After a year in which Africa’s post-Covid economic recovery was derailed by the combined effects of surging inflation, geopolitical instability, adverse weather and a looming risk of debt distress, negative impact for currencies looks set to continue into 2023. Higher global fuel and food prices driving record inflation are a particular strain on government finances and consumer spending in sub-Saharan Africa, where for the vast majority of people, food accounts for over 40% of spending. International capital exiting speculative assets, which caused depreciation of currencies across the continent in 2022, shows little sign for now of a reversal. We expect negative pressure to remain during 2023 for the Naira, Cedi, Egyptian Pound and Kenyan Shilling (see below). At the extreme end, Zimbabwe’s Dollar—the world’s worst performing currency, plunging 521% to 689 per dollar from 111—seems destined to fall further, with the country owing approximately $13bn to international financial institutions and ineligible for additional lines of credit from the IMF. At the opposite end of the spectrum, we expect a better year for the Rand while Tanzania’s Shilling maintains its status among Africa’s steadiest currencies.

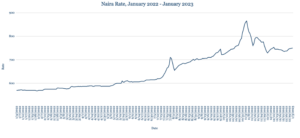

Election pivotal for pace of Naira decline after 2022 plunge

The Naira opened the year broadly unchanged at 750 from 748 in the final week of 2022. The currency lost almost a third of its value on the parallel market last year as Nigeria’s ability to benefit from higher commodity prices was challenged by an extended shutdown of its oil production facilities and crude pipeline vandalism and theft. With FX reserves steadily depleting during 2022, the central bank has halted dollar sales in the parallel market, further reducing supply and contributing to the Naira’s weakness. Given unwaning demand for dollars and reduced capacity for interventions in the parallel and official markets, we expect further currency depreciation over the next 12 months, with February’s presidential election pivotal in determining the pace of decline.

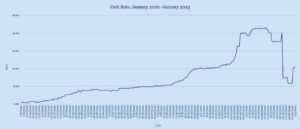

Default and 50% inflation cues Cedi for 2023 slide

The new year brought sharp declines for the Cedi, sliding to 10.20 from 8.35 at the end of 2022. Ghana’s currency fell 37% between January and mid-December last year, before rallying strongly as the country reached a staff level agreement with the IMF for a $3bn loan programme. However, the government’s move to suspend payments on most of its external debt in late December, labelled a default by credit rating agencies, caused the Cedi to resume its slump in 2023. Annual inflation hit 50.3% in November from 40.4% a month earlier, while the economy expanded at the slowest pace in two years in the third quarter, growing 2.9%. The Cedi, which had fallen as low as 14.50 per dollar in November, will remain under pressure this year, likely trading in a range of 10 to 17 against the dollar, amid a continued rise in global interest rates and gloomy investor sentiment following the country’s debt default.

Rand’s 2023 recovery constrained by outages and politics

The Rand opened the year slightly weaker against the dollar, trading at 17.02 from 16.97 at the end of 2022. Despite overall depreciation by 6.5% last year, the Rand found support from 18 levels partly from commodity exports, including coal to ease Europe’s energy crisis. We expect the currency to perform better in the coming 12 months, in part because China has lifted all Covid restrictions, potentially boosting economic activity and global sentiment longer term—something the Rand has historically benefited from as a bellwether emerging markets currency. The South African Reserve Bank’s decision to tighten monetary policy in line with the US Federal Reserve’s rate hikes has also helped to maintain the Rand’s appeal among international investors. Gains in the coming year could be capped as business and consumer confidence depends on addressing ongoing power outages and ending the period of political turbulence after the ‘Farmgate’ corruption probe.

Egypt Pound opens year with biggest daily loss since October

The Pound opened the new year with its biggest one-day depreciation since the October devaluation, losing 7.2% to 26.49, from 24.75 at the end of last year. The decline continues a currency slump that wiped 57% off the Pound’s dollar value in 2022 after Egypt’s central bank twice devalued the currency and allowed it to float more freely. Devaluation was triggered by foreign investor outflows and higher import costs because of Russia’s war in Ukraine. Now, a dollar shortage is causing backlogs at Egyptian ports, delaying the release of essential imports including food, medicine, and manufacturing supplies, and adding to inflationary pressures. With economic conditions remaining unsteady and the country facing sizable external debt obligations this year, we expect the Pound to continue weakening through 2023 until fiscal reforms take effect and the economy stabilises.

Fastest 2023 growth unlikely to revive record low Kenyan Shilling

The Shilling began the new year by sinking to a fresh low of 123.35/123.55 per dollar from 123.25/123.45 at last year’s close, extending an 8% overall decline in 2022. Dollar demand from oil importers remains elevated while inflation is hovering around a five-year high (hitting 9.1% in December), keeping the currency under pressure despite a more positive economic outlook. Kenya is likely to be Africa’s fastest-growing major economy this year, according to the Economist Intelligence Unit, with the EIU and IMF predicting 5% a growth rate. While investor inflows and adequate FX reserves (currently at just under $7.44bn) should offer some support in the months ahead, heightened dollar demand from importers and tighter global financing conditions are likely to have an overall negative impact on the currency.

Ugandan Shilling outlook clouded by higher energy prices

The Shilling was little changed at the start of the year, trading at 3721 compared to 3720 at last week’s close, after declining almost 5% against the dollar over the course of 2022. Uganda’s private sector continued to grow in December, with the Stanbic Bank Uganda Purchasing Managers’ Index increasing to an eight-month high of 52 from 50.9 in November. Output and new orders have expanded for five consecutive months, with employment levels rising for a third month. Annual inflation edging down to a three-month low of 10.2% in December from 10.6% in November is a further positive. Continued rising energy costs nevertheless risk reviving inflationary concerns, keeping the Shilling under pressure this year.

Tanzania’s revived trade maintains Africa’s steadiest currency

The Shilling was unchanged in the year’s first trading week, remaining at 2333 to the dollar and maintaining its status as one of Africa’s steadiest currencies. Over the past six months, the currency hasn’t moved more than 0.65% in either direction, depreciating by just over 1% overall in 2022. In the face of pressures from drought and the Russia-Ukraine war, the government has focused on improving international relations to open more trade corridors and boost tourism while promoting female empowerment. With economic growth set to accelerate to 5.6% this year, according to the African Development Bank, we see the Shilling continuing to hold firm against the dollar in the year ahead.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.