confidence declined in January, mainly due to the adverse effects of the country’s worsening power crisis. South Africa’s Chamber of Commerce and Industry (SACCI), which publishes the country’s business confidence index, called for urgent action to address Eskom’s capacity constraints and restore full generating capabilities. Given the scale and frequency of the country’s ongoing power cuts, we expect the Rand to weaken further in the near term.

Record food inflation pressures Egypt Pound

The Pound weakened marginally against the dollar, trading at 30.62 from 30.43 at last week’s close. Egypt’s annual inflation rate increased to 25.8%—the highest in five years. Food prices are rising at the fastest pace on record, pressuring households across the country (eggs are now considered a luxury item). In an effort to raise much needed dollar liquidity, the government is continuing to sell off state assets to Gulf nations, including Qatar, the UAE and Saudi Arabia, which are seeking to diversify their economies away from oil and gas. Egypt’s Prime Minister Moustafa Madbouly said the country is seeking to sell stakes in around 32 companies over the next 12 months. We expect the Pound to continue its gradual depreciation in the near term.

Shilling at fresh low as Kenya reserves dwindle

The Shilling hit a fresh record low, trading at 125.50 from 125.30 at last week’s close on the back of a stronger dollar and continued importer FX demand that outstrips supply. The US export credit agency this week issued a default notice for late payment on a KES57.8bn loan to Kenya Airways that was guaranteed by the government. Dollar-debt repayments have seen the country’s FX reserves sink to a near 10-year low of $6.9bn, enough for 3.88 months of import cover. The East African Community economic bloc urges members to hold sufficient reserves for at least 4 ½ months of import cover. To that end, we expect to see further pressure on the Shilling in the week ahead.

Ugandan Shilling stable amid push for grain quality standards

The Shilling was unchanged against the dollar, trading at 3665, in line with last week’s close. Ugandan grain producers and exporters are due to meet with Kenyan buyers later this year to establish trade standards in the grain industry and reduce potential disputes over quality. The country’s Ministry of Agriculture has raised concerns about the quality of post-harvest crops and is seeking to compel farmers to maintain quality crop production if it is to remain competitive in international markets. With that in mind, we expect the Shilling to weaken in the near term.

Tanzania Shilling steady as World Bank predicts 5.3% growth

The Shilling was little changed against the dollar, trading at 2338, slightly weaker than last week’s close of 2337. The World Bank said Tanzania’s economy will expand 5.3% this year, up from 4.6% last year and above the Sub-Saharan Africa average of 3.3%. Further growth is likely to be constrained by the broader global slowdown amid Russia’s war in Ukraine. The Bank of Tanzania said it will continue to use monetary policy to protect the country against inflationary pressures. FX reserves declined to $5.18bn at the end of last year from $6.39bn at the end of 2021, with the bank urging the private sector to increase exports to help boost dollar inflows. We expect the Shilling to be steady in the week ahead as the central bank remains active in the FX market.

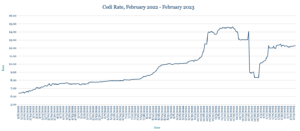

West African commercial banks to pay more for funding

The Central Bank of West Africa States has reinstated its variable lending rate to commercial banks, ending the fixed rate of 2.75% it had put in place to counter the economic effects of Covid-19. This week it lent out XOF6tr at a weighted average rate of 3.05%. Ivory Coast, Mali, Benin and Togo have this month raised more than XOF140bn in bond issuance—investors demanded a record high 7.5% return on Mali’s three-year bonds, while Ivory Coast will pay 6.04%. Senegal inaugurated a 120 megawatt, XOF101bn power station financed by the government and lenders including the African Development Bank.

Cameroon subsidy cut sparks fuel inflation

The Cameroon government this month reduced fuel subsidies as part of its recent staff level agreement with the IMF to access almost $75m in funding. Fuel prices increased 15% to XAF730 from XAF630, with diesel prices increasing 25% to XAF720 from XAF545. The potential for higher inflation is already starting to brew as the government has agreed to let taxi drivers hike fares by 20% in response to the fuel subsidy cuts. Congo is set to receive $84m in funding from the IMF as part of a three-year $455m extended credit facility to help the country maintain macroeconomic stability and support the economy’s recovery from the Covid-19 pandemic. The CFA remains pegged to the euro at around 655.96.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.