…The cocoa farmer, KOA or KOA’s collaborators

The assessment of KOA’s transparency system continuous

Continued from Part 1

The other issue revealed is how KOA gains, and the farmer loses out on the currency depreciation:

As noted in Graph 1, the Ghana cedi depreciated as US dollar appreciated by 55 percent. This means the income earned by farmers from KOA lost 55 percent of its value in just a year. On the other hand, KOA’s sales revenue in USD gained 55 percent in value against the Ghana cedi. This means KOA needs less USD to purchase more cocoa pulp from Ghanaian cocoa farmers in Ghana cedis. So, for example, KOA used US$43,889 to buy GH¢254,556.2 worth of cocoa pulp in the 2021/22 crop year. In the 2022/23 crop year, KOA can use the same US$43,889 to purchase GH¢395,001 worth of cocoa pulp. If the farmers want to import any product or pay their children’s fees at Harvard in US dollars, they will need to search for more Ghana cedis to buy a few dollars to pay these fees. This demonstrates how KOA’s decision not to pay farmers in the same currency they sell their final product can lead to farmers losing, and KOA gaining on the currency exchange rate front. This is the main reason I advised KOA to price the cocoa pulp in USD so that at different points when they purchase it from farmers, the farmers can benefit from the USD appreciation to offset the ever-growing inflation rates in Ghana. This will ensure that farmers retain a higher value for their income and increase their purchasing power even during the inflationary period. Between the 2021/22 and 2022/23 crop years, the Ghana cedi depreciated by 55 percent.

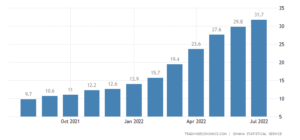

An example of the potency of my advice can be inferred from Graphs 2 and 3. From October 2021 to July 2022, Ghana’s inflation rate, as shown in Graph 3, has risen from 11 to 31.7. So, you can imagine how the 55 percent appreciation of the dollar against the Ghana cedi in graph 1, if the farmer were paid in dollars, would have offset the current 31.7 inflation rate, allowing the farmers to have a purchasing power that is inflation resistant.

Graph 3: Ghana’s inflation rate between October 2021 to July 2022

Source: Trading Economics with Raw data from Ghana Statistical Service

So, suppose KOA wants to be transparent as its transparency system aims, then they need to indicate the amount in Ghana cedis as that is the currency the farmers are paid in, or pay farmers in USD as I suggested. This will prevent misinformation issues and help farmers become resilient against inflation to deal with inflation-driven poverty.

“If KOA wants to be transparent, they must pay the cocoa farmers in the currency their finished product is sold. Suppose they still want to pay the farmers in Ghana cedis, they can agree on the exchange rate and indicate that exchange rate on the transparency system so that we can be sure that they are not leveraging the depreciation of the Ghana cedi to exploit cocoa farmers for profit. Consumers need to know how the purchase price of cocoa pulp keeps reducing in USD due to the Ghana cedi’s consistent depreciation. Transparency means providing a lot more details.”

Also, the system doesn’t indicate a detailed period in days, months or years in which a particular amount of cocoa pulp was purchased and an amount given. I believe this will make it easy to reconcile and audit their claims on the platform. One good thing about KOA is that they were willing to listen and consider recommendations, and feel that they need to get their feet held to the fire. KOA responded to this by highlighting that they started to verify transactions on 19th January, 2022, and that each transaction can then be seen as follows, which is quite detailed.

- Who are the stakeholders, what are their stakes, and how would you monitor their usage of the goodwill of the platform for their marketing gains?

Understanding the stakeholders of this platform was very critical to me. This is because a brand association has transferable positive outcomes for those who associate with it. KOA’s transparency system, like Fairtrade, could easily be hijacked by chocolatiers searching for means to improve their ESG ratings to please ethical consumers. Also, knowing the stake, the economic value of the brand and how farmers would benefit from it is essential because in the end, the transparency system would have a brand value. This information about the farmers will fuel this value.

KOA highlighted that the main stakeholders are their customers, who are business-to-business customers like Lindt, payment platform partners like MTN and verification partners like Seedtrace.

- Business-to-business customers

I asked if there was any set standard that their customers needed to meet regarding how much KOA pulp is used in their product to grant them the license to share in the benefits of the transparency system. KOA reflected on a discussion with one of their clients in line with this question. They discussed what percentage of KOA’s product should be in a customer’s product to allow them to claim the goodwill impact of KOA’s sustainable operations. While they haven’t firmed up the percentage KOA need to occupy in the ingredient composition of the customers’ product, they are currently considering at least 50 percent even though a lower percentage can also be considered. In addition, the customer needs to have KOA marketing and communications of their products. KOA felt that the value of KOA’s product is more than just a sweetener or an ingredient, but it is one connected to farmers and their community development. They are also looking to join the transparency system to a traceability system, where the farmers and the public know how much of their pulp was used in their customers’ products. I found this excellent as the system would move from just declaring a farmer’s income earned and food waste reduction to a traceability system which can help farmers negotiate their cocoa pulp price based on evidence.

I probed further to understand how much of the brand value in monetary terms would be awarded to the farmers. This is because KOA’s B2B customers will translate the benefits of their brand association with KOA and its transparency system into upward price adjustments for their products that contain KOA’s cocoa pulp ingredients. Ultimately, the transparency system leverages sensitive data from the farmers, which KOA or any other product supplier isn’t willing to put out there to the public. For example, KOA isn’t making public how much they paid to plastic or glass bottle manufacturing for their packaging. This is because that information has no value that is worth associating with their business-to-business customers. One of KOA’s executives felt this is a system they have curated on the seedtrace platform.

- MTN as the payment platform provider

I asked why they selected MTN Mobile Money as the payment medium for farmers. The management highlighted that their selection of mobile money was due to its accessibility to their partner farmers and the ease of integration with the transparency platform to enable payment traceability. They added that MTN Mobile Money was more convenient for the farmers as 95 percent of their partner farmers used it, and had a more extensive geographical coverage than the other providers. They talked about how E-Switch was limiting in terms of farmers’ access to banks that accept it and its implication to the environment as it comes in the form of plastic cards. Going to the bank was also perceived as an inconvenience to the farmer.

I felt the mobile money platform was selected because it facilitates the ‘radical transparency platform’ purpose, not necessarily its positive economic impact on the farmers’ income. The focus is on data generation and integration to demonstrate impact. Mobile money is a digital system that can help track payments. Its integration with the blockchain helps keep this mobile money receipts/invoices for both stakeholders, making it easy for payments to be tracked, reported and audited without human alteration.

Not using the E-Switch system due to its cost implication is not a solid argument even though I am not suggesting that it is the best system they should have used. Mobile money is one of the most financially regressive systems that harm the cost of living for poor people who use it. The transactional fee and the introduction of the 1 percent E-levy make it very costly for farmers. While Mobile money may be convenient, using that as the avenue for depositing farmers’ payments isn’t wise. Mobile money can be an alternative platform the farmer should choose to deposit money on for emergency cases. The increase in mobile money fraud makes farmers vulnerable to losing their entire income. Hence, the usage of mobile money costs the farmer much more and puts their monies at risk.

=================

The next article will discuss why KOA’s use of mobile money as the primary payment medium for farmers is problematic, and what KOA can do to ensure that the effects can be mitigated.

To support our independent research, consider paying for a subscription to cocoadiaries.substack.com/subscribe. You can equally engage us on a contract basis to consult on projects, research and strategy development within the Cocoa-Chocolate Industry.