Senegal’s economy is poised for 8% growth this year and 10.5% in 2024, according to the World Bank, in part as a result of the country benefitting from European efforts to diversify gas supplies away from Russia. Senegal is forecast to increase gas output to 2.5m tonnes this year and as much as 10m tonnes by 2030. While risks remain amid weaker global growth, tighter financial conditions, and inflationary pressures, Senegal looks destined to be among this year’s leaders for economic recovery, while pursuing longer term structural reforms under the ‘Emerging Senegal’ development model. Its currency, the CFA Franc, is pegged to the Euro.

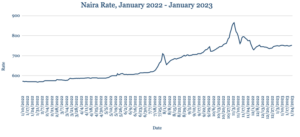

Naira slips as CBN hikes 100bps

The Naira weakened marginally against the dollar, trading at 752 from 749 at last week’s close. Nigeria’s central bank raised interest rates by 100 basis points to 17.5%, piling more pressure on small and medium-sized businesses already feeling the pinch from the struggling economy, the Naira note redesign, and a cap on over-the-counter withdrawals. While inflation slowed marginally in December to 21.34% from 21.47% a month earlier, the central bank said it remains resolved to mop up excess liquidity in the market and stem high inflation. With FX demand outweighing dollar supply, we expect the Naira to continue depreciating gradually in the coming weeks.

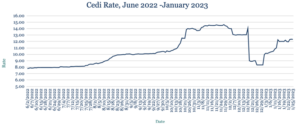

Ghana’s local debt exchange deal supporting Cedi

The Cedi depreciated marginally against the dollar, trading at 12.34 from 12.21 at last week’s close. The government and the Ghana Association of Banks said they reached agreement on the terms of a debt exchange programme for domestic banks holding Ghana’s local bonds. The government has agreed to pay a 5% coupon on its bonds maturing this year and 9% on all other restructured debt. The government had previously said it wouldn’t pay any interest on its 2023 bonds. Ghana also this week suspended the Bulk Oil Distribution Companies’ FX auction because the first batch of the gold-for-oil barter arrived. Despite the slight decline over the past week, we expect the debt deal for local banks to support the Cedi in the coming days.

Eskom crisis outweighs weaker dollar impact on Rand

The Rand was marginally weaker against the greenback, trading at 17.20 from 17.11 at last Friday’s close, as concerns about South Africa’s energy crisis outweighed the effects of broader dollar weakness. This is causing traders to doubt otherwise bullish signals for the Rand, given expectations of ongoing dollar weakness, a China-led global economic recovery and a more aggressive policy tightening stance in South Africa compared to the US. Problems at state-owned utility Eskom and the severity of its rolling power cuts mean domestic issues are likely to continue outweighing any positive external factors in the near term. We expect the Rand will continue trading between 17 and 17.20 in the coming week, barring any significant change in global risk sentiment.

Egyptian Pound stabilises as import backlog eases

After recent declines, the Pound was stable against the dollar this week, trading at 29.86 compared to 29.84 at last week’s close. Amid the weaker FX rate and five-year high inflation causing severe shortages of food staples, Egypt has now managed to clear almost half of the import backlog at its ports. This is partly due to increased FX availability and less stringent import regulations. About $5.3bn of goods were left uncleared in mid-January, down from $9.5bn in December. Economists are optimistic that Egypt’s economy will grow 4.8% this year, according to a Reuters’ poll, a faster pace than the government’s 4% prediction. We expect the Pound to remain around the 30 level in the short-term, absent any external shocks.

Kenyan Shilling hits new dollar low

The Shilling declined to a fresh record low against the dollar, trading at 124.10/124.30 from 124.00/124.20 at last week’s close, amid reduced liquidity in the interbank FX market and heightened dollar demand from importers—notably for oil and manufacturing. The Institute of Public Finance said Kenya’s economy will grow 5% this year, weighed down by higher commodity prices and the risk of debt distress. Investor wariness, adding to pressure on the Shilling, has not been helped by the new government’s plan to triple capital gains tax to 15% from 5%. While supported by Kenya’s FX reserves, which are adequate at just under $7.4bn, we expect the Shilling to remain under pressure over the coming week.

Debt levels crimp Uganda Shilling prospects

The Shilling weakened against the dollar, trading at 3689 from 3677 at last week’s close. Uganda outlined details of its long-delayed commercial oil drilling programme, commissioning the first of four oil rigs. It also started drilling its first production well at the Kingfisher development near Lake Albert in western Uganda. The Kingfisher development is being operated by China’s state-oil company China National Offshore Oil Corporation (CNOOC). Another development project is being operated by France’s TotalEnergies. Uganda hopes to be pumping oil by 2025 and expects to reach peak production of 230,000 barrels a day. Given the high levels of debt the country has taken on—particularly from China—we expect the Shilling to weaken in the near term.

Tanzanian Shilling lowest in almost 4 years

The Shilling depreciated to its lowest level in almost four years, trading at 2340 from 2336 at last week’s close. Foreign investors have sold TZS4bn-worth of shares over the past three weeks, according to the Dar es Salaam Stock Exchange. Equity analysts cited depressed share prices and a broader risk-off approach amid concerns about the global economy among reasons for the outflows. With Tanzania’s central bank selling FX reserves, we expect the Shilling to continue weakening against the dollar in the week ahead.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.