Pressure on Africa’s central banks to raise interest rates continues into 2023 amid lingering inflationary strains. Sierra Leone became the first African country to hike rates this year, lifting its benchmark 125 basis points to 18.25% last week. The Leone lost 68% of its value against the dollar in 2022, and is currently trading at 19,090. Annual inflation soared to 43.62% in November. Elsewhere in West Africa, inflation is even more rampant. Ghana’s inflation hit a record 54.1%, the seventh highest in the world, last month. Inflation has been above the central bank’s target ceiling of 10% since September 2021, fueling a currency and debt crisis that pushed the Bank of Ghana to raise interest rates to 27% last year. Defending currencies against depreciation adds to pressure for further rate hikes in the year ahead.

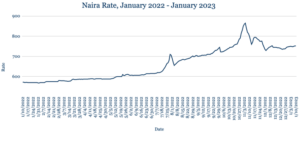

Naira weaker as World Bank pares Nigeria GDP outlook

The Naira weakened against the dollar, trading at 752 from 748 at last week’s close following a gradual pick up in FX demand. The World Bank says it expects Nigeria’s economy to grow at a slower rate than previously forecast, predicting 2.9% GDP expansion this year compared to an earlier estimate of 3.1%. The bank pointed to continued weakness in the country’s oil sector, which has been hard hit by pipeline attacks and theft, leading to production shutdowns and curtailing Nigeria’s ability to take advantage of last year’s elevated oil prices. With crude prices moderating and security issues persisting, the country’s oil production outlook remains challenged. We expect FX demand to further weaken the Naira in the near term.

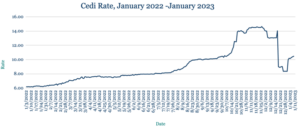

Record high inflation weighs on weaker Cedi

The Cedi tumbled against the dollar, trading at 11.02 from 10.20 at last week’s close as December’s debt default continues to weigh on the currency. With Ghana’s annual inflation hitting a record 54.1% last month—the seventh highest rate in the world—investors are continuing to exit the market. Inflation has been above the central bank’s target ceiling of 10% since September 2021. The World Bank says it expects Ghana’s economy to expand 2.7% this year, below the sub-Saharan Africa average of 3.6%, citing rising public debt, high inflation and the depreciating Cedi for the country’s weaker growth outlook. We expect the Cedi to trade in the 11 to 12.5 range in the coming week.

Risk-on Rand rally capped by power challenges

The Rand strengthened against the dollar, trading at 16.95 from 17.11 at last week’s close amid a broader risk-on sentiment that is lifting emerging market currencies globally. There has been little to support the Rand locally. January’s government policy statement outlined development plans to repair infrastructure and improve state-owned enterprises, though market participants are not confident of a quick fix. The country resumed ‘stage six’ loadshedding this week, indicating rolling power cuts of up to 4 ½ hours at a time. We expect the Rand to continue trading in line with global risk sentiment in the week ahead, though any further gains are likely to be capped by those domestic concerns, with any reversal in global sentiment likely to result in steeper losses for the currency.

Egypt devaluation No.3 pushes Pound to new low

The Pound sank to a record low against the dollar, trading at 30.5 from 27.4 at last week’s close, following the central bank’s third devaluation in less than a year to narrow the gap between official and parallel market rates. The bank has committed to allowing the currency to float more freely and not to intervene in the FX market as part of a deal to unlock fresh IMF funding and to ease the impact of a dollar shortage in the country. Annual inflation hit a five-year high of 21.3% in December from 18.7% in November, led by a sharp rise in food and beverage prices. The government said it will reduce fiscal spending and shelve infrastructure projects that consume large quantities of FX. We expect the Pound to continue depreciating in the short term until those spending cuts take effect.

Record low Kenyan Shilling under pressure from FX shortage

The Shilling fell to a fresh dollar low, trading at 123.75/123.95 from 123.35/123.55 at last week’s close as FX demand from the manufacturing, oil and energy sectors remain elevated. Foreign currency reserves declined to $7.38bn from $7.44bn a week earlier. The government’s ‘Bottom-Up Economic Transformation Agenda’ seeks to boost inclusive growth, with Finance Minister Njuguna Ndung’u predicting 6.1% medium term GDP expansion, accelerating from 5.5% in the 2021/ 22 fiscal period. We expect the Shilling to remain under pressure in the week ahead, with central bank support likely to prevent a steeper decline.

End to Ebola epidemic spurs Uganda Shilling gains

The Shilling strengthened against the dollar, trading at 3685 from 3713 at last week’s close, as Uganda and the World Health Organization declared an end to the country’s Ebola epidemic after almost four months. No new infections have been detected for more than 42 days—double the incubation period for the virus. Uganda’s worst Ebola outbreak in more than two decades resulted in 143 cases and 55 deaths. We expect further gains for the Shilling in the near term.

Tanzanian Shilling stable under new central bank leadership

The Shilling was steady against the dollar, trading at 2335—in line with last week’s close and halting a short-lived weakening trend. The government has appointed former finance ministry official Emmanuel Tutuba as the country’s new central bank governor, replacing Florens Luoga at the end of his term. Tanzania’s inflation rate eased slightly in December, falling to 4.8% from 4.9% in November amid slowing economic activity. Third quarter GDP growth slipped to 5.2% from 5.5% for the same period a year earlier. Crop production growth fell to 2.7% from 6.8% a year earlier, although revenue was supported by food price increases amid export demand from neighbouring countries. We expect the Shilling to remain stable at around the 2335 level in the week ahead as the country seeks to control inflationary pressures by easing international trade barriers.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.