African supply chains often export natural resources and overly rely on imported goods and services. The mindset behind the dominance of non-value adding export activities in Africa’s supply chains dates back to the days of colonialism, when the continent was largely exploited for its natural resources such as gold, among other valuable minerals. Though the days of colonialism are long gone, there seems to be a constant desire for African countries to export their natural resources and import value-added versions of these resources at higher costs.

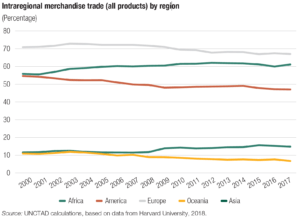

The share of exports from Africa to the rest of the world ranged from 80 percent to 90 percent in 2000–2017. The only other region with a higher export dependence on the rest of the world is Oceania. In addition, intra-African trade, defined as the average of intra-African exports and imports, was around 15.2 percent during the period 2015–2017, while comparative figures for America, Asia, Europe and Oceania were, respectively, 47 percent, 61 percent, 67 percent and 7 percent. This reliance exposes African countries to shocks in global commodity price vulnerabilities and increases the risk of economic instability.

While the overreliance on raw material exports and imports of value-added versions at higher costs is a major concern, African supply chains are also supported by poor infrastructure. The supply chains are bedeviled by a lack of extensive road networks and railway lines to facilitate delivery of goods and services. Rail transport on the continent is below 20 percent of total freight transport volume, and air travel within Africa is one of the most expensive in the world. Ports that support sea transport are largely congested, and delivery lead times are long. It is estimated that close to 600 million Africans lack access to electricity and about 400 million lack access to potable water.

Though the state of supply chains in Africa seems dire, it is not an entirely hopeless situation. There is a glimmer of hope. Since 2008, Africa has grown its intra-regional trade, and it is the only region in the world besides Asia to do so. While this trend is promising, much more must be done to improve African supply chains. It is against this backdrop that AfCTA promises to promote trade among African countries and thereby improve African supply chains considerably.

Figure 1: Graph showing the growth trend of intra-regional trade for Africa and other regions

The promise of the African Continental Free Trade Area (AfCFTA)

AfCFTA is a trade pact that seeks to create the world’s largest free trade area through a single market for goods and services for over 1.3 billion people. The trade pact aims to deepen the economic integration of Africa, which boasts a combined gross domestic product of around $3.4 trillion. It is the world’s largest trade bloc with 54 member states. Of these, 43 have ratified the AfCFTA agreement, including the three largest African economies: Nigeria, South Africa and Egypt.

The AfCFTA Secretariat is located in Ghana. Under the AfCFTA agreement, the states have committed to steadily reducing tariffs by 90 percent over the next five years. Currently, 81 percent of products are traded under preferential terms, with negotiations still ongoing for the remaining 19 percent.

Figure 1: Map showing 54 AfCFTA Member States and their Ratification Status

Source: https://au-afcfta.org/state-parties/

AfCFTA promises to boost intra-African trade and bolster regional supply chains by removing tariffs, progressively liberalizingtrade in services, and addressing other non-tariff barriers. The removal of tariffs under AfCFTA is estimated to boost intra-African business by more than 50 percent by 2040, according to the United Nations Economic Commission for Africa (UNECA). The World Bank anticipates that AfCFTA could boost Africa’s intra-regional exports by 29 percent, or around $560 billion, and lift more than 30 million people out of extreme poverty by 2035. Though AfCFTA promises a lot and has great potential, several challenges must be overcome to ensure maximum benefit for supply chains in Africa.

AfCFTA challenges

-

AfCFTA promises to boost tariff-free and near-seamless intra-regional trade to aid the integration of the entire African continent by removing barriers to trade and movement between countries within the region. However, member countries need to address the attendant challenges, which include: Varying degrees of preparedness of member states: African countries are at different stages of economic, social and developmental growth. Each country requires different investments and capacities to implement the requirements of the agreement and its related protocols and annexes.

-

Industrialization and infrastructure development: Unlike Great Britain, continental Europe and the United States, which underwent industrial revolutions in the 18th century, industrialization didn’t come to Sub-Saharan Africa until the 1920s. The process gained momentum in the 1960s. Since then, industry has grown and developed in Africa gradually and unequally. Some African countries and regions have advanced far ahead of others.

-

Weak supply chains: The lack of industrial muscle is one reason why Africa mostly exports raw materials and imports finished goods. As a result, Africa’s supply chains are more global than most but are weak within the continent.

-

The risks of open borders: Several risks are associated with more open borders in aid of free trade. Among these are the fears of significant tariff revenue losses, the inhibition of manufacturing self-sufficiency and the threat of terrorist attacks from groups such as Boka Harem in Nigeria and Ansar al-Sunna in Mozambique. In 2019, Nigeria closed its borders with Cameroon, Chad, Benin and Niger to curb the smuggling of goods, particularly rice, into the country. Nigerians and commercial partners in neighboring West African countries began pleading with the Nigerian government to reopen the borders to avoid further hardship, especially as the COVID-19 outbreak spread.

A high level of imports indicates a robust domestic demand and a growing economy. However, when the imports are more goods (food items and other consumables) than assets (equipment, parts, machinery), the country loses funds in the exchange. In addition, industries are not building much manufacturing or processing capacity.

A more recent fear associated with open borders is the threat of terrorist attacks in the subregion. Although this phenomenon cannot be directly linked with the operationalization of the AfCFTA agreement, the lack of preparedness of most African countries to deal with such attacks makes the fear of more open borders a very real concern, with terrorist groups such as Boka Harem in Nigeria and Ansar al-Sunna in Mozambique impacting nieghboring countries.

● Historical trade routes: Trade routes were established in the colonial era to transport precious minerals and objects of art, among other assets, out of the continent and into Europe and America. It is little wonder that most African nations’ trade policies are geared toward getting goods and raw materials out of the continent and not necessarily into other African countries. Border patrols tend to be stricter and tariffs higher for intra-regional trade than for inter-regional trade. Further, tax waivers are more likely granted to foreign investors, who repatriate most of their earnings, than to local African businesses, even here in Ghana.

● Lack of standardization: Intraregional demand patterns and standards for product exchange are not well understood. More analysis is needed to identify which countries have the highest demand/need for products and which countries are in the best position to supply them. Trade partners must agree to and adopt clear quality, quantity, currency, payment and transport standards.

Monitoring and measuring AfCFTA’s impact

Africa needs data and monitoring tools to assess AfCFTA’s impact, and information needs to be widely shared with a range of supply chain practitioners and leaders. The UN Economic Commission for Africa launched the African Continental Free Trade Area Country Business Index in 2018 to measure and monitor the implementation and implications of the AfCFTA agreement. Research institutions have a role to play in building multiple indices that capture the real-time experiences of African supply chain professionals in navigating the AfCFTA maze and disseminating this information across the continent. Such indices will be especially useful in policy development and decision-making.

Successfully navigating the AfCFTA maze

The objectives of AfCFTA are to create a single, continent-wide market and to enhance competitiveness at the enterprise level. Despite the challenges outlined above, suggestions are available for navigating this maze to bring the continent closer to achieving AfCFTA objectives.

These solutions include incremental rollout of the agreement for different countries, addressing the infrastructure deficit of the continent, collaborative efforts for border security and continuous monitoring and measuring of the impact of this agreement in real time. These suggestions can be classified as policy solutions, funding and capacity-building solutions; and research and facilitation solutions.

Incremental/phased roll out

Even though 43 of the 54 member states have ratified the agreement, a potential strategy would be an incremental rollout of the implementation. Because countries are at different stages of preparedness, a full-scale rollout may overwhelm certain parties and skew benefits toward a prepared few. Capacity development can happen concurrently with the rollout. Countries can then focus better on areas in which they have strengths while they build capacity in other aspects through their participation and through stakeholder engagement.

Addressing infrastructure needs

For AfCFTA to succeed, the continent must address its annual infrastructure deficit. In 2018, the African Development Bank estimated the infrastructure deficit to be over USD$108 billion per year. To reap the benefits of the accord, the continent will also need billions of dollars to strengthen supply chains, as well as fiscal and monetary policies. The recently launched Pan African Settlement System will enable smoother transactions and funds transfers between intraregional trading partners. Fiscal stability and currency standardization are critical to the success of this system.

Collaborative Border Protection Policies and Efforts

Collaborative transnational security that facilitates trust-building and information sharing among trading partners will mitigate the risks associated with open borders. National policies on border security should facilitate the free movement of goods while protecting countries from terrorism. This strategy calls for a cost-benefit analysis of security versus free trade.

A bright future for Africa.

History must not always dictate the future, and Africa can learn from it and do things differently. There is a need to refocus trade routes within Africa and match demand to supply within the continent. The best way to do this is to make conscious efforts to use policy as a tool to appropriate funding to address the continent’s infrastructural deficit and also engage industry in capacity building. Africa has its quirks, and this could be an advantage. For example, bartering instead of using hard currency presents opportunities for informal economies. Countries with needs that can be supplied by their neighbours can in turn provide other products and services in exchange. A monetary equivalent of these goods and services will have to be agreed upon to enable a “fair” exchange.

About CARISCA

The Centre for Applied Research and Innovation in Supply Chain – Africa (CARISCA) generates and translates innovative research into positive development outcomes for Ghana and pan-African supply chains, driving country self-reliance. It is a partnership of the U.S. Agency for International Development, Arizona State University and Kwame Nkrumah University of Science and Technology. CARISCA’s Supply Chain Action Network (SCAN) engages supply chain stakeholders in Ghana and across Africa to discuss current topics, trends, opportunities and challenges for managing African supply chains. The goal is to create a strong network of policymaking, private sector and civil society organizations to strengthen supply chain research and education and facilitate knowledge transfer.