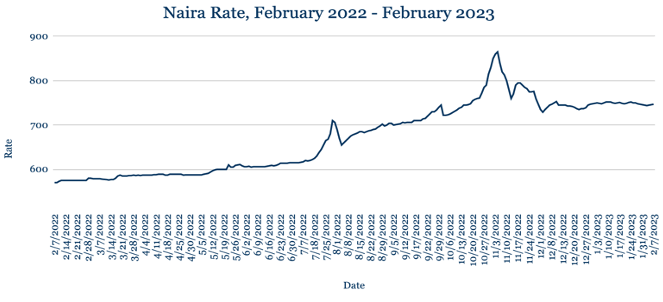

Two weeks before Nigeria’s election, a scarcity of cash and fuel is stoking chaos in the country. After clashes at empty ATMs and accusations of banks hoarding new Naira bills, the Supreme Court on Wednesday suspended the central bank’s second deadline to end the use of old bank notes. Meanwhile, Africa’s biggest oil exporting nation continues to struggle with severe petrol shortages, with retailers unwilling accept old Naira notes and to sell at official subsidized rates. Amidst concern that cash and fuel shortages will prevent the mobilisation and payment of officials by the Electoral Commission of Nigeria, its Chairman Mahmood Yakubu said on Wednesday that polling will go ahead as scheduled on Feb. 25 and that the Commission is working with the national oil company and the central bank to assure supplies. Turnout to the polling stations could prove the deciding factor, with a Stears poll this week putting Labour’s Peter Obi as favourite in the event of high voter turnout and the ruling APC’s Bola Tinubu given a low turnout. For the currency markets, the lack of physical cash has held the Naira stable against the dollar this week, trading at 747 from 748 at last week’s close. We expect renewed Naira weakness once the new notes are fully circulating and business returns to normal.

Cedi climbs as Ghana sweetens debt restructuring offer

The Cedi appreciated against the dollar, trading at 12.05 from 12.25 at last week’s close as FX demand eased. The Bank of Ghana sold only $9.2m of dollars in the spot market last week, compared to $40m at the previous Jan. 30 sale. Ghana is sweetening its debt swap offer to encourage participation of local pension funds, which would under the latest plan receive their full interest payments but over a longer time horizon. Other bondholders will receive lower interest payments as part of the debt swap. Ghana is also expected to convert around GHS40bn of loans it owes to the central bank into bonds as part of the broader restructuring plan to unlock a $3bn IMF bailout. As the country continues to advance with its restructuring efforts, we expect the Cedi to appreciate in the near term.

Rand hits three-month low as PMI signals contraction

The Rand slumped to its lowest level since November, trading at 17.82 from 17.48 at last week’s close as energy shortages hamper economic activity. S&P Global’s South Africa Purchasing Managers’ Index fell to 48.7 in January from 50.2 in December, signalling a contraction in activity. The country’s capital expenditure also fell by more than a third last year as the government scaled back spending on infrastructure projects. The economy continues to be crippled by ongoing rolling power blackouts, with food insecurity and unemployment rising. We expect the Rand to continue its current downward trajectory in the short term as investors seek better alternatives.

Egypt Pound nears record low after Moody’s cut

The Pound weakened against the dollar, trading at 30.43 from 30.28 at last week’s close, continuing its slide towards its record low 30.50 hit in early January. Moody’s Investors Service cut Egypt’s credit rating one notch to B3, six levels below investment grade, citing reduced ability to deal with external macroeconomic shocks while the economy undergoes a structural adjustment towards private sector and export-led growth. Companies face deteriorating conditions as output prices rise at their fastest pace in six years and purchase cost-inflation is the highest in more than four years. We expect the Pound to continue depreciating until structural reforms start to take effect.

Kenya Shilling at new low while deficit narrows

The Shilling slipped to a fresh low against the dollar, trading at 124.92 from 124.62 at last week’s close amid sustained pressure from importers to meet their obligations and broader dollar strengthening. Shortages of foreign currency in Kenya have continued to weigh on business growth in the country. Despite such strains, the current account deficit was lower than forecast last year, coming in at 4.9% of GDP compared to 5.4% in 2021 on the back of increased exports and diaspora remittances towards the end of the year. The central bank had expected the deficit to hit 5.6% in 2022. With dollar demand continuing to outweigh supply, we expect the Shilling to remain under pressure in the coming days.

Shilling strengthens as Uganda resists rate rise

The Shilling strengthened against the dollar, trading at 3674 from 3684 at last week’s close. Uganda’s central bank kept its benchmark interest rate on hold at 10% for a second consecutive monetary policy meeting. The bank last raised by 100 basis points in October, with rates ending the year 350 basis points higher than they were at the start of 2022. Policymakers said the decision to hold rates was aimed at containing domestic demand pressure and supporting economic recovery. The bank said it expects inflation to slow to its 5% target by the end of the year despite inflation edging up to 10.4% last month. In the near term, we expect the Shilling to weaken amid continued food and energy price inflation.

Tanzanian Shilling back to 4-year low

The Shilling edged slightly weaker against the dollar, revisiting its 4-year low at 2340 from 2338 at last week’s close. It’s the second time this year that the Shilling has hit this level, the lowest since March 2019. Tanzania has sought to strengthen ties with Morocco as the North African country agreed to help develop a fertiliser factory in Kisarawe. The development will benefit both countries, which are looking to increase African fertiliser production to help tackle food insecurity on the continent. Tanzania’s stock market saw its market cap increase by 1.53% over the past week, though demand for 10-year treasury bonds fell during its last auction, with yields jumping 28 basis points to 11.0548%. We expect the Shilling to continue trading around current levels in the week ahead.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.