Credit analysis is a complete analysis of the client’s overall performance and the specific project to be financed with a loan in order to assess the credit risk – i.e., the creditworthiness of a loan applicant. The credit analysis is a component of the credit process, during which the bank must undertake a detailed examination of the enterprise’s operations and reason for the loan-financed project. Moreover, processing the loan application comprises a variety of qualitative and quantitative factors. The first concerns the borrower’s previous work, legal standing, management, loan security, competition, etc.

The quantitative analysis includes analysis of the company’s financial statements, as well as analysis of certain financial indicators. The ultimate purpose of the bank’s credit analysis is to evaluate the credit risk, or creditworthiness, of the loan application. For qualitative analysis, banks have a variety of tools at their disposal; including CAMPARI, PEST, SWOT, etc.

Lending is a constant worry for banks and financial institutions – because it is the primary operation that permits them to invest their resources and it is also their most profitable endeavour. Through lending, banks assist, on the one hand, the production of resources for businesses that need to finance investment initiatives; and on the other, they encourage fund holders to invest for profit (interest).

To attain a high rate of profitability, banks must take on some risks. In recent years, particularly following the global financial crisis and the banking sector clean-up in Ghana, the focus has been on changing business models to enable financial institutions build an effective risk assessment methodology without compromising profitability. Consequently, performance and risk in loan activities become essential market mechanisms, especially given Basel II requirements.

Credit risk is one of the primary risks a bank faces, and it is generated through client lending (individual or corporate). Investors are reimbursed by the borrower or issuer of a debt obligation in the form of interest payments for incurring credit risk. Credit risk is strongly related to the prospective return of an investment, therefore the rate of interest that investors will demand in exchange for loaning their capital is proportionate to the perceived credit risk.

Developing and applying credit risk management techniques has been a concern for many years; and it has progressed from traditional techniques, such as exposure assessment, to limiting excessive concentration on the debtor, business sector or industry level, to new management techniques such as transactions with swaps and options tailored to this type of risk.

Credit Evaluation or Analysis

The credit analysis is a method that evaluates the client’s, the borrower’s, creditworthiness. Creditworthiness refers to the borrower’s ability to get cash, i.e. credit, to utilise it and to repay it under precisely and stringently outlined circumstances.

This definition of credit analysis and creditworthiness demonstrates the necessity of completing a thorough and impartial credit analysis, which will provide a realistic picture of the borrower’s creditworthiness and allow the bank to avoid potentially problematic loans.

The credit analysis of a client who is a legal entity includes an evaluation of past business success, current market position, available human resources, the industry in which the client operates, the financial statements, justification for the project (to be financed), and information regarding the borrower’s credit history. This is in the direction of evaluating the borrower’s financial readiness and capacity to meet the responsibilities that would result from approval of the proposed loan amount.

A shallow and insufficient review of the borrower’s creditworthiness exposes the bank to greater credit risk than was anticipated in its credit policy.

Credit analysis requires further information and data analysis. Given that some of them have a quantitative nature and others a qualitative one, credit analysis can be viewed from two perspectives, such as:

- Qualitative analysis – includes an analysis of information related to the industry in which the company operates; its market position, its management, the manner in which the loan is secured, etc.

- Quantitative analysis – comprises an examination of the data extracted from the company’s financial statements.

Qualitative analysis

The qualitative study provides a clearer picture of the company in terms of its historical evolution, its primary business, the situation of the market in which it operates, condition of the branch and its customers and suppliers.

The advantage of this study is that it provides a chance with the qualitative components to uncover the potential risks of the business in future.

Each type of credit analysis addresses the same challenges. In this regard, the qualitative analysis of the loan application can be characterised by the abbreviation 5C or 6C (5Cs, 6Cs), which is derived from the initial letters of the regions considered during the study:

- Character – which reveals whether the debtor is responsible, honest, and whether there is a serious purpose to repay the loan in time.

- Capacity – assessment of the financial status of the borrower and its ability to adequately repay the loan.

- Capital or cash – i.e., the borrower’s ability to earn sufficient funds to repay the loan.

- Collateral – as a true cover for the loan.

- Macroeconomic conditions – i.e., the macroeconomic or sectorial situations that impact the borrower’s capacity to timely repay the loan.

- Quality control – i.e., evaluation of whether changes in legal and regulatory rules may have a negative impact on the creditworthiness of the borrower, and whether the loan application meets the quality criteria established by the regulatory body, Bank of Ghana.

The credit analysis also considers external elements over which the company has no control, but which might have a significant impact on the loan’s timely repayment. In actuality, this is about studying the borrower’s business environment. The following will be evaluated: developments in the borrower’s industry, technical trends in the industry, the borrower’s market position, the stability of his relationships with suppliers and customers, the phase of its economic cycle, and the future movement of interest rates. Long-term lending places a premium on an analysis of the borrower’s industry’s features, as well as its strengths and weaknesses in relation to competitors.

Analysis of Qualitative Factors

Structure of the company’s ownership

During his visit to the company, the credit officer will examine the borrower’s ownership structure to detect any probable relationships with other businesses – “statement of connection and credit obligations”. The finding of a possible relationship with other businesses is an indication that they should also undergo a financial analysis in order to form a complete picture of the borrower.

Historical growth of the business

By gaining an understanding of the company’s past, not only do we gain a better understanding of the company but we also discover the entrepreneurial capabilities of the client – as well as the extent to which they are flexible and willing to take advantage of market opportunities and to mitigate the risk and problems they face.

What is the company’s core business?

With this qualitative aspect, we must determine what the business is doing. It is therefore important to understand the client’s business in order to define all the fields that are relevant to analysis and assessment of possible risks. In order to acquire the required business information, it is necessary to determine the organisational structure of larger companies. In any quality analysis, the credit officer must have an in-depth understanding of the client’s industry.

Product, manufacturing process and technical equipment

The credit officer determines whether the object of the company activity is merchandise, products or services. Concerning this factor, the officer must determine the maximum and ideal production capacity, as well as whether or not there is a bottleneck in this process. In addition, it should examine the underlying assets and their obsolescence, as well as the costs associated with preserving the funds. Both the volume of inventory and length of time the client may go without purchasing fresh inventory are crucial pieces of information.

Market for the client

The credit officer should be knowledgeable about the client’s product, the competitors, and the product’s strengths, shortcomings and price. First, the client’s market must be defined geographically and in terms of the clients it serves.

Here is the list of some necessary questions to make a proper determination of the market:

- Who needs the products that the company produces or sells, and what is their purpose?

- What is the type of demand – i.e. what is their price elasticity and possible substitution with other products?

- Who buys the products? Who are the end-users? Are the products for final consumption or for further trade?

- Does the sale of products offer additional services, such as transporting products to the consumer etc.?

- Who are competitors of the borrower and how much is their market share?

- Is the borrower competitive based on pricing, quality or service in comparison to competitors?

- What is the potential demand for products, is the market overshadowed, what are the distribution channels of the product?

Buyers and suppliers

Relationship with buyers

Necessary information that bank needs about the companies’ buyers are as follows:

- What are the dynamics of buying, are they regular buyers or are ad hoc, can their plan be planned, what is the percentage of chargeability, etc.?

- What is the number of buyers? This information is necessary due to diversification of the risk of collecting receivables.

Relationship with suppliers

Necessary information to be obtained for suppliers of the company are as follows:

- How many suppliers does the client operate with?

- Is the client dependent on one supplier?

- How easily can new suppliers be found?

- Who pays the transport costs?

Quantitative analysis

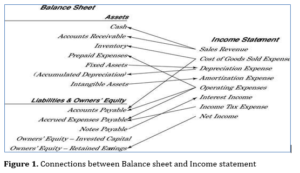

Quantitative analysis focuses primarily on the company’s financial statements, such as the Balance Sheet, Income Statement and Cash Flow Statement. The income statement and cash flow statement describe the business’s historical economic status. The balance sheet is a snapshot of the current state of a company’s assets and liabilities.

Analysis of Financial Statement

Assessment of liquid assets

Cash in bank accounts, cash on hand and bank deposits constitute liquid assets. On the day of the analysis, it is crucial for the credit officer to review the client’s accounts and, if he has accounts with other banks, to get extracts from all accounts (bank statement).

Evaluation of customer accounts receivable

Trade receivables are a form of working capital that must be converted to cash throughout the collection process. In a dialogue with the client, the corporate referent must disclose which claims are truly charged, consider up to five main consumers, and establish the method of collection and the terms agreed upon with the buyers.

The indicator for trade receivables collection might serve as an indicator for the average period of receivables collection:

Trade receivables X 365 / annual sales.

Evaluation of inventory

The corporate referent should examine the inventory structure and assess, through a conversation with the client, if the stock is competitive or uncompetitive. For example, if the season for a stock has already gone it will be sold at a discount for the next period, and its cost on the balance sheet at the time of the analysis will not be accurate.

The indicator of inventory turnover provides a strong basis for evaluating the stock and its age: Inventory x 365 / cost of goods sold.

If the client seeks for a loan for working capital, it is crucial that: for manufacturing enterprises, the loan repayment duration should coincide with the production process from the acquisition of raw materials to the sale and return of finished goods. For commercial enterprises, the loan should be repaid by selling the merchandise and collecting the claims.

Evaluation of obligations to suppliers

The client’s obligations to suppliers are a form of interest-free loan that must be repaid in the current year. It is essential to learn which customers suppliers depend on, the conditions of payment and whether payment is governed by payment guarantees or letters of credit. This information will provide a more accurate depiction of the company’s liquidity. The payment time for obligations owed to suppliers can be determined using the following indicator:

Short-term obligations to suppliers multiplied by 365 / the purchase price of items sold throughout the year.

Relationship between Balance Sheet and Income Statement

During preparation of the balance sheet and income statement, a check or cross-check is made between them.

Example 1:

If the value of the capital in a balance sheet of the company in 2021 is 100,000 cedis, the value of the capital in the balance sheet in 2022 is 120,000 cedis.

The net profit in the income statement in 2022 is, and should be, 20,000 cedis.

Second check: Total purchases during the year should match the costs of sold products (COGS) in the income statement. In order to make this check during the analysis, the credit officer will request information from the client for total purchases during the year.

Example 2:

Total purchases in 2022 amount to 250,000 cedis at purchase price (information received through a conversation with the client and can be confirmed with input invoices).

According to the income statement, the costs of sold products for 2022 were 260,000 cedis. The value of the stock for 2021 was 50,000 cedis, and in 2022 it was 55,000 cedis.

Initial stock + total purchases – final stock = costs of sold products 50,000 + 250,000 – 55,000 = 245,000

260,000 – 245,000 = 15,000

In our example, the deviation is 15,000 cedis, which can be accepted as an accurate check.

Example 3:

The client for 2022 has earned a profit of 50,000 cedis.

Changes in the balance sheet are as follow: the value of the capital in 2021 is 70.000 cedis (Y1), while in 2022 it is 90,000 cedis (Y2).

The client has taken part of the profit, net profit, from the business for private investment (purchasing of private apartment).

Check: Y2 – Y1 + PRIVATE INVESTMENTS = Net income 90,000 – 70,000 + 30,000 = 50,000.

The figure bellow shows the connection between balance sheet and income statement, which should be taken in consideration during the credit analysis of a company

Conclusion

Credit is a fundamental element of the contemporary economy and the global financial system. Credit expansion has been a crucial contributor to global economic growth and is frequently referred to as the lifeblood of the economy. Access to credit has supported expansion of the gross domestic product by increasing spending and resource allocation for productive reasons. Access to money for expansion, capital expenditures, research and development, and hiring has also contributed to the increased productivity and profitability of businesses.

Two major concerns have been voiced regarding operations of banks following the financial crisis: “too little, too late” provisioning for loan losses and “too big to fail”. The subject of credit risk management became not only a compliance requirement for banks, but also a crucial factor for determining the strategy and execution path.

During the dialogue with a customer, the credit officer must disclose the purpose of the loan and whether it is compatible with the company’s financial structure, existing activities and future goals. If it is an investment in a business building or piece of equipment, the client should be briefed on the investment strategy.

The cost of the loan should be less than the return on investment; otherwise, there is no economic logic to funding. For investors to establish if a firm has the financial capacity to satisfy its financial obligations, a thorough credit analysis is needed. Understanding and implementing the five Cs of credit analysis provides investors with a practical and effective methodology for assessing a corporate issuer’s creditworthiness. This framework consists of an evaluation of ability, collateral, covenants, character and credit rating. Credit analysis using the five Cs can aid in managing default risk, while it is by no means a guarantee against default.

Understanding of this loan appraisal process by the credit officer and the loan applicant can go a long way toward expediting the processing of loans, reducing the risk of default, and fostering a more amicable business relationship between banks and loan clients.

The writer is a Banker/Economic Policy Analyst

Email: [email protected]