Private pension funds have maintained their strong growth over the years, reaching a record high of GH¢28billion in 2021 from the previous year’s GH¢22billion.

The increase represents 27 percent, with private pension funds – the mandatory 2nd Tier and voluntary 3rd Tier schemes – now controlling a 71 percent share of the industry’s total assets under management (AUM) in the year under review, latest data from the National Pensions Regulatory Authority (NPRA) show.

A breakdown of private schemes shows that the 2nd Tier accounted for GH¢20.3billion – 72 percent of private pension assets, with the 3rd Tier contributing GH¢7.7billion, 28 percent.

The Basic National Social Security Scheme (BNSSS) or 1st Tier, managed by SSNIT, controls the industry’s remaining 29 percent of assets – which translates into GH¢11.9billion from 1.7 million active contributors.

This brings total pension funds of the three-tier pension scheme as at the end of December 2021 to GH¢39.6billion compared to GH¢33.5billion recorded in 2020. The 2021 AUM is an increase of GH¢6.1billion and a growth of 18 percent from the previous year.

The increase, according to the regulator, is attributable to improvement in the collection of contributions during the year under review.

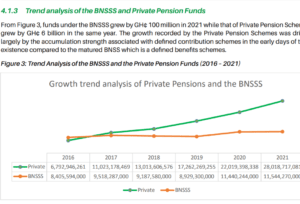

Meanwhile, a study of pension funds’ growth under the 3-Tier Pension Scheme from 2016 to 2021 shows an annual average growth rate of 21 percent. Private sector pension Schemes consist of the mandatory Occupational Pension Scheme (2nd Tier) and the Voluntary Provident Fund Scheme and Personal Pension Scheme (3rd Tier).

Together with the BNSSS they make up the three-tier pension scheme launched in September 2009, with its implementation starting in January 2010. “Generally, pension coverage improved in the year under review, with both the BNSSS (1st Tier) and private pensions (2nd and 3rd Tiers) recording increases in the number of contributors,” said NPRA’s Chief Executive Officer, Hayford Attah Krufi.

The number of active contributors on the mandatory BNSSS was 1.7 million at end of the year, compared to 1.6 million in the previous year. The mandatory 2nd Tier also increased from 2.1 million in 2020 to 3.2 million by the close of 2021. The number enrolled under various informal sector schemes meanwhile stood at 415,950.