Consumer inflation declined to 53.6 percent in January, marking the first time in the last 19 months that a fall in the year-on-year inflation rate has been recorded.

The inflation rate had accelerated for 19 consecutive months, ending at 54.1 percent year on year in December 2022 according to data from Ghana Statistical Services (GSS).

In January’s data, the non-food inflation group saw a decline, resulting in the reversal; but the rate still sits at around 5.36 x above the Bank of Ghana’s upper policy target of 10 percent. Non-food inflation was 47.9 percent, down from 49.9 percent in the previous month, while food inflation stood at 61.0 percent – up from 59.7 percent in December.

On a month by month basis, inflation between December 2022 and January 2023 fell by 1.7 percent, signalling a reduction in inflationary pressures. Food inflation was at 2.8 percent and non-food inflation 0.8 percent.

Inflation for locally produced items was at 50.0 percent, while imported items had an inflation rate of 62.5 percent. The decline in inflation is a positive sign for Ghana’s economy, and government will be looking to build on this momentum by introducing policies that can control rates in the future.

Highlighting the drivers of decline in January 2023 inflation, Government Statistician, Professor Kobina Annim, observed that the decline in non-food inflation to 47.9 percent during the period from 49.9 percent largely contributed to the overall decline in consumer inflation – notwithstanding the increase in food inflation from 59.7 percent in the previous month to 61 percent in January 2023.

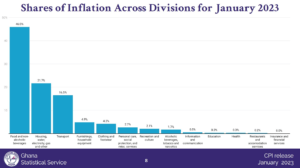

While commenting on the share of inflation across the various divisions, Prof. Annim indicated that the top-three drivers of inflation during the period were food and non-alcoholic beverages, leading by 46 percent from the 47.5 percent recorded in the previous month; followed by housing, water electricity, gas and other fuels from 15.7 percent to 21.7 percent in January; and Transport, from 14 percent to 16.5 percent.

Further to this, across the 13 divisions of inflation, the GSS also noted that of the top five divisions leading to the current inflationary record, the leading four were from the non-food group. They include furnishings, household equipment and routine household maintenance which recorded 71.7 percent; followed by housing, water electricity, gas and other fuels leading by 71.7 percent. And then Transport, which logged 68.8 percent while personal care, social protection and miscellaneous goods and services registered 63.1 percent; and lastly, food and non-alcoholic beverages at 61 percent.

MPC Actions

In an effort to drive inflation on a downward path, the Monetary Policy Committee (MPC) of the Bank of Ghana has further raised the policy rate by 100 basis points to 28 percent from 27 percent.

During 2022, the central bank cumulatively increased the benchmark policy rate by 1250 basis points to 27 percent – the highest rate in almost two decades, as the MPC remains resolute in its stance at least through Q1-2023; until inflation shows signs of moderation and the implementation of other available monetary tools to control the money supply reins-in inflation.

The Bank of Ghana Governor, Dr. Ernest Addison, at a press briefing on the MPC’s actions expressed the importance of moderating liquidity in the system in order to underpin macroeconomic adjustments taking place to drive inflation on a downward path.

“In the interim, the MPC sees the need to remain vigilant and moderate liquidity in the system to underpin macroeconomic adjustments taking place to drive inflation on a downward path. Under the circumstances, the Committee decided to increase the policy rate by 100 basis points to 28 percent,” the Governor said.

Although the central bank expects inflation to peak in Q1-2023, the Governor noted that the Bank expects to bring inflation back to the medium-term inflation target band of 8±2 percent in the next four year, amid the International Monetary Funds (IMF) programme.

“We are focused on our mandate and try as much as possible to take policy decisions which will help bridge the inflation gap. In that context, the direction of inflation is not only going to be determined by the policy rate but also a whole lot of other factors, including the macroeconomic framework which we have described.

“If you look at the time-frame, we’re looking at three to four years. This is what the IMF programme is designed to do. During that time-frame, we expect to bring inflation down to the target of a single digit, thus a medium-term inflation target band of 8±2 percent. So, this is really the objective of monetary policy over the next three to four or five years,” the Governor added.

The MPC believes that these measures will help restore fiscal and debt sustainability and bring down inflation, as well as help stabilise the cedi.